Why Paramount Global NYSE:PARA Is An Investment Potential

Analyzing Acquisition Interest, Streaming Growth, and Financial Performance for a Strong Buy | That's TradingNEWS

Paramount Global (NYSE:PARA) Analyzing Key Developments and Market Potential

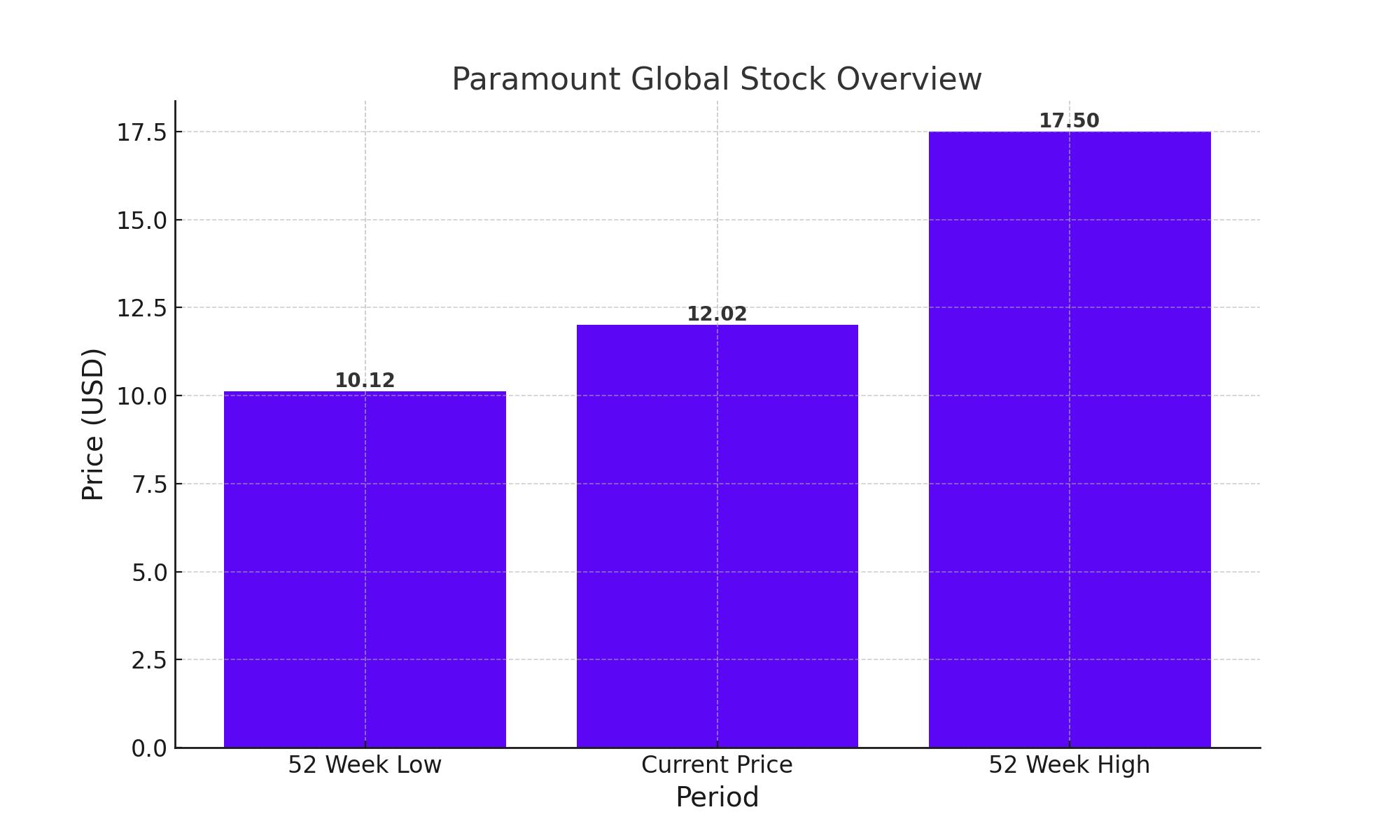

Paramount Global Stock Overview

As of May 17, Paramount Global (NYSE:PARA) closed at $12.02, down 4.91% for the day. The stock experienced a slight uptick after hours, trading at $12.05, up 0.25%. Over the past 52 weeks, PARA has traded between $10.12 and $17.50, with a current market capitalization of $8.39 billion and a beta of 1.76, indicating higher volatility relative to the market.

