Sanctions on Russian Oil Propel Crude Prices Higher

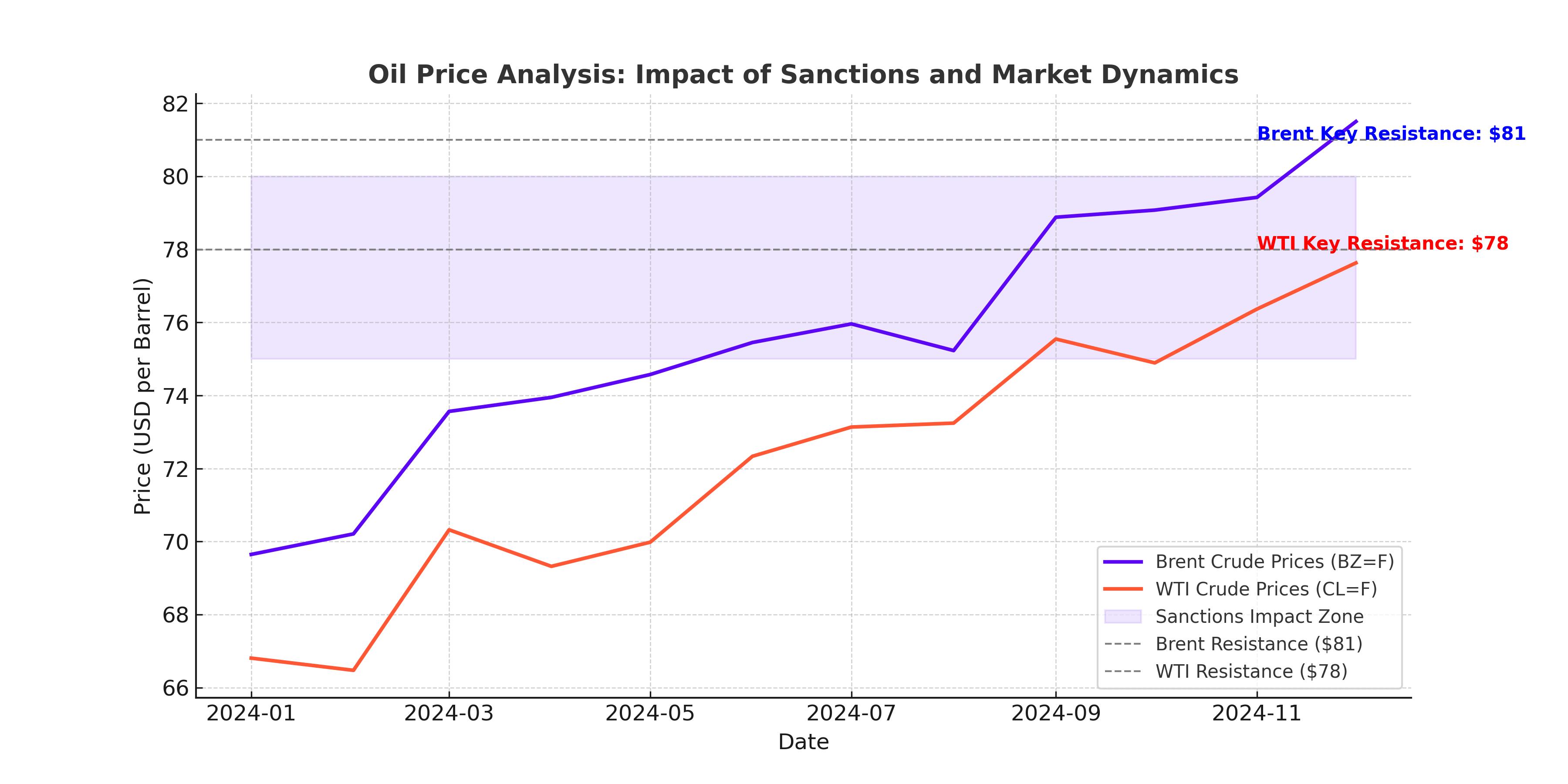

The global oil market has seen a significant shift, with Brent crude (BZ=F) climbing to $81.01 per barrel and West Texas Intermediate (WTI) futures (CL=F) settling at $78.82 per barrel. These price levels mark the highest close for Brent since late August and WTI since mid-August, highlighting the impact of recent geopolitical and economic developments. With front-month contracts rising over 6% in the past three sessions, traders are witnessing the steepest time spreads in months, reflecting robust near-term demand expectations amid constrained supply.

