Global Oil Market Trends: WTI and Brent Prices Show Resilience Amid Geopolitical and Seasonal Dynamics

WTI Crude (CL=F) and Brent Crude (BZ=F) Maintain Stability

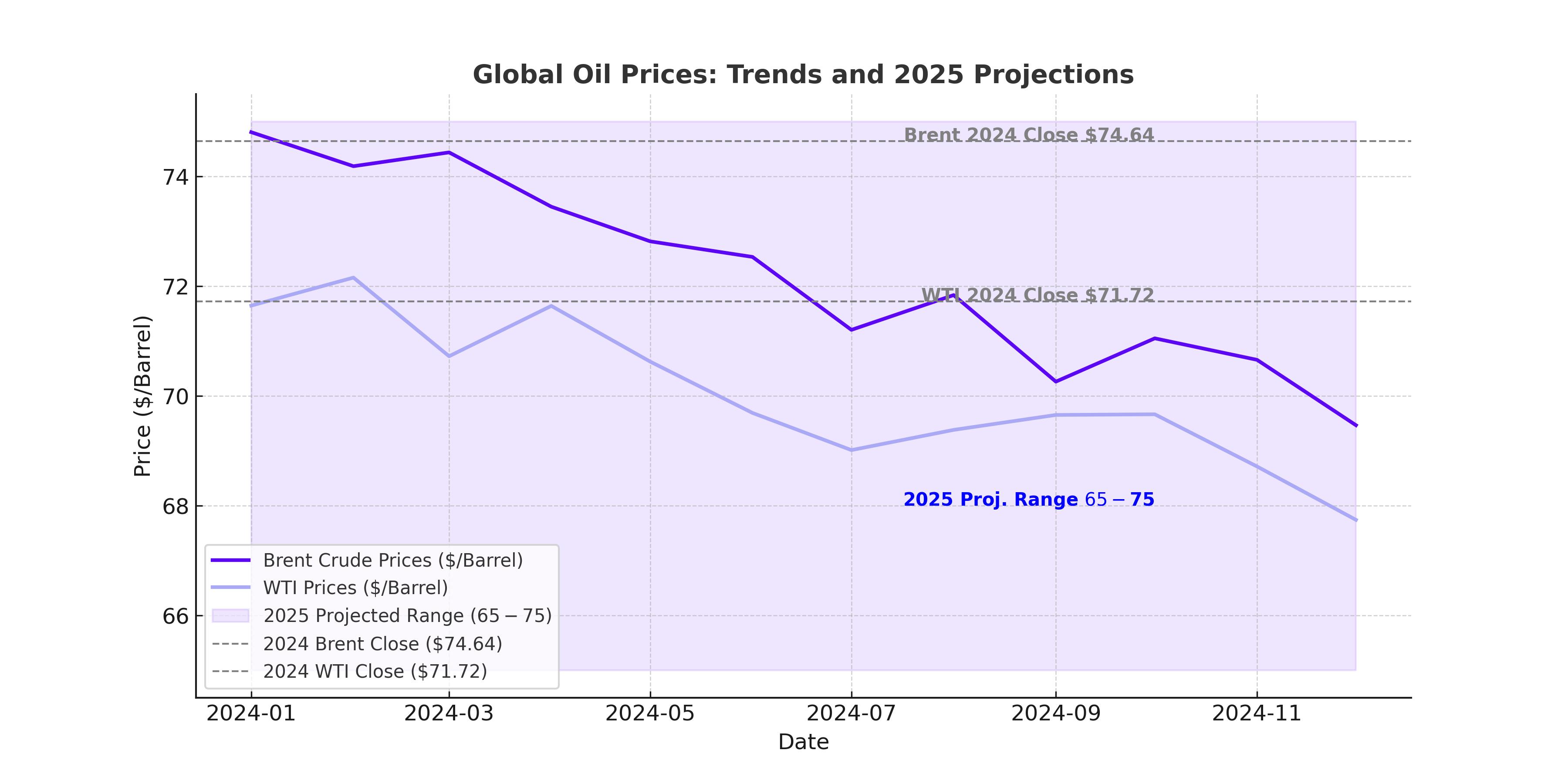

West Texas Intermediate (WTI) crude oil, symbolized as CL=F, currently trades around $74.07 per barrel, reflecting a modest 0.69% increase in response to heightened global demand. Brent Crude, represented as BZ=F, follows closely at $77.08 per barrel, up 1.02% during the same period. Both benchmarks show resilience amid geopolitical uncertainties, tight supply, and seasonal demand shifts. The current trading range signals a delicate balance between supply disruptions and demand optimism fueled by Chinese economic recovery measures.

