Gold Price Trends Amid Rate Decisions and Geopolitical Tensions

Gold (XAU/USD) Holding Steady Near $2,650 as Central Bank Decisions Loom

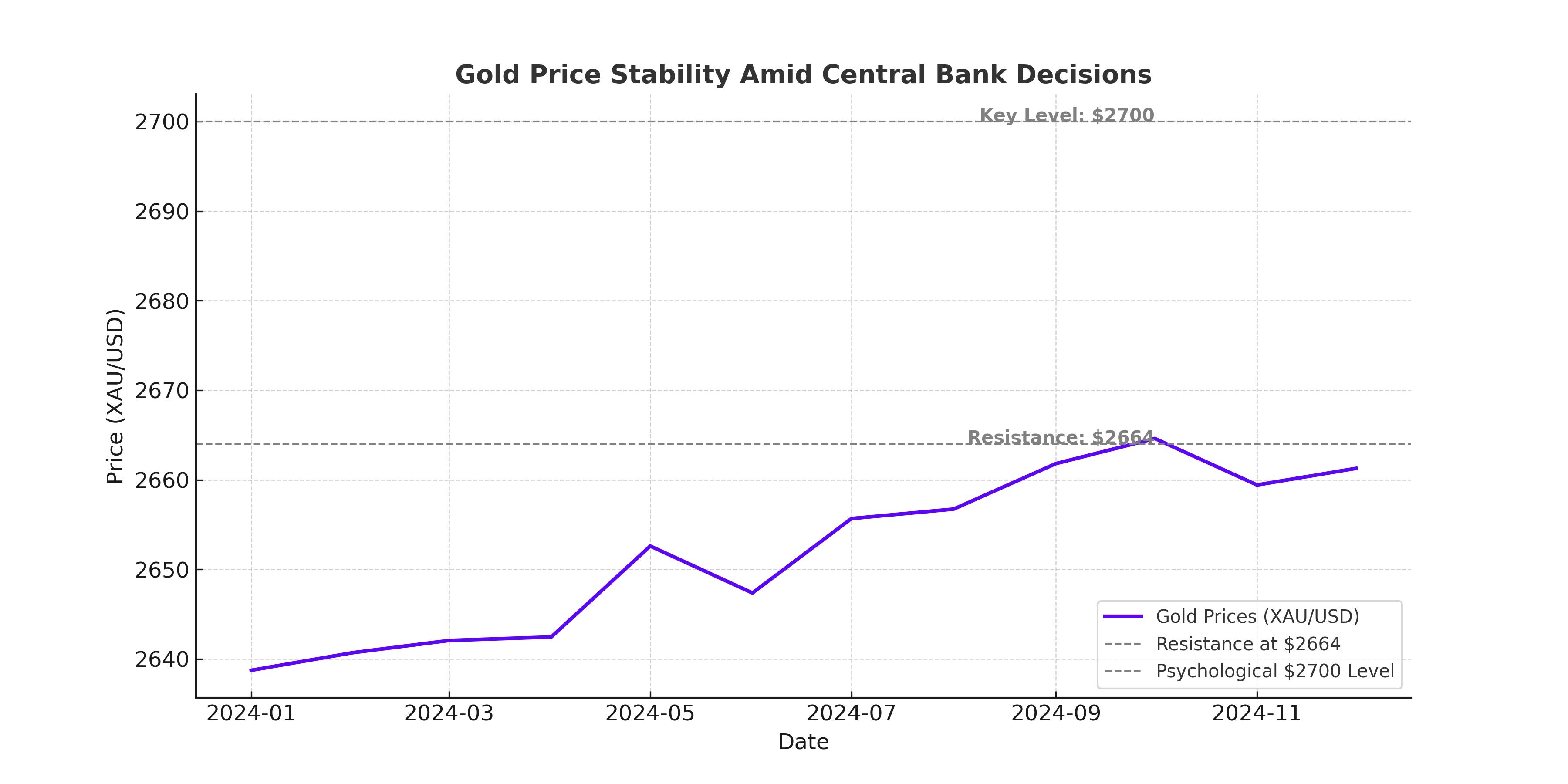

Gold prices remain tightly range-bound, trading between $2,639 and $2,664 per ounce as the market braces for significant central bank updates this week. Investors are watching the Federal Reserve's highly anticipated rate decision, alongside updates from the Bank of Japan (BOJ) and Bank of England (BOE). Spot gold fell 0.5% to $2,639.56 per ounce, while February futures dipped 0.6% to $2,653.81, with traders cautiously aligning positions ahead of what could be pivotal policy shifts.

The Federal Reserve is expected to deliver a 25-basis-point rate cut in its final meeting of the year. However, all eyes will be on the Fed's forward outlook as inflation persists and labor market resilience adds complexity. The dollar index (DXY) rose to a three-week high above 107, pressuring gold by increasing its opportunity cost. A less aggressive rate-cutting trajectory from the Fed could cap further gains for XAU/USD.