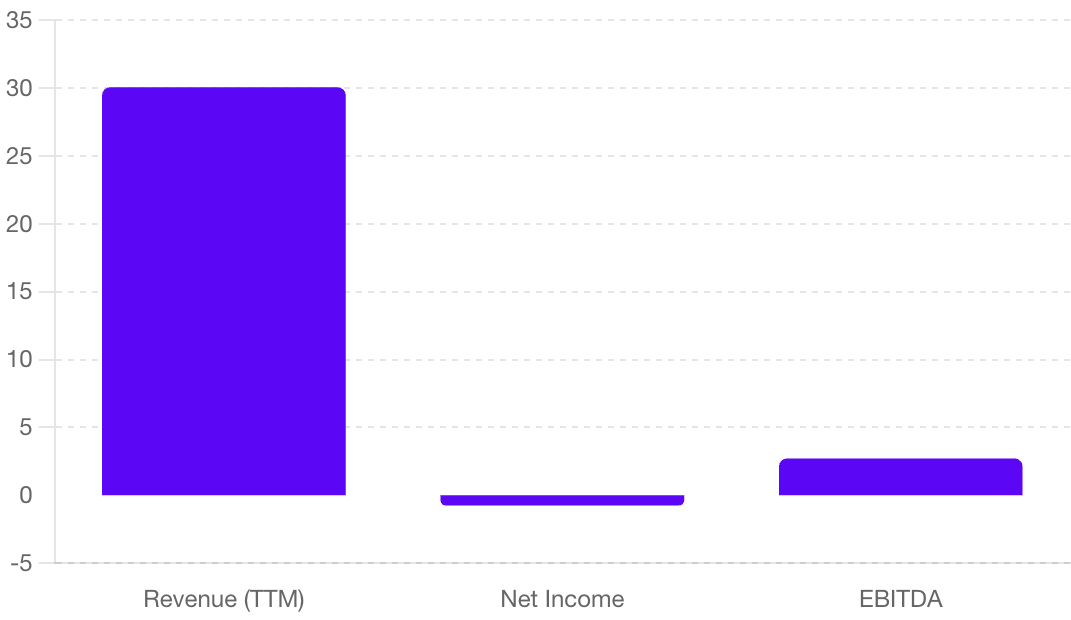

Financial Performance and Valuation Metrics

Paramount Global’s financial highlights reveal a mixed picture. The company's revenue for the trailing twelve months (TTM) stands at $30.07 billion, with a net income loss of $742 million. The EBITDA for the same period is $2.72 billion, reflecting operational profitability despite net losses. The company’s enterprise value (EV) is $21.81 billion, resulting in an EV/EBITDA ratio of 24.02, which suggests a high valuation compared to earnings before interest, taxes, depreciation, and amortization.

Paramount Global’s forward P/E ratio is projected at 12.21, showing investor optimism for earnings recovery. The PEG ratio, indicating the stock's value relative to its growth rate, is 0.29, highlighting potential undervaluation given expected earnings growth.

Recent Developments and Insider Transactions

Paramount Global’s Acquisition Interest

The entertainment giant has been the subject of acquisition interest, with significant bids from various suitors. In early 2024, Byron Allen’s Allen Media Group offered $14.3 billion for Paramount Global, sparking considerable market activity. More recently, a consortium led by Sony (SONY) and Apollo Global Management (APO) proposed a $26 billion acquisition deal. The market responded favorably to these developments, with significant stock price movements reflecting investor sentiment.

Sony’s Non-Disclosure Agreement and Deal Prospects

Sony has recently signed a non-disclosure agreement (NDA) with Paramount Global, allowing deeper access to financials and facilitating more detailed deal negotiations. The NDA comes after a failed exclusive negotiation period with Skydance, which had proposed a merger valuing Skydance at $4-$5 billion and injecting $3 billion into Paramount Global to reduce debt.

NYSE:PARA Stock Performance and Analysis

The stock has shown significant volatility in response to acquisition rumors and financial results. On May 2, Paramount’s Class B shares surged 13.1%, while Class A shares, which have voting rights, jumped 21.6% following the news of Sony and Apollo’s interest. However, skepticism from key shareholders, particularly Shari Redstone of National Amusements, regarding private equity involvement has introduced uncertainty, leading to subsequent price drops.