Impact of Chinese Demand and Supply Constraints

China, the world’s largest oil importer, plays a critical role in driving current price trends. Recent announcements from Shandong Port Group restricting U.S.-sanctioned tankers underscore Beijing's strategic response to international pressures. This move tightens access to Middle Eastern oil supplies, creating a ripple effect in the global market. Chinese refiners, often referred to as "teapots," rely heavily on discounted Iranian crude, and logistical bottlenecks may drive demand for alternative supplies, lifting market prices. Additionally, Saudi Arabia’s increase in oil prices for February exports to Asia underscores the region’s tightening crude markets.

Sanctions and Production Dynamics

Tighter Western sanctions targeting Russian and Iranian crude exports are also reshaping supply patterns. Russia’s crude production in December fell below its OPEC+ quota to 8.971 million barrels per day, marking a significant decline compared to previous months. Concurrently, reports suggest Iranian exports face renewed scrutiny, further straining global supply chains. The Biden Administration’s outgoing moves to increase sanctions amplify this supply-side pressure, inadvertently boosting prices as fears of restricted output intensify.

OPEC+ Adjustments and Geopolitical Tensions

OPEC+ continues to play a pivotal role in stabilizing the oil market. Production cuts remain a core strategy to counteract overproduction by member states such as Iraq and Kazakhstan. In December, the alliance reduced output by 120,000 barrels per day, with notable adherence from members like the UAE. However, overproduction by other members still exceeded 400,000 barrels daily, complicating efforts to manage global inventory levels.

Geopolitical shifts, including Sudan’s resumption of oil exports following a ten-month disruption, contribute to regional output volatility. The reopening of South Sudan’s Dar Petroleum pipeline offers relief to the market, yet its long-term stability remains contingent on improved security conditions.

Technical Indicators and Market Sentiment

Technical analyses indicate bullish momentum for both WTI and Brent prices, supported by improving Relative Strength Index (RSI) levels. WTI’s RSI stands near 59, while Brent hovers around 60, signaling favorable buying conditions. Analysts project Brent could test the $80 resistance level, with support anchored around $75. For WTI, sustained support at $70 is critical for maintaining upward momentum. Recent bullish crossovers in Moving Average Convergence Divergence (MACD) charts reinforce positive sentiment, suggesting potential for further gains.

Seasonal and Regional Influences on Heating Oil Demand

Colder-than-expected weather across Europe and the United States has intensified demand for heating oil, particularly in the U.S. Northeast and Midwest. Wholesale electricity prices in New England surged to $120 per megawatt-hour, reflecting heightened energy consumption. Simultaneously, Texas’ Permian Basin reported a spike in natural gas prices to $3.67 per mmBtu, highlighting increased regional heating demand.

Long-Term Forecasts and Market Risks

Oil prices are forecasted to remain range-bound in the near term, with potential upward spikes driven by geopolitical uncertainties. Analysts like Giovanni Staunovo of UBS emphasize the market’s susceptibility to disruptions from tightened sanctions and rising Chinese demand. Conversely, bearish risks persist as global inflationary pressures and the potential for slower economic recovery in major markets temper optimism.

The delicate interplay of supply constraints, geopolitical developments, and seasonal demand dynamics continues to shape the global oil market. Whether these factors sustain current price levels or catalyze further volatility remains closely tied to macroeconomic indicators and geopolitical resolutions. For now, both WTI and Brent stand as key indicators of energy market resilience in a complex global landscape.