Will Bitcoin’s Record $106,648 High Spark a Run to $120,000?

Bitcoin hits $106,648 amid Trump’s crypto reserve plans and institutional inflows. With predictions pointing to $120,000, what’s next for BTC in 2024? | That's TradingNEWS

Bitcoin’s Record Surge: Is BTC Poised for Even Greater Heights?

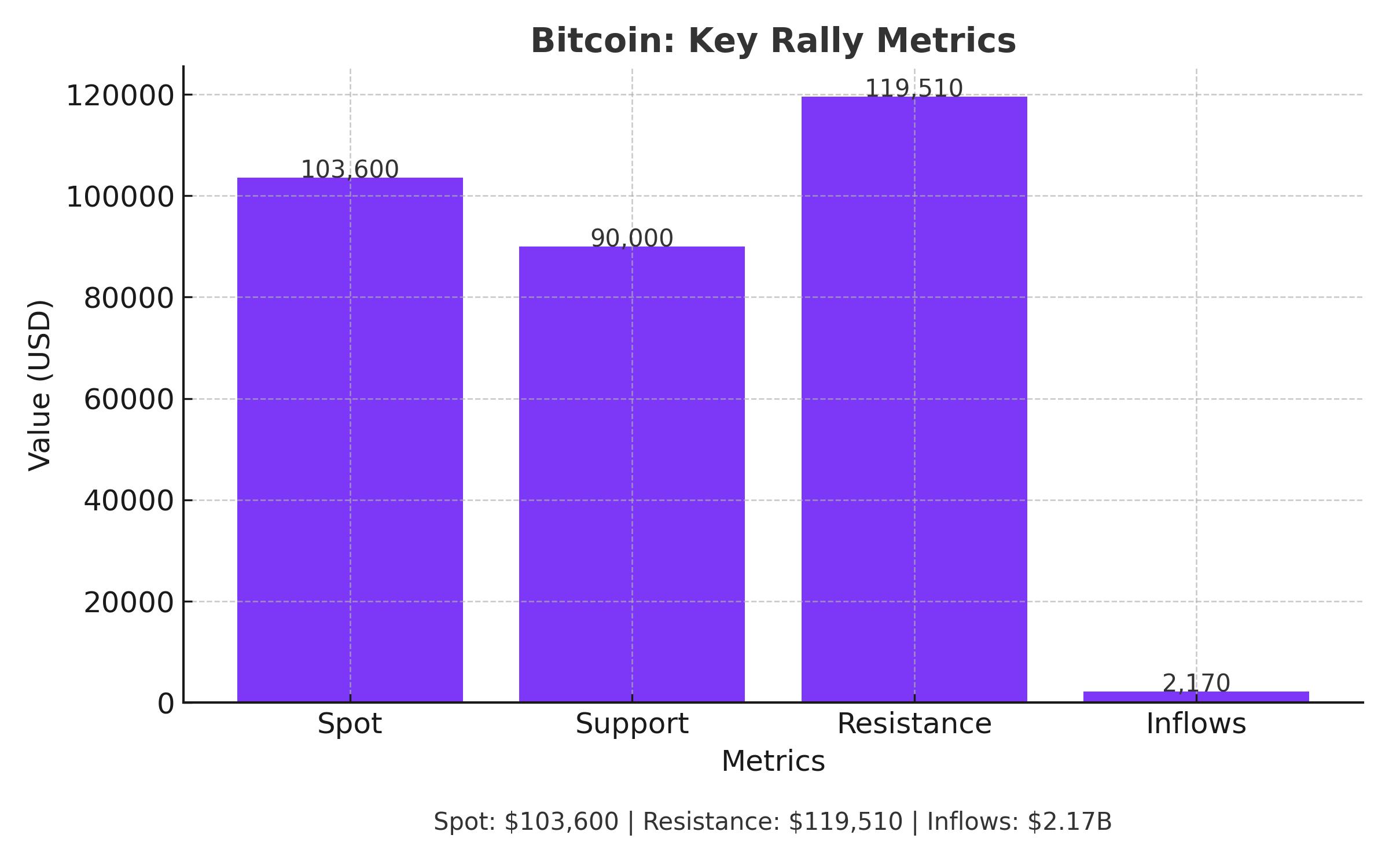

Bitcoin (BTC) has continued its bullish run, reaching a new all-time high of $106,648 before settling around $103,600 during the European session. This surge has positioned Bitcoin as a centerpiece of global financial discourse, buoyed by both market sentiment and strategic announcements, particularly President-elect Donald Trump’s proposal for a U.S. Bitcoin Strategic Reserve. With institutional inflows, bullish technical indicators, and growing adoption, Bitcoin’s trajectory appears robust, though cautionary signals suggest a potential pullback.

BTC’s Record-Breaking Momentum: A Deep Dive into the Numbers

Bitcoin’s year-to-date gains have surged 136%, with the cryptocurrency rallying over 50% since the November election. The total market capitalization of cryptocurrencies now exceeds $3.8 trillion, with Bitcoin commanding more than $2 trillion, making it the sixth-largest global asset. Institutional support remains strong, with spot Bitcoin ETFs seeing inflows of $2.17 billion last week alone. For instance, BlackRock's IBIT ETF secured $393 million, while Fidelity's FBTC attracted $60 million in the same period.

