Warner Bros. Discovery (NASDAQ:WBD): Can This Media Powerhouse Overcome $40.7 Billion in Debt?

With WBD stock trading near $12, restructuring and streaming growth are in focus. Could asset sales and blockbusters like Barbie lead to a turnaround? | That's TrasdingNEWS

Restructuring Warner Bros. Discovery (NASDAQ:WBD): Addressing Debt, Growth, and Content Challenges

Warner Bros. Discovery (NASDAQ:WBD) has reached a pivotal moment as it navigates a complex restructuring to ensure long-term sustainability while tackling the twin challenges of high debt and competitive market dynamics. The stock has fluctuated significantly, reflecting both skepticism and optimism about its strategic direction. With a reported gross debt of $40.7 billion and a leverage ratio of 4.2x, the company must act decisively to address its financial constraints while capitalizing on growth opportunities in streaming and content production.

Q3 Performance and Financial Challenges

In its Q3 earnings report, Warner Bros. Discovery showed promising signs of financial discipline, paying down $900 million in debt, yet challenges remain significant. The company’s interest expense totaled $1.5 billion over nine months, and free cash flow declined dramatically to $600 million, compared to $2 billion in the same quarter last year. These figures highlight the ongoing strain that debt servicing places on the company’s ability to invest in content and innovation.

