WTI and Brent Crude Oil Rally as Market Eyes Geopolitical Risks and OPEC+ Decisions

Global oil prices climb with WTI at $69.10 and Brent near $72.78, driven by renewed supply concerns, volatile geopolitical developments, and anticipation for OPEC+ production strategy updates | That's TradingNEWS

Crude oil markets remain in a state of flux, with West Texas Intermediate (WTI) and Brent crude prices navigating through a storm of geopolitical tensions, OPEC+ policy uncertainties, and shifting demand patterns. These dynamics, paired with global macroeconomic factors, have placed significant pressure on oil markets while also offering glimpses of bullish potential under specific scenarios.

WTI Crude Oil Gains Traction Amid Uncertainty

WTI crude oil, trading near $69.10, reflects the broader uncertainties gripping the market. The ongoing conflict between Russia and Ukraine continues to pose risks to energy supplies, particularly as winter looms for Central and Eastern Europe. Russian President Vladimir Putin's warnings about potential escalations, including nuclear-capable missile deployments, have reignited concerns over regional stability.

While WTI saw marginal gains on Friday, supported by a weaker U.S. dollar and geopolitical tensions, broader market sentiment remains cautious. Investors are closely watching the upcoming OPEC+ meeting, postponed to December 5, for clarity on production policies. With previous voluntary production cuts of 2.2 million barrels per day set to expire, speculation grows over whether these cuts will be extended into 2025. Market participants suggest this decision could be pivotal in determining the near-term trajectory of WTI prices.

