NYSEARCA:XLK's 2024 Underperformance—A Temporary Setback or a Warning Sign?

NYSEARCA:XLK, the go-to ETF for tech sector exposure, returned 16.6% in 2024, falling behind the S&P 500’s 23.4% gain. This underperformance was surprising given the dominance of XLK’s largest holdings: Apple (AAPL), Microsoft (MSFT), and Nvidia (NVDA). Despite tech’s strong fundamentals, macroeconomic headwinds, including higher interest rates and supply chain concerns, tempered its growth.

Can XLK stage a comeback in 2025, or will the sector remain volatile? With AI, cloud computing, and quantum computing driving innovation, and Federal Reserve rate cuts potentially on the horizon, XLK may be positioned for a strong rebound.

Apple (AAPL): Still the Backbone of XLK or a Growth Concern?

As the largest holding in NYSEARCA:XLK, Apple (AAPL) comprises 14.5% of the ETF’s total weight. The company’s stock climbed over 32% in 2024, fueled by strong demand for iPhones, Apple Silicon, and services like Apple Pay and iCloud. However, concerns over slowing revenue growth in China and intensifying competition from Huawei have sparked doubts about its future trajectory.

Apple’s pivot toward AI integration—through its work with Baidu (BIDU) and Alibaba (BABA) in China—could be a game-changer. Analysts expect the company to roll out AI-powered Siri and on-device AI computing in iPhone 16 and MacBooks powered by the M4 chip. But will AI features be enough to push AAPL stock higher, or is the era of double-digit growth behind it?

Microsoft (MSFT): The AI Powerhouse That Keeps Expanding

Microsoft (MSFT), the second-largest XLK holding at 22.5%, had another strong year in 2024, climbing over 55% as it continued to dominate in cloud computing, enterprise software, and AI services.

The company’s deep partnership with OpenAI, along with its focus on AI-powered enterprise solutions, cloud computing through Azure, and AI-driven search tools via Bing, places Microsoft in a strong position for 2025.

The latest Stargate AI Project, a $500 billion investment in AI infrastructure, could further fuel Microsoft’s revenue. But with growing competition from Google’s (GOOGL) Gemini AI and Amazon’s (AMZN) AWS AI initiatives, can Microsoft maintain its lead?

Nvidia (NVDA): Is AI Enough to Justify Its Valuation?

With a market capitalization exceeding $1.8 trillion, Nvidia (NVDA) remains one of the strongest growth drivers in XLK, contributing 9.1% of the ETF’s weight.

Nvidia delivered a staggering 180% return in 2024, fueled by soaring demand for its AI chips and data center GPUs. The launch of the Blackwell AI accelerator and Grace-Blackwell superchips keeps Nvidia at the forefront of AI-driven computing.

However, China’s DeepSeek AI breakthrough raised concerns about future demand for Nvidia’s H100 and Blackwell GPUs. With competitors like AMD (AMD) pushing their AI chips into hyperscale data centers, is Nvidia at risk of slowing growth?

Broadcom (AVGO): The Silent Winner in AI Infrastructure

Broadcom (AVGO), which ranks as XLK’s fourth-largest holding at 5.1%, saw its stock surge 85% in 2024, outperforming most other semiconductor companies.

The VMware acquisition helped Broadcom expand into enterprise cloud computing, while its custom AI accelerators for hyperscale cloud providers like Google, AWS, and Microsoft positioned the company as a key AI infrastructure provider.

Broadcom's AI revenue is projected to exceed $10 billion in 2025, making it one of the most stable AI investment plays within XLK. Could AVGO be the ETF’s most underrated growth stock?

Quantum Computing and Cybersecurity—The Next Big Tech Wave?

Beyond AI, another major theme for 2025 is cybersecurity and quantum computing.

Post-Quantum Cryptography (PQC) is becoming a major focus for large enterprises, with companies like IBM (IBM), Accenture (ACN), and Oracle (ORCL) developing next-generation encryption algorithms to defend against cyberattacks.

IBM’s recent acquisition spree in cybersecurity and hybrid cloud services has analysts predicting a 5% revenue expansion in 2025, making IBM one of the top performers in XLK’s portfolio.

XLK’s Expense Ratio and Growth Potential—Is It Worth the Investment?

With $75 billion in assets, 69 holdings, and a low expense ratio of 0.08%, XLK remains one of the best ways to gain diversified exposure to technology.

The fund’s 3-5 year EPS growth estimate is 18%, justifying a Buy rating, but risks remain. The U.S.-China trade war, potential AI regulation, and competitive pressures could all impact returns.

