NYSEARCA:VIG – Why This Dividend Growth ETF is a Buy?

With a 10% dividend growth rate, ultra-low fees, and a 1.70% yield, is NYSEARCA:VIG the ultimate blend of growth and income? Discover the data-driven answer here | That's TradingNEWS

The Comprehensive Analysis of Vanguard Dividend Appreciation ETF (NYSEARCA:VIG)

The Vanguard Dividend Appreciation Index Fund ETF (NYSEARCA:VIG) stands as a beacon of consistent growth and income for investors seeking a balanced strategy between capital appreciation and stable dividend growth. With its focus on high-quality companies that have demonstrated a consistent history of dividend increases, VIG has managed to carve a niche as one of the most reliable dividend growth ETFs in the market. Its current performance, sector allocation, expense ratio, and valuation metrics make it a compelling choice for long-term investors, particularly in a market driven by economic volatility.

The Core Structure of NYSEARCA:VIG

The NYSEARCA:VIG tracks the performance of the S&P U.S. Dividend Growers Index, prioritizing companies with a history of growing dividends for at least ten consecutive years. This stringent criterion eliminates the top 25% highest-yielding stocks, a method designed to avoid the inclusion of distressed companies that may offer unsustainable high yields. As of now, VIG boasts a 1.70% forward yield, which, while modest, is backed by a remarkable 10.11% five-year dividend growth rate.

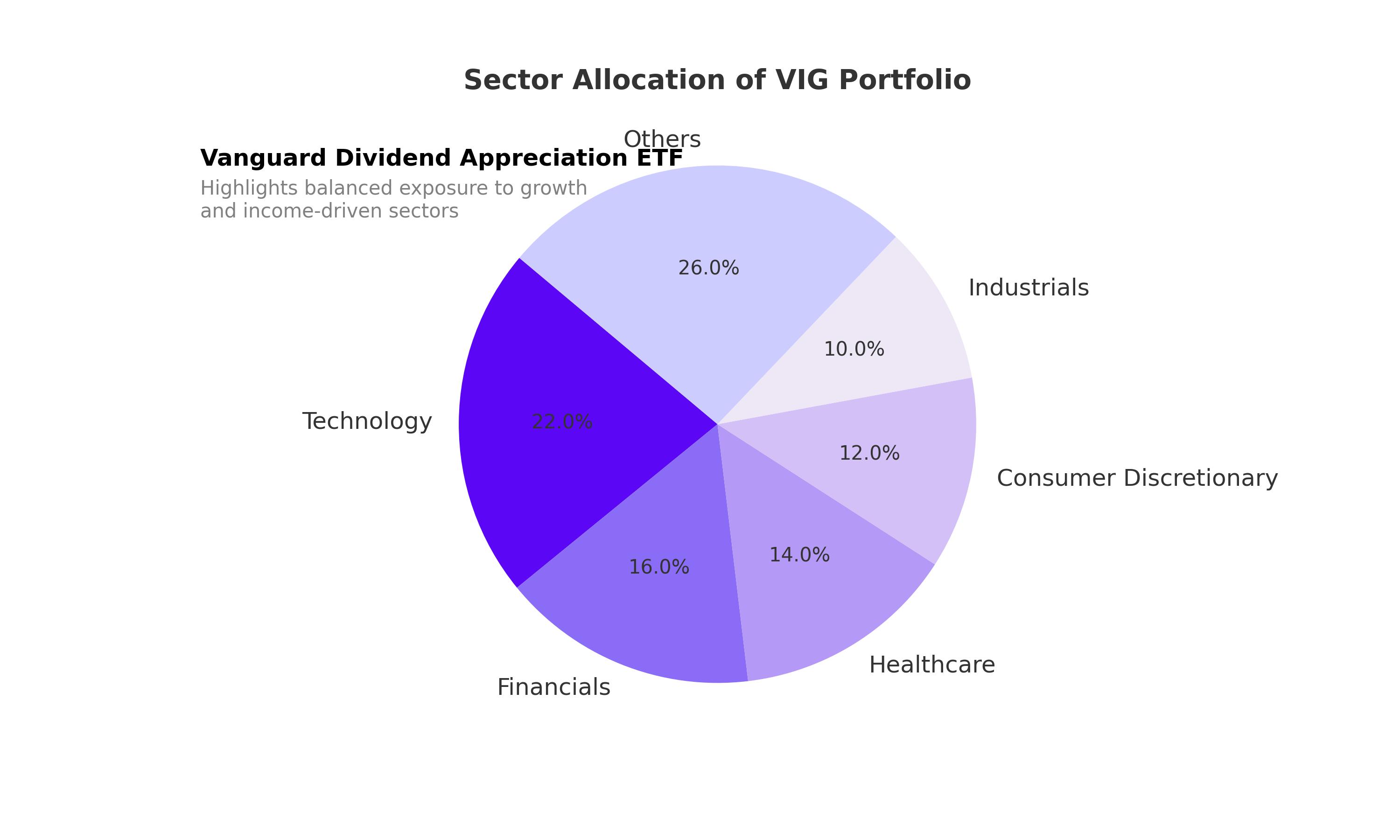

With 338 holdings across diverse sectors, VIG represents a well-diversified portfolio. Its top holdings include tech giants such as Apple (AAPL), Microsoft (MSFT), and Broadcom (AVGO), reflecting its sector-leading approach in technology and financials. Technology accounts for approximately 22% of the portfolio, followed by financials at 16%, further solidifying its exposure to growth-oriented yet dividend-reliable companies.