Financial Stability and Cash Flow Analysis

Despite facing challenges, Paramount Global’s financials indicate resilience. For the fiscal year ending March 31, 2024, the company reported $7.69 billion in revenue, up 5.8% year-over-year. This increase was primarily driven by CBS broadcasting Super Bowl LVIII, contributing an 8% boost. However, licensing revenue saw an 18% decline due to reduced TV licensing volumes and disruptions from industry strikes.

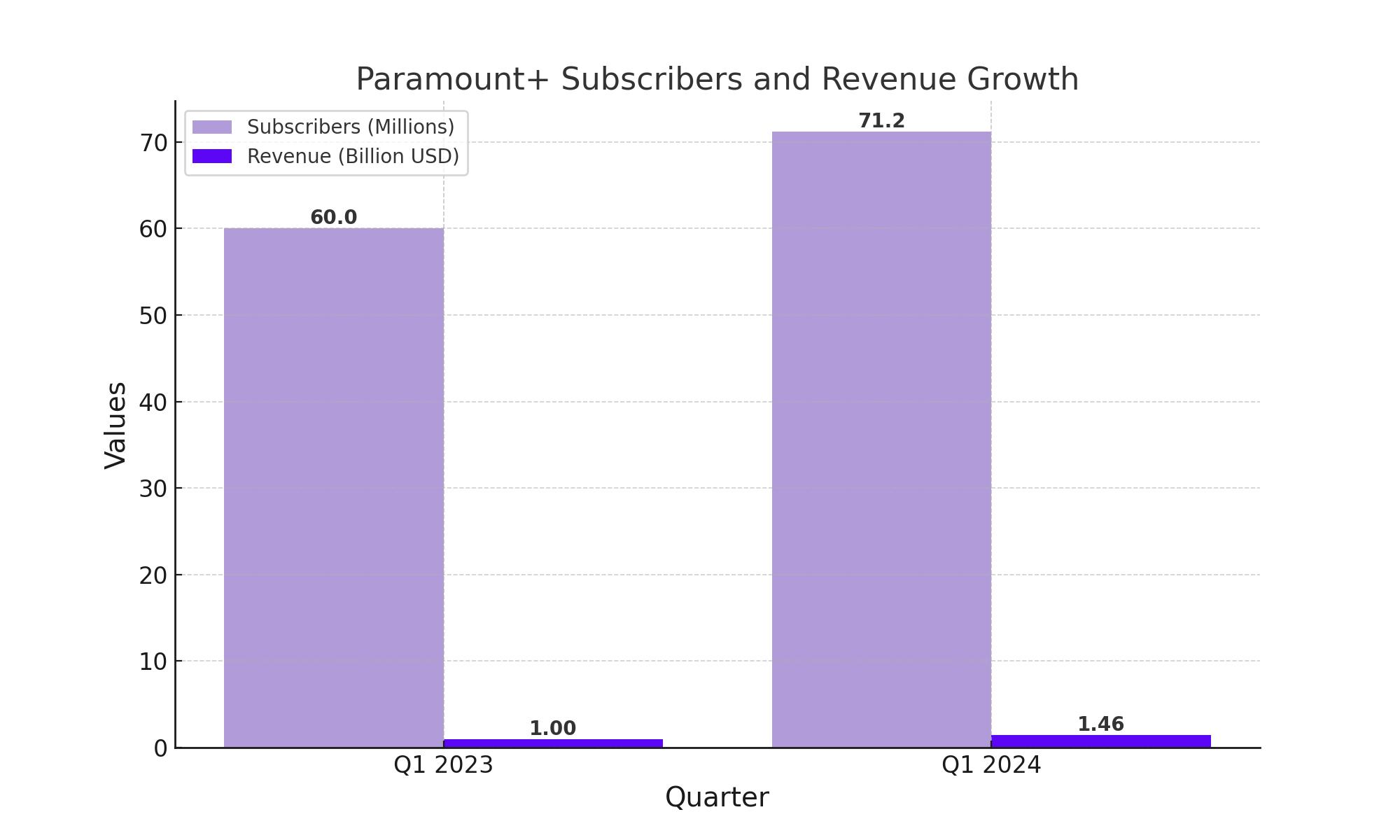

Paramount’s streaming service, Paramount+, continues to be a bright spot, with subscriber numbers growing from 60 million to 71.2 million year-over-year. This growth led to a 51% increase in streaming revenue, reaching $1.46 billion. The average revenue per subscriber rose to $6.83 per month, translating into substantial annual revenue growth.

