WTI Crude at $71.38 – Can Oil Prices Hold Amid Russian Sanctions and Geopolitical Risks?

With Brent crude at $75.01 and U.S. sanctions targeting Russian oil exports, can OPEC+ and global demand push prices higher, or will supply chain shifts keep oil under pressure? | That's TradingNEWS

WTI Crude (CL=F) and Brent (BZ=F) Struggle as Russia Evades Sanctions – Where Are Oil Prices Headed Next?

Oil Prices Under Pressure as Russia Dodges Sanctions – Will WTI Crude Rebound?

Oil markets remain volatile as WTI crude (CL=F) trades at $71.38, while Brent (BZ=F) holds at $75.01, struggling to gain momentum. The latest U.S. sanctions on Russian crude exports were expected to tighten global supply, but Moscow has already developed workarounds to keep its oil flowing. The International Energy Agency (IEA) revised its Russian production estimate higher, revealing that crude output actually rose by 100,000 barrels per day (bpd) in January, reaching 9.2 million bpd.

Russia's ability to bypass restrictions has significantly altered market expectations. With crude exports continuing largely uninterrupted, fears of a supply crunch have eased. However, the broader oil market remains on edge as demand signals weaken in China, which has historically been a key driver of oil price rallies. The biggest question now is whether OPEC+ production cuts can counteract growing non-OPEC supply and keep prices from sliding further.

U.S. Tariffs, Russian Oil Sanctions, and the Impact on Global Energy Markets

The Biden administration's latest sanctions on Russian oil traders and shippers have led to a sharp rise in freight costs, with shipping rates from Baltic ports to India surging by 20% in February, now sitting at $7 million to $8 million per voyage. Despite this, Russian refineries are processing more crude to ramp up fuel exports, maintaining a steady supply flow into Asia.

India, a major buyer of discounted Russian crude, is facing growing uncertainty. Bharat Petroleum’s CFO confirmed that traders supplying Russian oil have halted offers for March shipments, signaling the first real disruption from sanctions. As India and China reassess their energy strategies, alternative suppliers like the U.S. and Middle Eastern producers stand to benefit. India’s oil demand growth exceeded China’s for the first time in 2024, rising by 180,000 bpd, compared to China’s 148,000 bpd increase. With India expected to continue its 3.2% annual demand growth in 2025, its shift in supply sources could significantly impact global oil flows.