At present, Bitcoin is consolidating around the $100,000 psychological barrier, with analysts predicting a high probability of Bitcoin testing $119,000 in the short term. Longer-term forecasts are even more optimistic, with PlanB’s stock-to-flow model suggesting Bitcoin could reach an average price of $500,000 by 2025, potentially hitting $800,000 if pro-crypto policies materialize globally.

Trump’s Strategic Reserve Proposal Sparks Optimism

President-elect Donald Trump’s announcement of a Bitcoin Strategic Reserve has injected fresh optimism into the crypto markets. Drawing parallels with the U.S. Strategic Petroleum Reserve, Trump envisions the U.S. becoming a global leader in cryptocurrency, citing the need to counter China’s rapid crypto adoption. Trump has also appointed David Sacks, a pro-crypto advocate, as the White House czar for artificial intelligence and cryptocurrencies, and plans to nominate Paul Atkins to lead the SEC.

Currently, the U.S. government holds approximately 200,000 BTC worth over $20 billion, while China has 190,000 BTC in reserves. These reserves are already substantial, but their potential formalization as a strategic asset could revolutionize Bitcoin’s status as a globally accepted store of value.

MicroStrategy’s Nasdaq 100 Inclusion Fuels Institutional Interest

MicroStrategy (NASDAQ: MSTR), the world’s largest corporate holder of Bitcoin, has further strengthened Bitcoin’s bullish case. The company, which recently increased its holdings to 439,000 BTC at an average price of $61,725, was recently added to the Nasdaq 100 index. This inclusion has driven MicroStrategy’s stock price up by over 500% this year, with its total Bitcoin holdings now valued at $45.6 billion. The company funded its latest acquisition of 15,350 BTC (worth $1.5 billion) through its ATM program, underscoring its commitment to Bitcoin as a core corporate strategy.

The inclusion of MicroStrategy in the Nasdaq 100 is expected to attract more institutional inflows into Bitcoin, as exchange-traded funds tracking the index adjust their holdings. This creates a self-reinforcing loop, where higher Bitcoin prices fuel MicroStrategy’s valuation, enabling further Bitcoin purchases.

Technical Analysis: Bitcoin's Next Move

From a technical perspective, Bitcoin’s recent breakout past $106,000 places it firmly in uncharted territory. The key support levels are identified at $104,100, $100,000, and $90,800, with the latter serving as the ultimate safety net for bulls. On the upside, the next significant resistance levels are $119,510, derived from the 141.4% Fibonacci extension, and $155,500, based on historical Fibonacci fractals.

Momentum indicators are showing mixed signals. The RSI has entered overbought territory at 72, indicating strong bullish momentum, while the Awesome Oscillator (AO) suggests early bearish divergence, a potential precursor to a short-term correction. If Bitcoin closes below $100,000, it could retest the $90,000 support zone, presenting a buying opportunity for long-term investors. Conversely, sustained bullish momentum could propel Bitcoin toward $120,000 in the near term.

Institutional Adoption and ETF Momentum

Institutional activity has been a cornerstone of Bitcoin’s 2024 rally. The surge in spot Bitcoin ETF inflows reflects increasing confidence among institutional investors. Since October 10, wallets holding at least 100 BTC have grown by 10%, underscoring strong accumulation by high-net-worth individuals and institutions.

This trend aligns with forecasts that Bitcoin ETFs could bring $15 billion in inflows over the next 12 months, significantly boosting Bitcoin’s liquidity and price stability. The $2.17 billion inflows recorded last week mark the 12th consecutive week of positive flows, highlighting sustained institutional interest.

Broader Crypto Market Dynamics

Bitcoin’s rally has catalyzed mixed performance among altcoins. Ethereum (ETH), the second-largest cryptocurrency, tested the $4,000 level, while Solana (SOL) and Cardano (ADA) faced declines of 1.6% and 2.3%, respectively. Despite these fluctuations, the Fear & Greed Index remains at 80, signaling extreme investor confidence in the broader crypto market.

Long-Term Projections: The Path to $600,000?

Bitcoin’s long-term outlook remains exceptionally bullish. Analysts project a price range of $201,355 to $459,368 by 2029, driven by increasing scarcity, institutional adoption, and global geopolitical shifts. The 2028 Bitcoin halving event is expected to further reduce supply, potentially pushing prices toward $347,782 or higher.

By 2030, some forecasts suggest Bitcoin could trade between $238,152 and $610,646, solidifying its status as the digital gold standard. Cathie Wood’s ARK Invest remains the most optimistic, predicting a potential price of $3.8 million per Bitcoin by 2030.

Final Analysis

Bitcoin’s current price of $103,600 offers a compelling entry point for long-term investors, particularly given its robust institutional support, bullish technical indicators, and increasing adoption as a strategic asset. While short-term volatility is likely, Bitcoin’s fundamentals and macroeconomic tailwinds suggest significant upside potential in both the medium and long term. For investors seeking exposure to a transformative asset class, Bitcoin remains a strong Buy.