Management and Insider Transactions

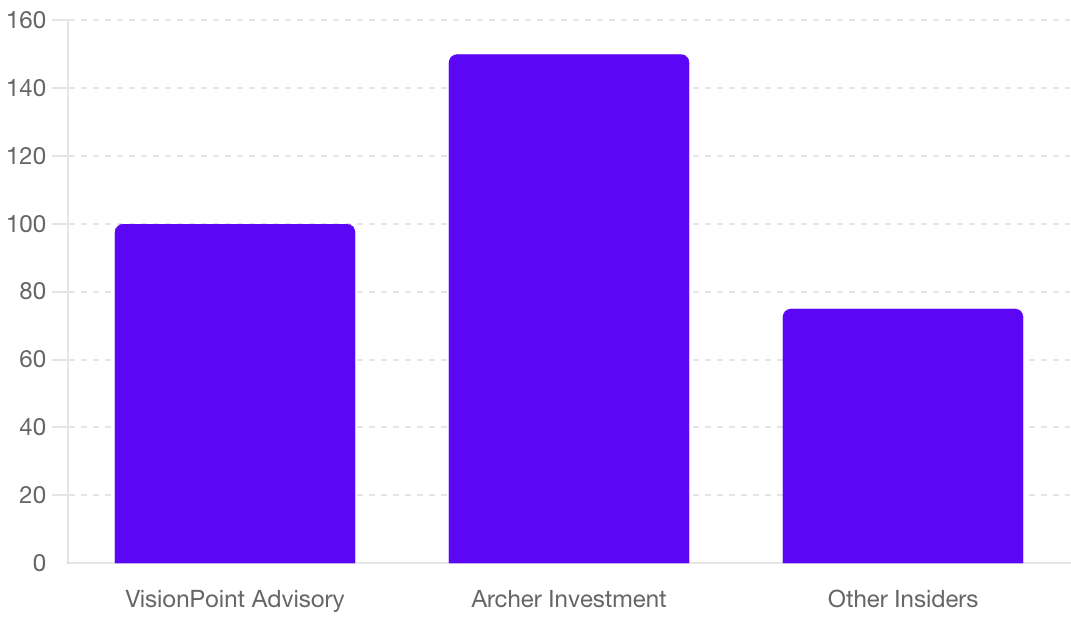

Insider Transactions for Paramount Global have been notable. Significant institutional investors have modified their holdings, with VisionPoint Advisory Group LLC and Archer Investment Corp acquiring new stakes in the third and fourth quarters of the past fiscal year. These transactions underscore confidence in Paramount’s long-term potential despite current market challenges.

Streaming Growth and Market Dynamics

Paramount Global’s streaming segment, especially Paramount+, shows promising growth. The platform's subscriber base and revenue have expanded significantly, with the average revenue per subscriber increasing. This growth is critical as the company navigates the decline in traditional TV media revenue.

Comparative Valuation and Competitive Landscape

Compared to competitors like Netflix (NFLX), Paramount Global trades at a lower valuation multiple. Netflix’s price to operating cash flow multiple is 33.3, and its EV/EBITDA ratio is 30.8, indicating a premium valuation due to its market leadership. Paramount’s relatively lower multiples suggest potential undervaluation, offering attractive entry points for investors considering its growth prospects in streaming and other entertainment segments.

Strategic Outlook and Investor Sentiment

The strategic outlook for Paramount Global is influenced by ongoing acquisition talks and the company's operational performance. The possibility of a major buyout by Sony and Apollo or other interested parties like Skydance presents significant upside potential for investors. However, even without a deal, Paramount’s improving financial metrics and growth in streaming services position it well for future success.

For more detailed financial metrics and to follow Paramount Global’s stock performance in real-time, visit the trading chart.

Why Paramount Global (NYSE:PARA) Is An Investment opportunity ?

Paramount Global (NYSE:PARA) presents a compelling investment opportunity with its stock at $12.02. Acquisition interest, notably from Sony and Apollo Global Management, values the company at $26 billion. Q1 2024 revenue rose 5.8% to $7.69 billion, driven by streaming growth. Paramount+ saw subscribers increase to 71.2 million, boosting streaming revenue by 51% to $1.46 billion. The stock’s forward P/E ratio is 12.21, indicating positive future earnings prospects. Investors should consider Paramount for its significant growth potential and favorable market position.