Bitcoin Price Analysis: Navigating Volatility Amid Fed Concerns and Market Dynamics

Bitcoin Dips Below $90,000: Key Price Levels and Market Sentiment

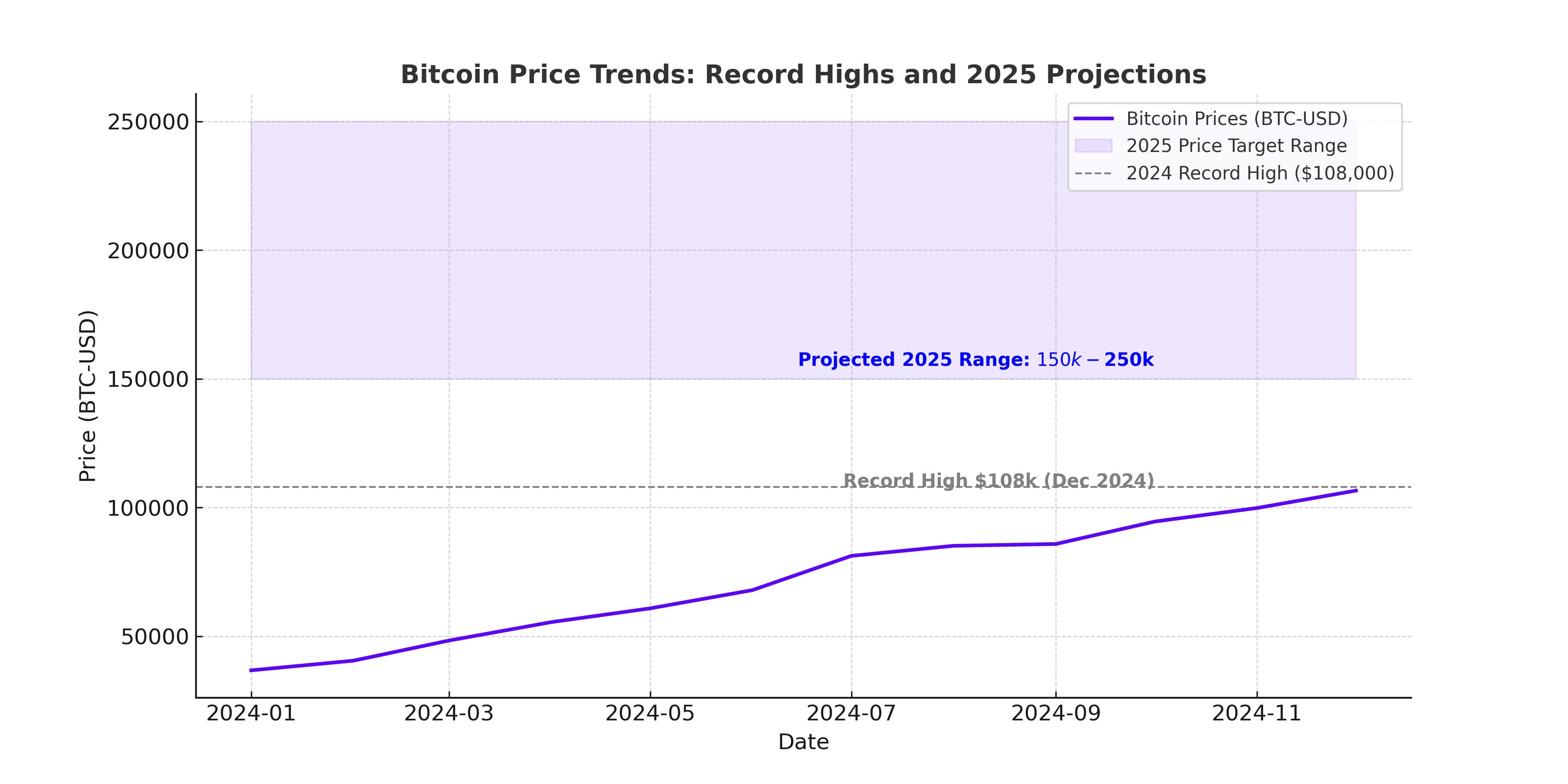

Bitcoin (BTC-USD) experienced a sharp decline, briefly falling below $90,000 for the first time since November, hitting a session low of $89,259. This marked a notable pullback from last week's high of $100,000. The cryptocurrency currently trades around $92,567, reflecting a 9% decline over the past week. This downward trend has reignited discussions on the factors influencing Bitcoin’s price action, with macroeconomic conditions, government sales, and market sentiment taking center stage.