Performance Metrics: Outpacing the Broader Market

VIG has delivered stellar year-to-date (YTD) returns of +17.18%, outperforming similar ETFs like the Dow Jones Industrial Average ETF (DIA) and others in the equity dividend space. Over the past five years, VIG has consistently outperformed its peers, driven by strong earnings growth from its underlying holdings. The fund’s expense ratio of 0.06% remains one of the lowest in the industry, ensuring that investors retain more of their returns over the long term.

While its forward PEG ratio stands at an attractive 2.5x, it highlights VIG’s superior valuation compared to its peers. For example, the Vanguard High Dividend Yield ETF (VYM) has a lower P/E ratio but significantly higher PEG at 3.8x, reflecting the quality and growth premium investors are willing to pay for VIG.

Sector Analysis and Allocation

VIG’s sectoral allocation showcases its ability to blend stability with growth. Technology remains the top-performing sector within VIG’s portfolio, driven by robust earnings growth from Apple and Microsoft. These companies have consistently increased dividends while maintaining strong balance sheets and market leadership. The financial sector, representing 16% of the fund, includes stalwarts like JPMorgan Chase (JPM) and Visa (V), ensuring exposure to economically sensitive yet dividend-reliable stocks.

Dividend Growth: A Key Driver for Long-Term Investors

Dividends are an essential component of VIG’s total returns. With a five-year dividend growth rate of over 10%, VIG allows investors to enjoy increasing income over time. This growth trajectory significantly enhances the yield on cost for long-term holders. For example, an investor starting with a 1.70% yield could see it grow to 2.7% in five years and 4.4% in ten years, assuming consistent dividend growth. This compounding effect is a cornerstone of VIG’s attractiveness for income-focused investors.

Risks and Macroeconomic Considerations

Despite its strong fundamentals, VIG is not immune to broader market sell-offs. During the COVID-19 market downturn, VIG declined by 30%, slightly better than the S&P 500's 33% drop, showcasing its relative resilience. However, as a fund concentrated on dividend growth, VIG may underperform in environments where high-yield or distressed stocks experience a temporary rebound.

Another risk is the shift toward share buybacks by corporations, which might limit future dividend growth. However, VIG’s focus on companies with a proven dividend growth record mitigates this risk, ensuring that its holdings maintain shareholder-friendly capital allocation policies.

Financial Strength and Expense Advantages

One of VIG’s standout features is its ultra-low expense ratio of 0.06%, significantly lower than the industry average of 0.77%. Over the long term, this cost efficiency translates to higher compounding returns for investors. When compared to other dividend ETFs like VYM or WisdomTree U.S. Quality Dividend Growth ETF (DGRW), VIG’s expense advantage becomes even more evident. For example, a 0.06% expense ratio on a $100,000 investment growing at 10% annually results in an additional $16,000 over 20 years compared to a fund with a 0.77% expense ratio.

Valuation and Investment Decision

With a current price hovering around $167 and a P/E ratio of 25.5x, VIG may appear overvalued at first glance. However, its 12% average earnings growth rate justifies this premium. Compared to the broader market, VIG’s superior PEG ratio and robust dividend growth provide a compelling case for long-term investment. Investors seeking a balance of income and growth will find VIG’s risk-reward profile attractive.

Final Considerations: Is NYSEARCA:VIG a Buy?

Given its disciplined focus on quality, consistent dividend growth, and low-cost structure, NYSEARCA:VIG is a clear buy for long-term investors. Its ability to blend growth and stability makes it a standout choice for both income-focused portfolios and those seeking total return. The fund’s alignment with high-growth sectors like technology, coupled with a strong dividend policy, ensures that it remains relevant even in evolving economic landscapes.

Investors looking to add NYSEARCA:VIG to their portfolio can track its real-time performance at VIG Real-Time Chart. While broader market risks remain, VIG’s focus on dividend reliability and earnings growth makes it a compelling choice in today’s uncertain economic environment.

That's TradingNEWS

Read More

-

GPIX ETF Climbs to $52.54 as 8% Yield Turns S&P 500 Volatility Into Income

02.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Rally: XRPI $11.54, XRPR $16.35 And XRP-USD At $1.99 Aim For A $5–$8 Cycle

02.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Tests $3.50–$3.60 Floor Before LNG Wave

02.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds Near 157 as BoJ Caution and Fed Cut Bets Drive the Move

02.01.2026 · TradingNEWS ArchiveForex