The BOJ decision remains a wildcard, with analysts split on whether the central bank will raise rates further following its historic pivot earlier this year. Meanwhile, the BOE is expected to hold steady, aligning with global trends toward monetary stability amid ongoing economic uncertainties.

Geopolitical Unrest and Central Bank Demand Support Gold’s Safe-Haven Status

Despite recent short-term consolidation, gold's outlook remains robust, fueled by persistent geopolitical risks and increased central bank purchases. Record central bank buying in 2024, particularly from emerging economies, has underpinned gold's strength, driving a 30% surge year-to-date. Ongoing geopolitical conflicts, including the Russia-Ukraine war and escalations in the Middle East, continue to push investors toward gold as a hedge against uncertainty.

China's central bank is anticipated to return to gold buying in 2025, bolstering sentiment after a temporary pause. Coupled with supportive monetary easing measures, China's resurgence in gold demand could inject further momentum. Analysts expect that continued purchasing from countries like Turkey, India, and China will stabilize gold above $2,600.

Technical Analysis: Key Levels to Watch for XAU/USD

Gold prices face immediate resistance at the $2,664-2,666 range, which acted as the recent intraday high. A breakout above this level could allow gold to test $2,677 before reclaiming the psychological $2,700 mark. Sustained strength beyond $2,700 would signal a resumption of the long-term uptrend, with potential to target $2,726, a recent monthly swing high.

On the downside, gold finds initial support at $2,638, with stronger levels at $2,625 and $2,600. A decisive drop below $2,600 could trigger bearish momentum, paving the way for declines toward $2,531. The Relative Strength Index (RSI) remains neutral, signaling indecision as traders await the Fed's monetary policy clarity.

Gold’s Stability Amid Dollar and Yield Dynamics

The US dollar's recent strength, driven by rising US Treasury yields, has posed headwinds for gold. The benchmark 10-year Treasury yield climbed to 4.37%, reflecting expectations of inflationary pressure under a potential second Trump administration and reduced Fed dovishness. Higher yields typically weigh on gold as they increase the opportunity cost of holding the non-yielding metal.

Yet, gold's ability to maintain stability near $2,650 highlights its resilience. The CME FedWatch Tool indicates a 96% chance of a 25-basis-point rate cut this week, with markets now pricing in fewer rate cuts for 2025 – a critical factor impacting gold’s near-term direction.

Global Economic Data and the Road Ahead for XAU/USD

US economic data has presented a mixed picture, with services sector strength overshadowing manufacturing weakness. December’s S&P Global Services PMI surged to a 38-month high at 58.5, while Manufacturing PMI slipped to a three-month low of 48.3. This divergence underscores the Fed’s challenging balancing act as it seeks to combat inflation without derailing economic growth.

In addition to the Fed’s rate decision, upcoming US retail sales and industrial production data will provide short-term cues for gold traders. Should data show economic resilience, expectations of prolonged higher rates could limit gold’s upside, at least in the near term.

China's economic fragility adds further complexity to the gold market. Copper, another key industrial metal, fell 1% to $8,979 per ton due to fears of weakening Chinese demand. As Beijing rolls out additional stimulus measures to stabilize growth, a turnaround in economic activity could bolster commodity sentiment and indirectly support gold prices.

Is Gold Set to Break Above $2,700, or Will Rates Cap Its Advance?

Gold's future trajectory hinges on central bank actions and inflationary trends. The recent easing stance by major central banks, including the European Central Bank and Bank of Canada, contrasts with the Fed’s cautious tone. Should the Fed signal a slower pace of rate cuts, gold could remain capped below $2,700. However, any dovish tilt or unexpected economic weakness would reignite bullish momentum, pushing XAU/USD higher.

Geopolitical instability remains a key wild card, driving safe-haven demand and solidifying gold’s role as a global hedge. Analysts, including prominent voices such as Peter Schiff, have reiterated that gold is unlikely to dip below $2,000 per ounce, with long-term structural factors favoring continued gains. Schiff predicts that gold’s upward direction is firmly intact, supported by global uncertainty and declining real yields.

Final Outlook on Gold Prices and Strategy

While gold remains in a holding pattern near $2,650, it is well-positioned for an upward breakout if the Fed signals dovish flexibility. Geopolitical risks, central bank buying, and inflation concerns continue to provide a floor for XAU/USD. Traders should monitor critical levels at $2,638 and $2,700 while remaining cautious of any dollar strength post-Fed decision.

For long-term investors, gold’s appeal remains compelling amid shifting monetary policies and global economic uncertainties. The metal’s resilience and upward bias present a strong case for holding gold as a hedge against both inflation and geopolitical instability. Gold’s path toward $2,700 and beyond remains well-supported, making it a strategic buy on dips for those seeking safety and growth.