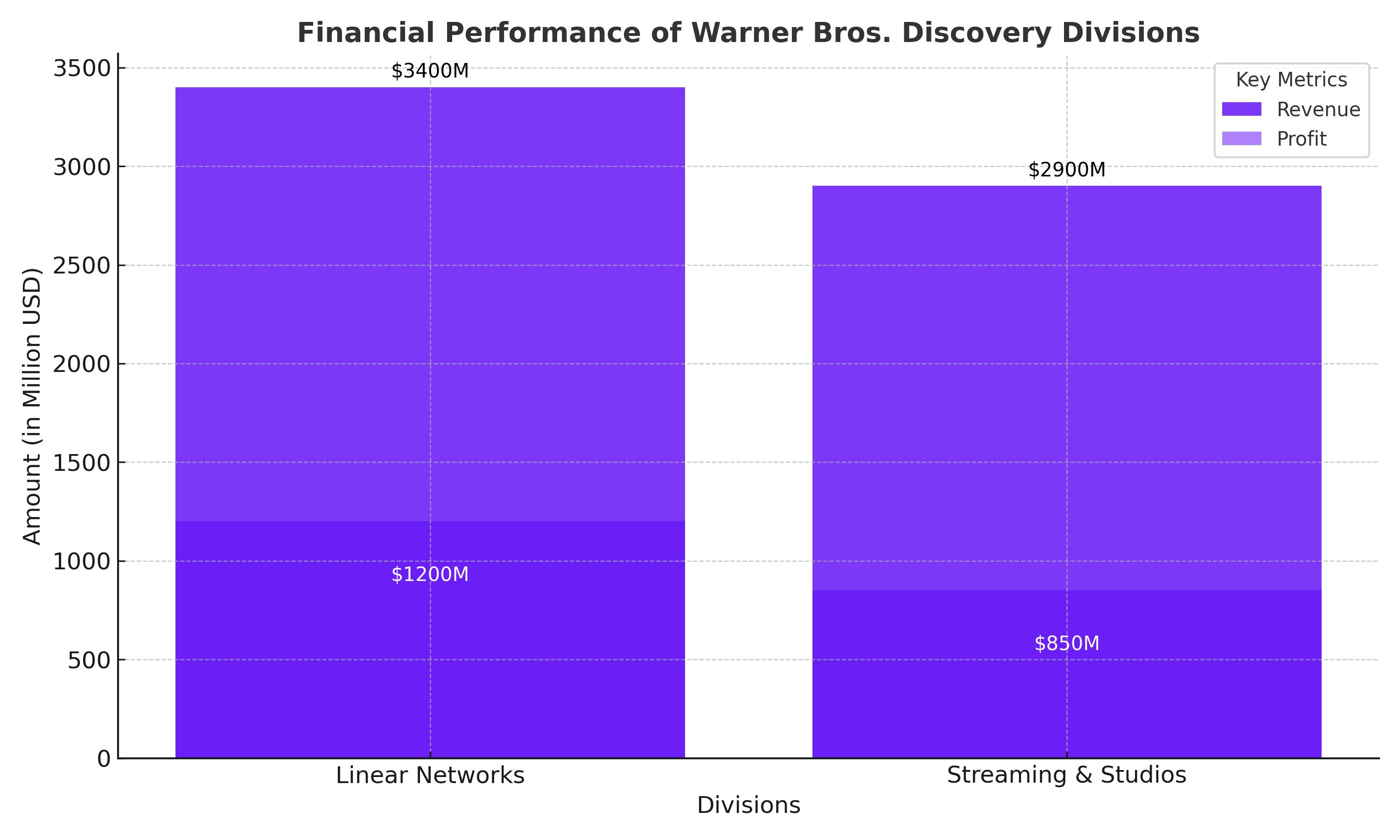

Despite these financial pressures, the company posted a profit for the first time since its merger with Discovery. Earnings per diluted share reached $0.05, compared to a loss of $0.17 in the same period last year. However, Warner Bros. Discovery’s adjusted EBITDA dropped in key segments, particularly studios, where year-over-year declines in revenue and profitability were stark.

Strategic Restructuring: A Two-Division Approach

Warner Bros. Discovery has announced a major restructuring plan that splits its operations into two distinct units: Global Linear Networks and Streaming & Studios. This move aims to streamline operations and create flexibility for potential mergers, asset sales, or other strategic moves. The Global Linear Networks division will focus on cash flow and profitability, while Streaming & Studios will prioritize growth and content-driven returns.

The streaming segment, which includes Max, added over 7 million subscribers globally in Q3, bringing its total to more than 110 million. International markets drove much of this growth, compensating for a flat performance domestically. Initiatives like bundling with Disney and cracking down on password sharing contributed to these gains. However, profitability remains a challenge as content costs and competition with Netflix and Disney persist.

Content Production: Hits and Misses

The company’s content strategy has seen mixed results. While Barbie provided a significant financial boost earlier this year, other high-profile projects have underperformed. Joker: Folie à Deux stalled at just over $200 million globally, falling short of expectations. The Beetlejuice sequel fared better, earning $450 million worldwide, yet these results underscore the need for consistent billion-dollar blockbusters to drive revenue and shareholder value.

Warner Bros. Discovery also faces challenges in optimizing its sports broadcasting portfolio. A recent NBA settlement retained key digital rights for platforms like Bleacher Report and House of Highlights, while also securing international NBA content rights in Europe and Latin America. This deal provides $350 million in revenue over its term but reflects the broader difficulty of maintaining sports-driven revenue streams in an increasingly fragmented media landscape.

Debt Reduction and Asset Sales

Debt reduction remains a top priority for CEO David Zaslav, who has signaled openness to asset sales or spin-offs to accelerate deleveraging. Speculation includes potential sales of cable channels, reductions in sports broadcasting exposure, or divestitures of gaming assets. The company’s $3.5 billion in cash provides some breathing room, but long-term debt repayment remains critical to improving its financial position.

Insider transactions indicate confidence among key executives, with notable stock purchases by President Gerhard Zeiler and others. These moves suggest that leadership believes in the long-term value of Warner Bros. Discovery’s assets and strategy.

