Why NASDAQ:IBIT Is the Best Bitcoin ETF for 2025’s Bull Run

Can Bitcoin’s 2025 Price Target of $120K Make IBIT the Ultimate Crypto Investment? | That's TradingNEWS

NASDAQ:IBIT—A Deep Dive into BlackRock’s iShares Bitcoin Trust ETF

BlackRock’s iShares Bitcoin Trust ETF (NASDAQ:IBIT) has established itself as a leader in the rapidly growing Bitcoin ETF market, managing an impressive $53 billion in assets. It dominates nearly half of the total $112 billion in spot Bitcoin ETF assets, a remarkable feat given that the majority of these ETFs didn’t exist a year ago. IBIT provides a compelling investment vehicle for those seeking exposure to Bitcoin without the complexities of direct ownership, offering low fees, substantial liquidity, and significant growth potential.

AUM Growth and Market Leadership

IBIT has achieved record-breaking growth in assets under management (AUM), fueled by strong inflows from institutional and retail investors. Over the past year, Bitcoin ETFs collectively surpassed gold-backed ETFs in AUM, signaling a significant shift in investor appetite for alternative assets. As of now, IBIT’s AUM dwarfs its competitors, such as Grayscale’s Bitcoin Trust (GBTC) and Fidelity’s Wise Origin Bitcoin Fund (FBTC), with assets more than 2.5 times greater than its closest peers.

This dominance reflects BlackRock’s strategic positioning and the growing demand for Bitcoin as an institutional-grade investment. IBIT’s relatively low expense ratio of 0.25% and high trading volume—averaging over 25 million shares daily—make it a preferred choice among investors. Its tight bid-ask spread of just two basis points further enhances its appeal.

