WTI Crude Oil (CL=F) and Brent Crude (BZ=F) Price Outlook: Will Oil Rally or Break Lower?

Surging Production in Guyana and Suriname: A Game-Changer for Oil Markets?

Suriname’s oil industry is on the verge of a massive transformation, with the IMF predicting a staggering 55% GDP growth in 2028 when production from offshore block 58 begins. The final investment decision, made in October, has set the stage for $10.5 billion in capital expenditures, with crude production expected to peak at 73 million barrels in 2030 and 2031 before entering a gradual decline. Suriname, while not matching Guyana's massive reserves, has the advantage of quickly ramping up production.

Guyana’s oil boom tells a similar success story. Exxon Mobil (NYSE:XOM), Hess Corp. (NYSE:HES), and Cnooc (OTCPK:CEOHF), operating under an Exxon-led consortium, have already surpassed 500 million barrels of oil production from the Stabroek block in just five years. Current production levels exceed 650,000 barrels per day (bpd) from three key projects—Liza Phase 1, Liza Phase 2, and Payara. With three more projects approved, Exxon and its partners aim to reach 1.3 million bpd by 2027.

The economic implications are staggering. In 2023, Guyana's government reported that Stabroek block’s operations generated $6.33 billion in revenue. Exxon took home $2.9 billion, Hess pocketed $1.88 billion, and Cnooc earned $1.52 billion. The trio’s dominance in Guyana's offshore fields underscores the region’s importance in shaping global oil supply in the coming decade.

Oil Prices Drop as U.S. Inventories Surge and Demand Wavers

Oil prices faced downward pressure as U.S. crude stockpiles increased more than expected, dampening investor sentiment. Brent crude (BZ=F) dropped 1.2% to settle at $76.58 per barrel, while WTI crude (CL=F) tumbled 1.6% to $72.62, marking its lowest close in 2025. The Energy Information Administration (EIA) reported a 3.46 million barrel build in U.S. crude inventories, surpassing analyst expectations of a 3.19 million barrel increase.

Refiners have been cutting their crude intake for three consecutive weeks, reducing near-term demand. Adding to the bearish outlook, the Federal Reserve held interest rates steady, offering no clear indication on when it might lower borrowing costs, which could otherwise stimulate economic activity and energy consumption.

Trump’s Tariffs and Geopolitical Risks: How Will They Impact Oil Prices?

Geopolitical uncertainty remains a critical factor in oil market volatility. President Donald Trump reaffirmed his plan to impose 25% tariffs on imports from Canada and Mexico starting February 1. If implemented, these tariffs could disrupt North American energy trade, increasing costs and pressuring supply chains.

Despite the tariff threat, OPEC+ ministers are set to meet on February 3 to discuss whether to proceed with their planned April production increases. Trump’s recent push for lower oil prices could influence the group's decision, though insiders suggest no major policy shifts are expected at this meeting.

Meanwhile, in Libya, protests threatened to block crude exports at key ports in the Oil Crescent region. However, after negotiations with the government, the National Oil Corporation (NOC) confirmed that operations continue as normal. Nonetheless, the potential for sudden disruptions in Libya remains a persistent risk for oil markets.

Russian Oil Supply Under Attack: Ukraine Targets Key Refineries

The conflict between Russia and Ukraine has intensified, with Ukraine launching another drone attack on a Russian oil refinery in Nizhny Novgorod—its second such strike in less than a week. The Lukoil Norsi refinery, which supports the Russian military’s logistics operations, was hit overnight, setting a 20,000-ton oil storage tank ablaze and damaging vital infrastructure.

This refinery, capable of processing 262,000 bpd (nearly 5% of Russia’s refining capacity), has been forced offline. These attacks are part of a broader Ukrainian strategy to weaken Russia’s energy sector, which has been a key revenue source for funding its war effort. The persistent strikes have reduced Russia’s crude processing rates, tightening global supply and adding upward pressure on oil prices.