Brent and WTI Face Resistance as OPEC+ Cuts Collide with Weak Demand

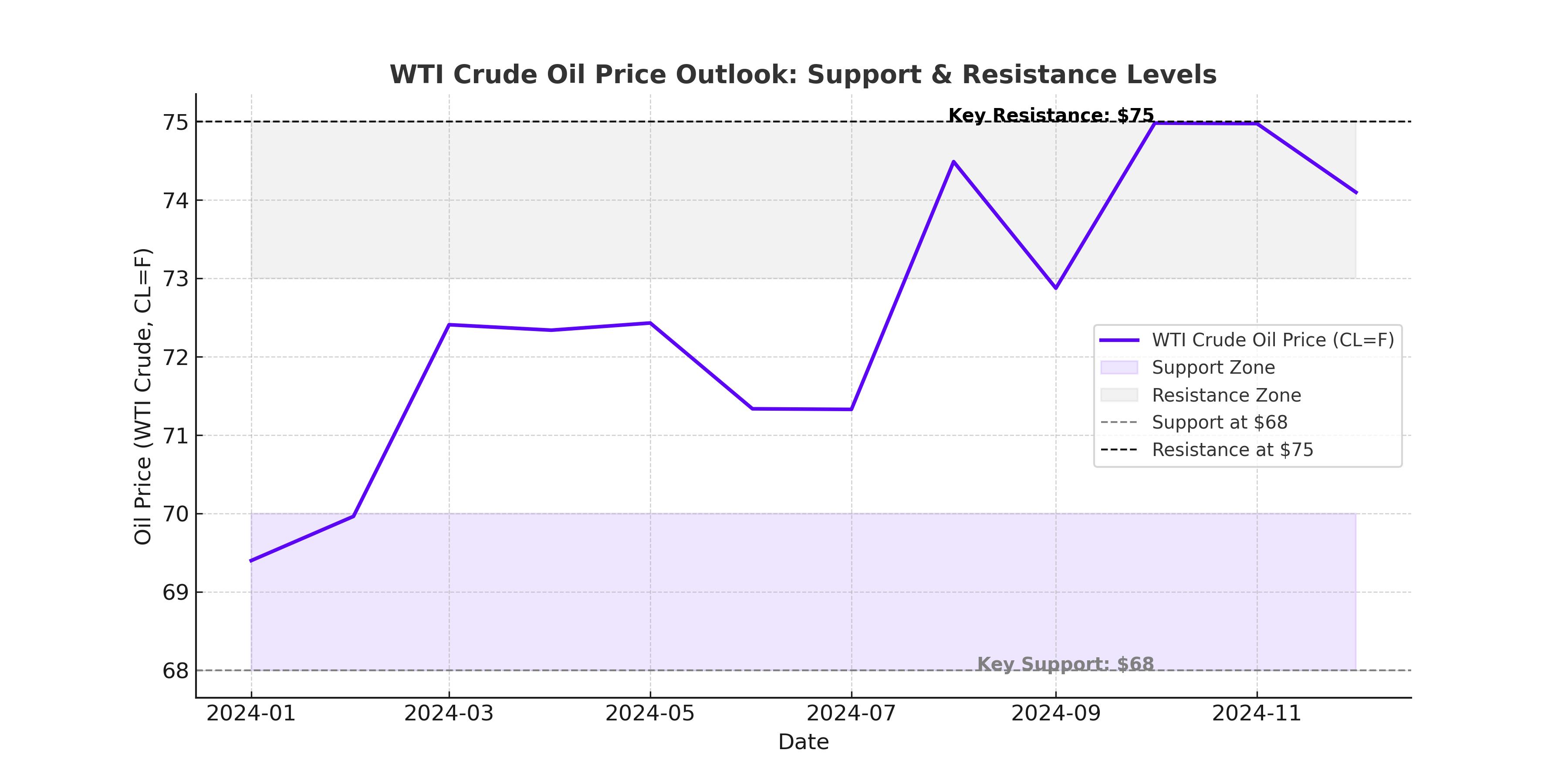

Oil prices have struggled to hold gains despite OPEC+ members maintaining their output cuts. WTI crude remains below key resistance at $72-$75, while Brent crude is battling to sustain levels above $75. Market sentiment is increasingly being driven by fears that global demand may not recover as strongly as anticipated.

China’s economy remains a major uncertainty. While its crude imports remain elevated, the IEA now believes fuel consumption may have peaked, with gasoline, jet fuel, and diesel demand barely surpassing 2019 levels. This raises the risk that oil demand growth will stagnate, especially if the global economy slows further in 2025.

OPEC+ is facing a major dilemma—if the cartel extends production cuts deeper into the year, it could support prices in the short term. However, with U.S. oil production surging and Russian exports finding new buyers, supply-side pressures may outweigh OPEC+’s influence, leaving oil prices vulnerable to further declines.

Geopolitical Risks: Russia-Ukraine Peace Talks and the Red Sea Crisis

The latest Russia-Ukraine peace negotiations, brokered by Donald Trump, have added another layer of uncertainty to the oil market. Trump’s claim that both Putin and Zelenskiy are open to a deal has dampened supply disruption fears, pushing oil prices lower. If peace talks gain traction, the potential lifting of sanctions on Russian crude exports could further weaken Brent and WTI prices.

At the same time, tensions in the Red Sea remain a wildcard. Houthi attacks on shipping have disrupted oil flows, leading to rerouted tankers and increased freight costs. While recent de-escalations have brought temporary stability, any renewed hostilities could lead to sudden supply shocks, driving oil prices higher. Traders remain cautious, keeping an eye on potential geopolitical flashpoints that could reshape global energy markets overnight.

U.S. Inflation, Fed Policy, and the Impact on Oil Prices

The latest U.S. inflation data came in hotter than expected, with CPI rising 3.0% YoY and core inflation up 0.4% MoM, exceeding forecasts. This has led to a reduction in rate cut expectations, strengthening the U.S. dollar, which in turn pressures crude oil prices. A stronger dollar makes oil more expensive for foreign buyers, potentially dampening global demand.

Federal Reserve Chair Jerome Powell’s latest testimony suggests the Fed is in no rush to cut rates, a stance that could keep energy markets under pressure. If inflation remains sticky, interest rates could stay higher for longer, reducing economic growth and limiting demand for oil in the second half of 2025.

Inventory Data: U.S. Crude Stocks Rise as Supply Outpaces Demand

The Energy Information Administration (EIA) reported a weekly crude oil inventory build of 4.1 million barrels, exceeding expectations. This increase in U.S. crude stockpiles adds further downside pressure to oil prices, signaling that demand is not keeping up with supply.

At the same time, U.S. shale producers continue to ramp up output, further complicating OPEC+’s ability to balance the market. With production still rising and global inventories increasing, WTI and Brent face an uphill battle to sustain a rally unless demand fundamentals improve.

Technical Analysis: Will WTI Crude Break Below $70?

WTI crude (CL=F) has been trading in a tight range, struggling to hold above $71.38, with resistance near $73-$75. If selling pressure increases, a breakdown below $70 could open the door for further declines toward $67.50-$68.00, where stronger support lies.

Brent crude (BZ=F) faces similar resistance at $75-$77, with immediate support at $72. A drop below $72 could trigger a sharper correction, with the next major level near $70.

Both benchmarks remain highly sensitive to geopolitical developments, inventory data, and interest rate expectations, making the next few weeks critical for direction.

Conclusion: Is WTI Crude a Buy, Sell, or Hold?

The current oil market presents a complex picture, with supply-side resilience counteracting demand concerns. Russia’s ability to bypass sanctions, OPEC+ production cuts, and rising U.S. inventories all contribute to an uncertain outlook.

For traders, WTI crude remains a sell on rallies unless it can sustain a move above $75. Brent crude also faces downside risks unless demand shows stronger signs of recovery. With macroeconomic pressures mounting, oil remains vulnerable to a further pullback, making it a cautious hold until market fundamentals improve.