Bitcoin’s Performance and Market Outlook

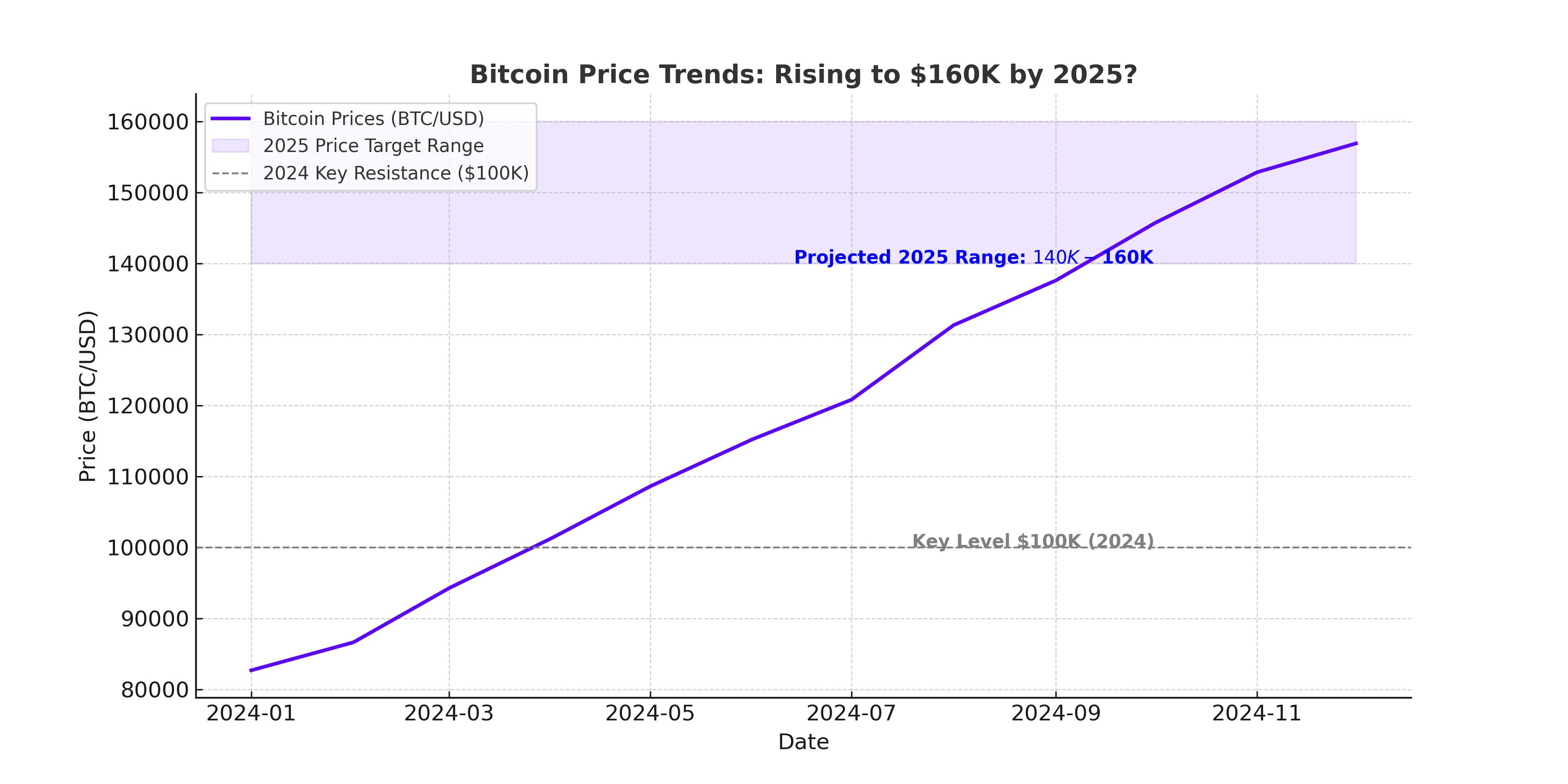

Bitcoin’s price performance has been exceptional, with a year-to-date (YTD) gain of 133%, making it the top-performing asset class of 2024. The digital asset hit an all-time high (ATH) of $108,000 before pulling back to its current level around $96,000. This rally was driven by increased institutional adoption, the halving event earlier this year, and optimism surrounding pro-Bitcoin regulatory changes.

Despite recent volatility, Bitcoin remains well-positioned for further gains in 2025. Analysts predict an average price target exceeding $170,000, supported by a tightening supply-demand dynamic, elevated global liquidity, and increasing institutional participation. The upcoming U.S. administration’s potential establishment of a National Bitcoin Reserve adds another layer of bullish potential.

Halving Impact and Long-Term Bullish Trends

Bitcoin’s April 2024 halving event reduced the daily issuance of new Bitcoins from 943 to approximately 412, intensifying supply constraints. Historical data indicates that halvings typically catalyze significant price appreciation in the subsequent years. Current trends suggest Bitcoin’s price trajectory aligns with previous halving cycles, pointing to further upside in 2025.

Global liquidity cycles, another critical factor, are expected to improve next year, creating a favorable environment for risk assets like Bitcoin. This trend aligns with seasonality patterns, as Q1 has historically been a strong quarter for Bitcoin, with average returns of 12% and a median gain of 5%.

IBIT’s Unique Value Proposition

IBIT’s low premium-to-NAV (Net Asset Value) ratio sets it apart from competitors. While most Bitcoin ETFs trade at premiums, IBIT’s razor-thin discount enhances its attractiveness for investors. This is particularly beneficial for those looking to capitalize on Bitcoin’s price movements without overpaying for exposure.

The ETF also benefits from BlackRock’s robust management and operational expertise, ensuring efficient execution and investor confidence. Its design simplifies Bitcoin investment, eliminating the need for digital wallets and reducing transaction costs compared to direct ownership.

Regulatory Tailwinds and Potential Catalysts

The incoming U.S. administration, coupled with a new SEC chairperson expected to be more crypto-friendly, could create a supportive regulatory environment for Bitcoin ETFs. Key policy changes, such as the introduction of in-kind redemptions, could further enhance ETF efficiency by allowing direct exchanges of ETF shares for Bitcoin. This innovation would reduce transaction costs and improve tracking accuracy, making IBIT an even more appealing investment.

Additionally, the potential creation of a National Bitcoin Reserve could drive significant institutional demand, reinforcing Bitcoin’s position as a strategic asset. Combined with increasing global adoption and improving macroeconomic conditions, these factors bolster the long-term outlook for IBIT.

Risks and Considerations

While the prospects for IBIT and Bitcoin are promising, investors should be mindful of risks. Short-term volatility, regulatory uncertainties, and macroeconomic headwinds, such as higher interest rates, could impact performance. Additionally, the emergence of new crypto investment products may dilute demand for existing ETFs.

Bitcoin’s historical price volatility, with drawdowns exceeding 70% during bear markets, underscores the importance of a long-term perspective. However, the asset’s resilience and the growing adoption of institutional-grade investment vehicles like IBIT mitigate these risks.

Technical and Seasonal Analysis

Technically, Bitcoin remains in a bullish trend, supported by its 200-day moving average. While the recent pullback from its ATH reflects healthy consolidation, key support levels at $90,000 and $85,000 are crucial to monitor. Resistance at $100,000 and $108,000 will likely be tested in the coming months, with long-term targets exceeding $120,000.

Seasonality trends favor Bitcoin in Q1, historically its strongest quarter. Elevated global liquidity and improving sentiment provide additional tailwinds, reinforcing the case for further gains.

Investment Decision: A Strong Buy

IBIT offers a compelling investment opportunity for those seeking exposure to Bitcoin through a trusted, efficient, and cost-effective ETF. With its dominant market position, low fees, and alignment with Bitcoin’s bullish outlook, IBIT is well-positioned to deliver strong returns in 2025.

Investors should view IBIT as a long-term investment, capitalizing on Bitcoin’s price appreciation and the structural growth of the crypto ecosystem. Despite short-term risks, the ETF’s fundamentals, combined with favorable macro and regulatory dynamics, make it a strong buy.