Why AMD (NASDAQ:AMD) the Most Undervalued AI Stock for 2025? Upside Potential Of 100%

Advanced Micro Devices: Dominating Data Centers, Narrowing the AI Gap, and Poised for Explosive Growth | That's TradingNEWS

Advanced Micro Devices (NASDAQ:AMD): Undervalued AI and Semiconductor Leader

Advanced Micro Devices, Inc. (NASDAQ:AMD) has emerged as a significant player in the AI and semiconductor industry, carving out a compelling position despite fierce competition from Nvidia and Broadcom. Trading at approximately $125, AMD presents an attractive investment opportunity, with a strong growth trajectory fueled by data center GPUs, AI-driven innovation, and expanding market share in CPUs. Analysts project a robust outlook for AMD, with potential upside to $250 over the next 12 months, representing a remarkable 100% increase.

Data Center and AI: The Core of AMD’s Future Growth

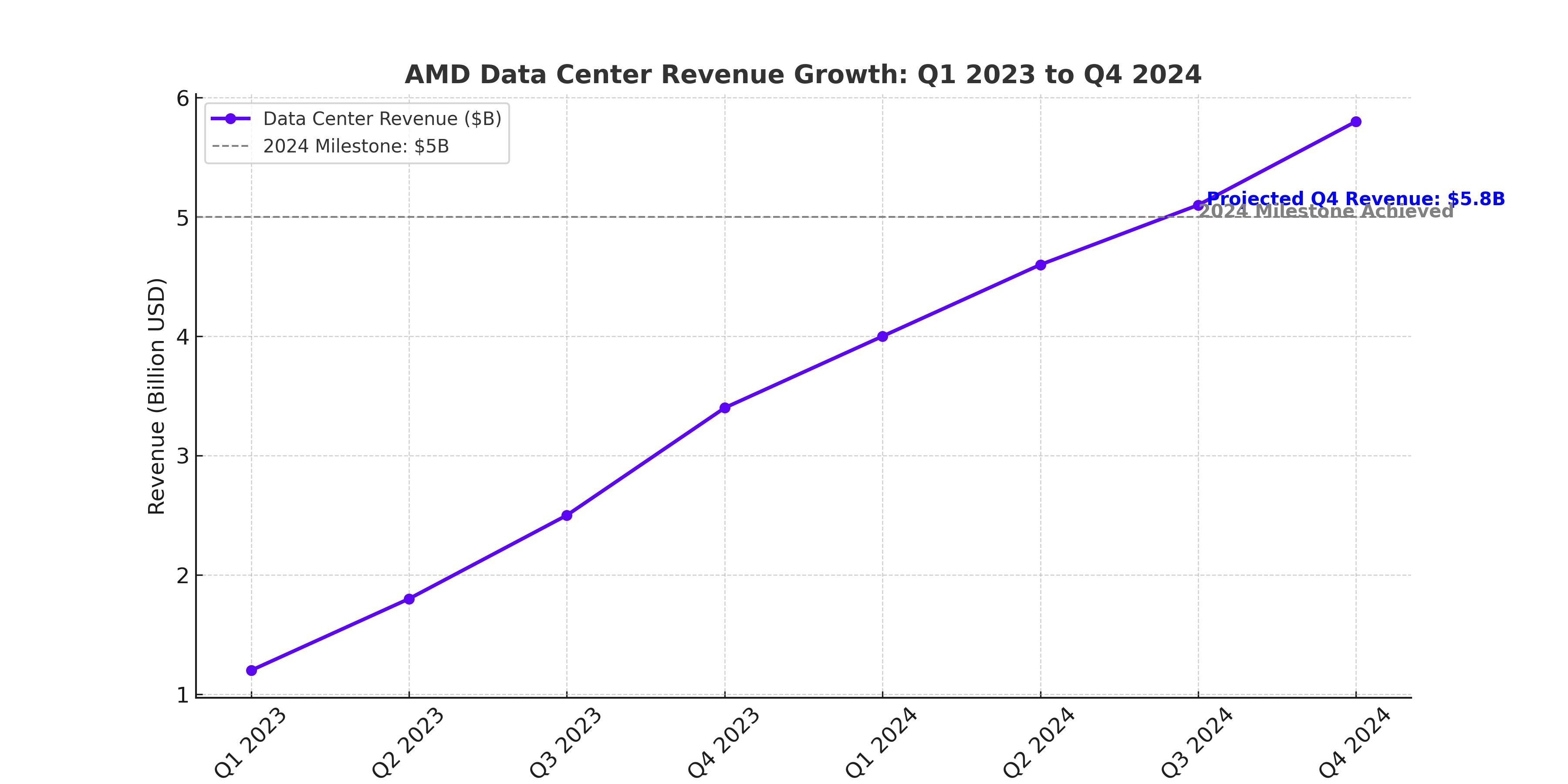

AMD’s data center segment is the heart of its growth story, driven by increasing demand for AI-enabled GPUs. In Q3 2024, AMD reported data center revenues of $3.5 billion, a 122% year-over-year increase and 25% sequential growth. With projected Q4 data center sales of $5 billion, the company is on track to double its full-year data center revenue from $6.8 billion in 2023 to $13.6 billion in 2024. This represents an annualized growth rate of over 120%, highlighting AMD’s ability to compete in the rapidly expanding AI hardware market.

The introduction of AMD’s MI325X accelerator and plans to launch the MI350 series demonstrate the company’s commitment to closing the technology gap with Nvidia. Partnerships with major tech giants like Microsoft, Meta, and OpenAI further solidify AMD’s credibility in the AI data center space. Analysts anticipate AMD’s data center AI revenue to grow to $9-$10 billion in 2025, reflecting an 80%-100% year-over-year increase.

Market Share Expansion Across GPUs and CPUs

While Nvidia dominates the GPU market, AMD is steadily gaining ground. The global GPU market, projected to grow at a 34% CAGR to reach $440 billion by 2030, offers substantial room for multiple players. AMD’s focus on affordability, energy efficiency, and open-source platforms like ROCm makes it an appealing choice for customers wary of Nvidia’s premium pricing and proprietary CUDA ecosystem.

AMD’s progress in CPUs is equally impressive, with a 24.2% share of the server CPU market in 2024, surpassing Intel in the high-performance segment. The company’s EPYC processors continue to gain traction among hyperscalers and enterprise clients, further strengthening its position in the data center ecosystem. AMD’s strong relationships with Microsoft, Google, and Meta enhance its competitive edge, ensuring continued demand for its cutting-edge chips.

Valuation and Financial Metrics Indicate Undervaluation