Impact of New U.S. and Allied Sanctions on Russian Oil

The Biden administration, alongside allies like the UK and Japan, has implemented its most stringent sanctions yet on Russian oil exports. Targeting over 180 vessels, including significant players like Gazprom Neft and Surgutneftegas, these sanctions aim to disrupt 25% of Russia’s daily oil exports—an estimated 1.7 million barrels. These measures, including barring Western maritime services for sanctioned tankers, force China and India, Russia’s primary buyers, to explore alternative sources. Goldman Sachs predicts these shifts could skew Brent crude prices toward the higher end of its $70-$85 forecast range.

Chinese and Indian Refiners Seek Alternatives

Indian and Chinese refiners, heavily reliant on discounted Russian crude, face a supply vacuum. Reports suggest 65 tankers have already anchored off Russian and Chinese coasts, awaiting clearance amid the sanctions’ enforcement. Analysts from Kpler estimate 900,000 barrels per day of Russian crude exported to China may be disrupted. India, which sources nearly 30% of its oil from Russia, is diversifying its imports toward Middle Eastern and African supplies, driving up shipping costs and global crude prices.

U.S. Labor Market Data Fuels Demand Speculation

Robust U.S. economic performance further supports oil prices. December’s nonfarm payrolls surged by 256,000, surpassing expectations of 160,000, while unemployment fell to 4.1%. These indicators reinforce market confidence in strong domestic demand from the world's largest oil consumer. However, this strength has also bolstered the U.S. dollar, reaching a 26-month high, which can temper global demand by making oil more expensive for buyers in other currencies.

Technical Trends and Market Sentiment

Oil benchmarks are trading in technically overbought territory for the second consecutive day. This bullish sentiment aligns with soaring futures volumes; Brent’s trading activity on January 10 reached its highest since March 2020, while WTI volumes hit levels last seen in March 2022. The sharp increase in open interest reflects traders betting on sustained higher prices amid tightening supply dynamics.

Emerging Risks: Inflation and Geopolitical Factors

Geopolitical risks remain a double-edged sword for oil markets. While heightened tensions, including sanctions and potential supply chain disruptions, support prices, they also introduce volatility. For instance, Israel-Hamas ceasefire negotiations and U.S. sanctions on Iranian oil exports add layers of uncertainty. Additionally, a stronger U.S. dollar and elevated Treasury yields, spurred by reduced expectations of Federal Reserve rate cuts, pose downward pressure on oil by curbing liquidity and increasing borrowing costs.

Market Outlook: Supply Constraints and Demand Recovery

Looking ahead, analysts anticipate constrained Russian exports and shifting trade dynamics will sustain the upward trajectory in crude prices. Meanwhile, OPEC+ production cuts and anticipated growth in Chinese demand—post-zero-COVID policy—will further tighten global supply. However, macroeconomic factors, including high inflation and elevated interest rates, could temper this bullish momentum by slowing global growth and energy demand.

Investment Considerations and Strategic Insights

Given the current landscape, the energy sector remains an attractive proposition for investors. Shares of oil majors like ExxonMobil (XOM) and Baker Hughes (BKR) have outperformed, with gains of nearly 3% and 4%, respectively, on the latest price rally. Conversely, energy-intensive industries, including airlines and cruise operators, face headwinds. Delta Air Lines (DAL) and American Airlines (AAL) saw stock declines exceeding 2% as fuel costs weigh on profitability. For long-term investors, the key will be navigating this complex interplay of supply constraints, geopolitical risks, and economic indicators.