Final Decision—Buy, Hold, or Sell XLK?

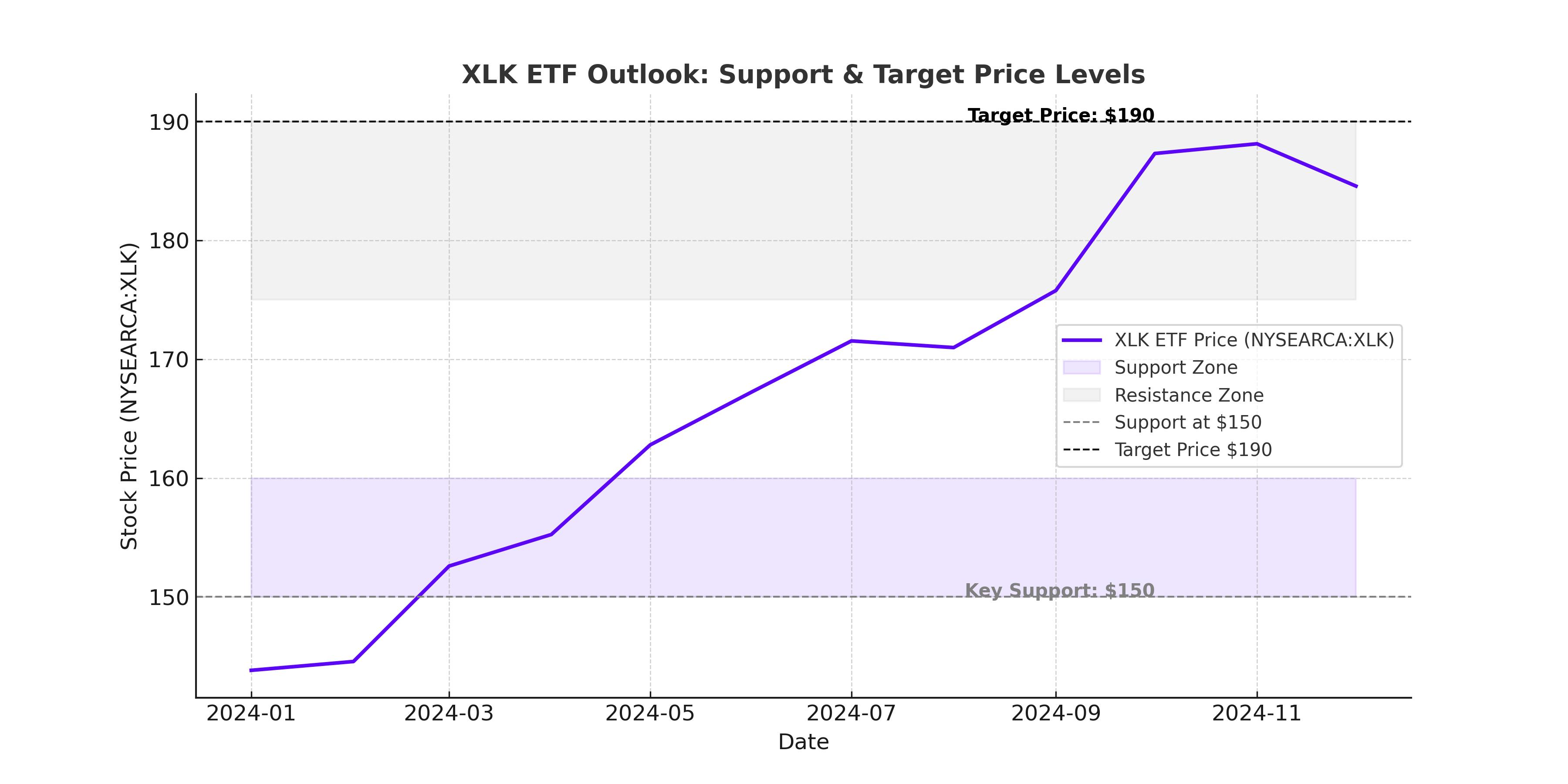

With the Federal Reserve expected to cut interest rates in 2025, tech stocks could outperform after last year’s slowdown.

The strong performance of Nvidia, Broadcom, and Microsoft, along with Apple’s AI transition, suggests XLK is well-positioned for long-term growth.

However, with AI demand cooling off and China’s tech advancements raising competitive concerns, the ETF may see volatility in the short term.

Verdict: XLK remains a strong Buy for long-term investors, but caution is warranted as valuations remain elevated.