EUR/USD Faces Pressure Amid Fed’s Hawkish Stance and ECB's Dovish Outlook

The EUR/USD pair, a critical barometer of global economic sentiment, has faced significant downward pressure, nearing its lowest levels in two years. As of the latest trading sessions, the pair has hovered around the mid-1.03 level, a sharp decline influenced by the Federal Reserve's hawkish rate cut and the European Central Bank's relatively dovish policy trajectory. These developments come against the backdrop of broader economic uncertainties and diverging monetary policies.

Fed’s Hawkish Rate Cut Elevates the Dollar

The Federal Reserve’s recent decision to cut interest rates by 25 basis points was widely anticipated. However, it was the bank's unexpectedly hawkish guidance for 2025 that sent shockwaves through global markets. The Fed’s dot plot now projects just 50 basis points of rate cuts for next year, half the reduction anticipated in September. This cautious stance highlights the Fed's prioritization of inflation control, particularly as the PCE price index showed inflation at 2.4% year-over-year in November, slightly below forecasts but still above the central bank’s 2% target.

The U.S. Dollar Index (DXY) responded by soaring to 108.54, its highest level since November 2022, bolstered by rising Treasury yields. The 10-year yield climbed to 4.51%, while the 2-year yield ended the week at 4.32%. These developments underscored the greenback's strength, particularly as traders recalibrated their expectations for future monetary policy adjustments. The dollar's strength has placed significant pressure on the euro, which fell to 1.034 before recovering slightly to 1.043.

ECB’s Dovish Signals Weigh on the Euro

In stark contrast to the Fed’s hawkish stance, the European Central Bank has signaled a dovish approach to monetary policy. The ECB recently reduced interest rates for the fourth time this year, bringing its benchmark rate to a record low of 4%. While ECB President Christine Lagarde emphasized a commitment to restrictive policies, she also acknowledged that further rate cuts could be necessary if economic data align with expectations.

Economic indicators paint a grim picture for the eurozone. The flash manufacturing PMI for both Germany and France has indicated a deepening recession, while the French central bank has downgraded its GDP growth forecast for 2025 to 0.9% from an earlier projection of 1.2%. Political instability, trade tensions, and the impact of U.S. President-elect Donald Trump’s proposed protectionist policies have further clouded the eurozone's outlook. Lagarde noted that these factors are likely to exacerbate the region's economic challenges, adding downward pressure on the euro.

Risk-Off Sentiment Dominates Global Markets

The Fed’s hawkish pivot has sparked widespread risk-off sentiment, with global equities and commodities taking a hit. The CBOE Volatility Index (VIX) surged 74% to 27, its highest level since August. Wall Street experienced steep declines, with the Dow Jones falling over 1,000 points and extending a nine-day losing streak. The S&P 500 and Nasdaq also fell sharply, reflecting investors' apprehension about future economic conditions.

The euro has not been the only currency impacted by the dollar’s strength. Commodity-linked currencies such as the Australian dollar, Canadian dollar, and New Zealand dollar have also faced significant declines. The Canadian dollar, for instance, fell to its lowest level since March 2020. Meanwhile, Trump’s threat of a 25% tariff on Canadian imports adds another layer of complexity to trade relations, potentially further weakening the loonie.