Macroeconomic Pressure and Federal Reserve Policy Impact

A series of strong economic reports, including a surprising 256,000 increase in nonfarm payrolls and a drop in unemployment to 4.1%, have dampened expectations of aggressive rate cuts by the Federal Reserve in 2025. Elevated interest rates typically strengthen the U.S. dollar, reducing the liquidity available for risk assets like Bitcoin. Additionally, the 10-year U.S. Treasury yield reached its highest level since November 2023, further diminishing the appeal of cryptocurrencies as investors seek safer havens.

This bearish macroeconomic backdrop has weighed heavily on Bitcoin, which is often seen as a hedge against inflation but struggles in high-interest environments. Analysts are closely monitoring $92,000 as a critical support level. A break below this could push BTC toward $87,000 or even $76,000, based on historical price behavior.

Government Bitcoin Sales and Market Jitters

Reports of the U.S. government planning to sell approximately $6.5 billion worth of Bitcoin seized from the Silk Road black market have added to investor anxiety. While concerns about this influx of supply potentially suppressing prices persist, market experts have pointed out that such sales are typically conducted via auctions, mitigating immediate impacts on open market prices. Nonetheless, the news has contributed to a cautious outlook among traders.

Mining Difficulty and its Implications

The Bitcoin network's mining difficulty has reached a record high of 110.45 trillion, marking the eighth consecutive increase. This reflects the robustness of the network and heightened competition among miners, with the current hashrate averaging 775 EH/s. While higher difficulty underscores Bitcoin’s security, it also squeezes profit margins for miners, particularly in a volatile price environment. Historically, sustained increases in mining difficulty have coincided with significant market turning points, both bullish and bearish.

Institutional Activity and Derivatives Metrics

Institutional inflows into spot Bitcoin ETFs have shown mixed trends, with $307.2 million in net inflows last week despite $150 million in outflows over a two-day span. Meanwhile, derivatives data reveals optimism, as the annualized premium for Bitcoin futures contracts stands at 11%, above the neutral range. However, liquidations remain a concern, with $50.45 million in Bitcoin liquidations in the past 24 hours, primarily from bullish positions.

MicroStrategy’s Persistent Accumulation

MicroStrategy (NASDAQ:MSTR), under CEO Michael Saylor, continues its aggressive Bitcoin acquisition strategy, purchasing 2,530 BTC for $243 million last week. This brings the company’s total holdings to 450,000 BTC, with an average purchase price of $62,691 per coin. Despite the market downturn, MicroStrategy's steadfast accumulation highlights long-term confidence in Bitcoin’s potential. At recent prices, its Bitcoin stash is valued at approximately $41 billion.

Technical Outlook: Short-Term and Long-Term Scenarios

On the technical front, Bitcoin’s price action suggests a bearish trend with a V-shaped recovery attempt on the 4-hour chart. The $93,739 support level is critical, with resistance at $95,119. A breach of these levels could determine the short-term trajectory. Analysts point to the potential formation of a head-and-shoulders pattern, which, if validated, could signal a further decline toward $76,000. Conversely, a sustained break above $95,000 may pave the way for a retest of the $100,000 level.

Broader Cryptocurrency Market Trends

Bitcoin’s slide has rippled across the broader crypto market, with Ether (ETH-USD) down 18% and Solana (SOL-USD) falling 19% over the past week. XRP (XRP-USD), however, has bucked the trend, gaining 1%, bolstered by optimism surrounding regulatory clarity under the incoming Trump administration. The overall cryptocurrency market capitalization has dropped by 1.12% in the past 24 hours, standing at $3.28 trillion.

Outlook and Investment Considerations

Despite the recent downturn, Bitcoin’s resilience and growing adoption by institutions signal long-term potential. However, near-term risks tied to macroeconomic uncertainties, regulatory developments, and market sentiment remain significant. Investors should watch key levels, particularly $93,000 and $95,000, while remaining cautious of further downside risk. For long-term holders, the current pullback could present an opportunity, but traders should approach with vigilance given the volatile landscape.