Valuation and Market Sentiment

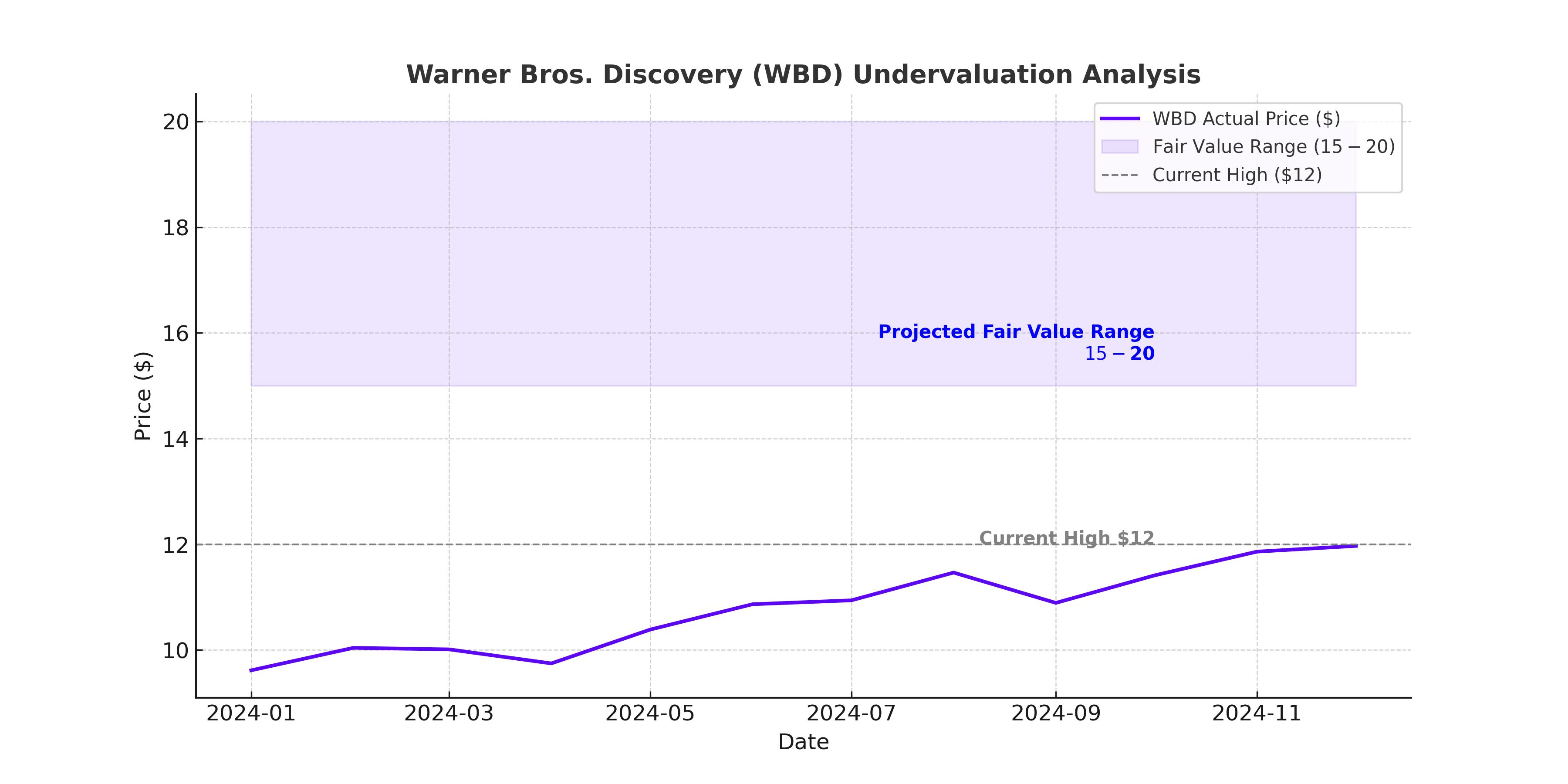

At a current trading price near $12, Warner Bros. Discovery appears undervalued by some metrics. Its Price-to-Book ratio of 0.87 and forward Price/Cash Flow of 4 are below sector averages, suggesting potential upside. However, financial distress indicators, such as an Altman Z-score of 0.11, highlight the risks associated with its high debt load.

The stock’s technical performance reflects this uncertainty. A post-earnings rally pushed shares up nearly 12% to $9.37 before profit-taking brought the price back down. Sustained growth in subscriber numbers and successful execution of asset sales or restructuring could help the stock break out of its current range and attract institutional interest.

Investor Patience and Long-Term Potential

Warner Bros. Discovery’s future hinges on its ability to balance aggressive debt reduction with strategic growth initiatives. The company’s restructuring offers a pathway to unlock value, but execution will be critical. Success in producing blockbuster content, expanding international streaming markets, and securing new revenue streams from sports and other partnerships could position Warner Bros. Discovery for a stronger financial footing.

While the company remains speculative, its extensive portfolio of intellectual property and brands—ranging from DC to Harry Potter—provides a foundation for long-term growth. Investors should monitor key developments, including updates on asset sales, debt repayment, and the performance of the newly restructured divisions.

For now, Warner Bros. Discovery remains a high-risk, high-reward proposition. The company’s significant challenges are balanced by its potential for recovery and growth, making it a compelling opportunity for those willing to weather volatility in pursuit of long-term gains. Follow Warner Bros. Discovery’s real-time stock performance here: NASDAQ:WBD.