EUR/USD Technical Outlook

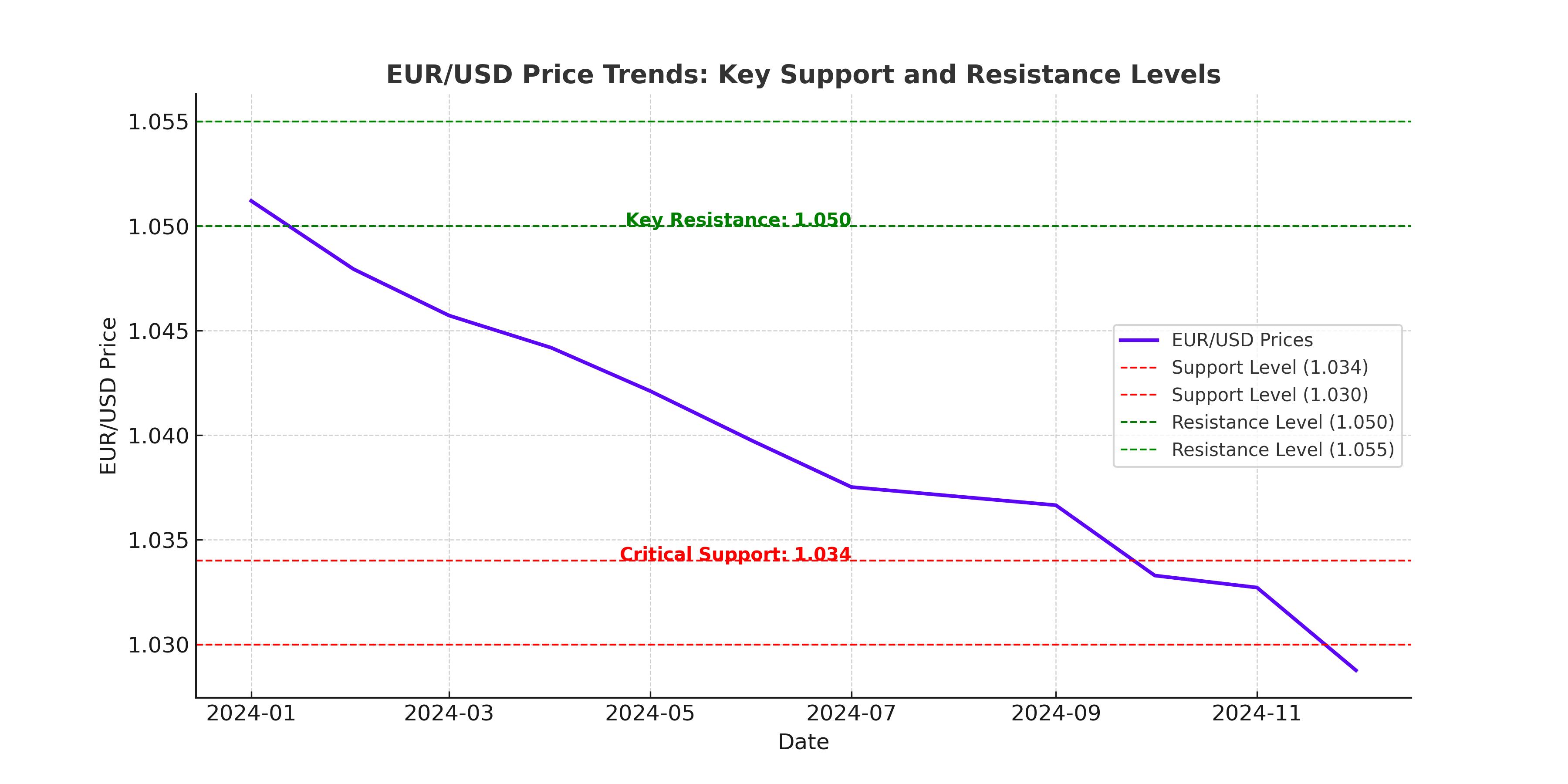

The technical landscape for EUR/USD remains bearish. The pair’s recent dip to 1.034 marks a critical support level, with analysts eyeing the 1.030 threshold as the next potential target. Resistance is expected around the 1.050-1.055 range, but any sustained recovery will likely depend on a shift in the dollar's trajectory or improved eurozone economic data.

Key indicators, including moving averages and oscillators, suggest continued downward pressure in the near term. The euro's ability to rebound will hinge on upcoming economic releases, including inflation data and PMI figures, as well as any shifts in ECB policy.

Economic Divergence Shapes Outlook

The diverging monetary policies of the Fed and ECB highlight the fundamental drivers of EUR/USD movements. While the Fed remains committed to a cautious easing path to ensure inflation control, the ECB faces the dual challenge of fostering growth amid recessionary pressures and maintaining financial stability. This divergence has placed the euro at a distinct disadvantage against the dollar, a trend that could persist into 2025.

Conclusion

The EUR/USD pair’s outlook remains bearish, driven by the Fed’s hawkish policy stance and the eurozone’s economic struggles. With the dollar maintaining its dominance and the ECB signaling further rate cuts, the pair faces significant headwinds. Traders and investors should remain vigilant, as upcoming economic data and geopolitical developments could further influence market dynamics. For now, the euro’s path forward appears challenging, with the dollar retaining its position as the global safe-haven currency.