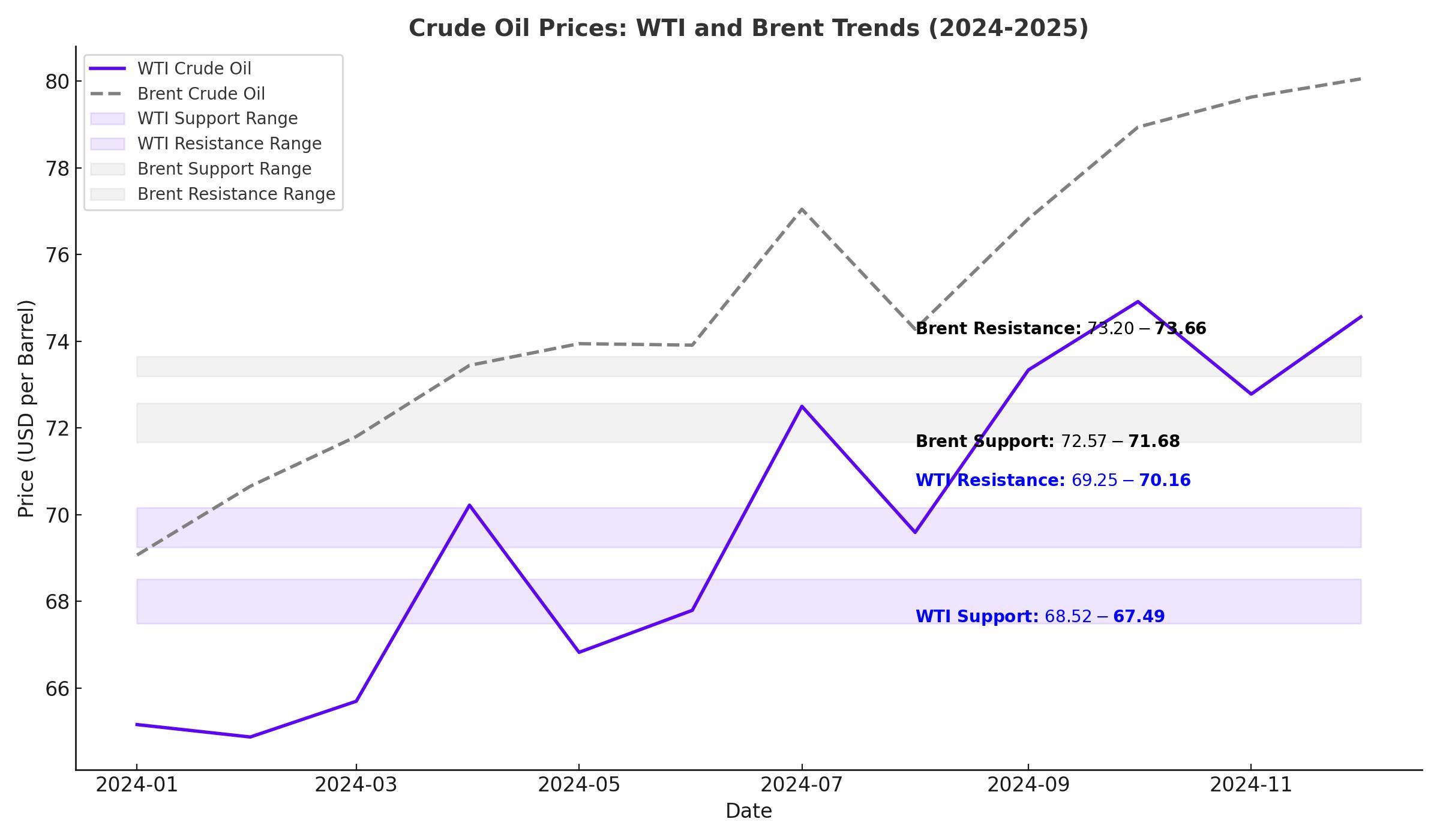

Technically, WTI remains in a precarious position. Immediate support levels around $68.52 and $67.49 offer a safety net for potential pullbacks, while resistance at $69.25 and $70.16 signals hurdles for further upward momentum. The 50-day EMA, aligning near $68.94, underscores the importance of sustaining these levels to maintain a bullish bias.

Brent Crude Oil Wrestles with Global Supply and Demand Dynamics

Brent crude, the international benchmark, has struggled to maintain upward momentum, trading near $72.78. Similar to WTI, Brent prices are influenced by geopolitical instability and uncertainties around OPEC+ production strategies. The ceasefire agreement between Israel and Hezbollah has temporarily eased concerns over Middle Eastern supply disruptions, although skepticism about the durability of this truce persists.

Meanwhile, weaker-than-expected demand from China, the world’s largest oil importer, has amplified bearish sentiment. The potential for a global supply surplus in 2025, driven by record U.S. production levels, has further complicated Brent’s outlook. Despite these challenges, Brent prices remain buoyed by a weaker U.S. dollar, which makes oil more attractive to holders of other currencies.

From a technical perspective, Brent faces resistance at $73.20, with additional upward targets at $73.66 and $74.16. Support levels near $72.57 and $71.68 provide a buffer against downward pressure. The alignment of the 50-day EMA with the pivot point at $72.59 underscores the significance of these levels in determining Brent’s next move.

OPEC+ Policy Decisions Loom Large

The upcoming OPEC+ meeting is a critical event for oil markets. With reports suggesting that the group may delay plans to increase production, traders are left speculating about the depth and duration of potential supply cuts. Persistent demand uncertainties and geopolitical risks have prompted OPEC+ to adopt a cautious approach, with members weighing the benefits of extending production cuts versus the risks of exacerbating market imbalances.

Saudi Aramco’s anticipated reduction in the official selling price of Arab Light crude by $0.70 per barrel for January sales to Asia further reflects the cautious sentiment within OPEC+. These decisions come as market participants remain wary of oversupply risks and fluctuating demand projections.

Market Fundamentals and Inventory Data

U.S. inventory data presents a mixed picture of supply dynamics. While crude inventories dropped by 1.8 million barrels for the week ending November 22, gasoline stocks rose by 3.3 million barrels, raising concerns over slowing demand in the world’s largest fuel consumer. Distillate stocks also increased, contributing to bearish sentiment.

These developments coincide with growing concerns over the Federal Reserve’s monetary policy. Market expectations for a 25-basis-point rate cut in December have fueled speculation about its potential impact on oil demand. Higher borrowing costs, coupled with slowing economic activity, could dampen demand for crude in the coming months.

Geopolitical Tensions Add Complexity

The fragile geopolitical landscape remains a significant factor shaping oil markets. The breakdown of the Israel-Hezbollah ceasefire, combined with escalating tensions between Russia and Ukraine, highlights the precariousness of regional stability. Russia’s continued strikes on Ukraine’s energy infrastructure and its warnings of further escalations underscore the risks to global energy supplies.

Meanwhile, Iran’s plans to expand uranium enrichment and potential sanctions enforcement could further constrain supply, adding another layer of complexity to the market. Goldman Sachs has warned that these developments could result in a drop of 1 million barrels per day in global oil output next year.

Natural Gas Trends and Correlations

While crude oil dominates market headlines, natural gas prices have also experienced volatility. Trading near $3.26, natural gas has shown signs of resilience, with upward trends supported by increased demand and colder weather forecasts. Key resistance levels at $3.40 and $3.52 signal potential bullish targets, while support near $3.18 provides a base for further consolidation.

Natural gas trends often correlate with crude oil dynamics, as both are influenced by broader energy market fundamentals. Traders are closely monitoring these interactions to assess the overall health of the energy sector.

Key Takeaways for Investors

Crude oil markets are navigating a complex web of geopolitical tensions, OPEC+ policy decisions, and macroeconomic uncertainties. While WTI and Brent prices have shown resilience in the face of these challenges, their future trajectories depend heavily on upcoming developments, including the December 5 OPEC+ meeting and evolving geopolitical risks. Investors should remain vigilant, focusing on technical levels and market fundamentals to navigate this volatile landscape.

That's TradingNEWS

WTI and Brent Oil Surge Amid Geopolitical Risks – What’s Driving Prices Above $70?

Gold Prices Surge to $3,128: What’s Fueling the Historic Rally in XAU/USD?