AMD’s current valuation is strikingly low compared to its growth potential. Trading at a forward price-to-earnings (P/E) ratio of 27.7x, AMD is priced well below Nvidia, which commands a P/E of 35x. Analysts forecast 2025 earnings per share (EPS) of $6.25, with the potential to reach $8.50 in 2026. At these levels, AMD’s forward P/E drops to 15.6x and 13.9x, respectively, making it one of the most attractively valued AI stocks on the market.

The company’s revenue is expected to grow from $35 billion in 2025 to $76.2 billion by 2030, driven by continued market share gains in GPUs, CPUs, and AI accelerators. This growth trajectory, combined with an improving gross margin—currently at 53.6% and guided to rise to 54% in Q4 2024—positions AMD for significant profitability expansion. Analysts project a long-term EPS growth rate of 20%, underscoring the company’s ability to deliver consistent returns for shareholders.

Technical and Market Sentiment Favor AMD’s Upside

From a technical perspective, AMD appears oversold, having declined 50% from its March 2024 peak of $230 to a recent low of $116. The stock’s RSI has dropped below 30, signaling a strong buying opportunity. Historical patterns suggest that AMD has significant rebound potential, with a 12-month price target of $250. This would represent a near doubling of its current value, driven by robust fundamentals, favorable technical conditions, and renewed investor confidence in its growth prospects.

Risks and Challenges

AMD faces execution risks as it works to maintain its momentum in a highly competitive market. Nvidia’s dominant position in AI GPUs, coupled with Broadcom’s custom silicon capabilities, poses significant challenges. Additionally, AMD’s reliance on large-scale partnerships introduces some dependency risks. Macroeconomic factors, such as a slowdown in enterprise spending or geopolitical tensions, could also impact AMD’s growth trajectory.

However, AMD’s diversified portfolio, including its leadership in CPUs and growing footprint in AI and gaming GPUs, provides a solid foundation to weather these challenges. The company’s innovative product roadmap and focus on cost-effective, high-performance solutions ensure its relevance in an evolving market.

Conclusion: AMD is a Strong Buy

Advanced Micro Devices is at a pivotal moment in its growth story, leveraging its competitive strengths to gain market share in the lucrative AI and data center segments. With a forward P/E of 27.7x, robust revenue projections, and expanding partnerships with tech giants, AMD is significantly undervalued. Its technical indicators suggest that the stock is primed for a rebound, with a 12-month price target of $250 offering substantial upside. For investors seeking exposure to transformative technology sectors, AMD remains a compelling "strong buy" at current levels.