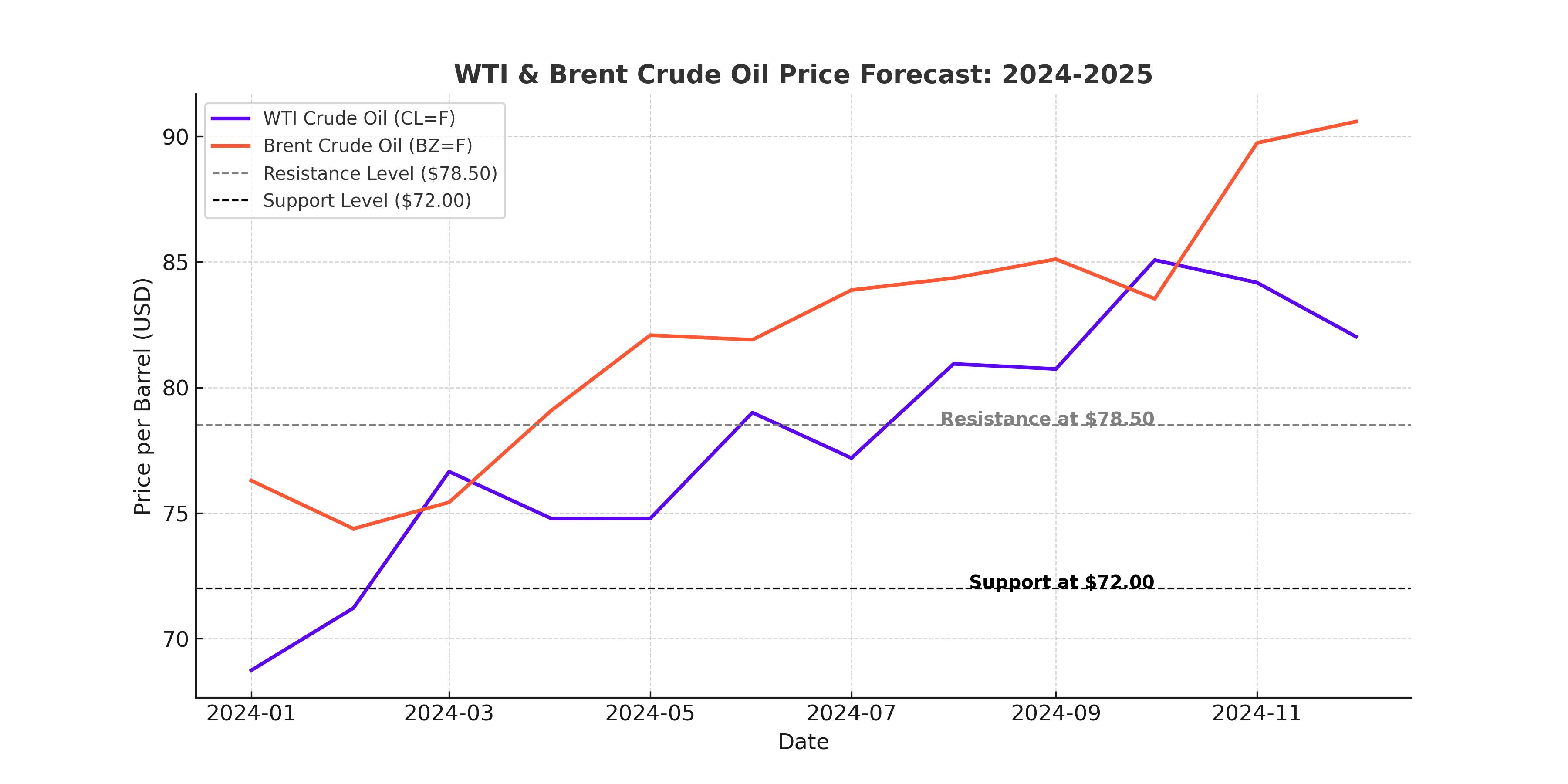

WTI (CL=F) and Brent (BZ=F) Technical Analysis: Key Support and Resistance Levels

WTI crude is currently trading near $73.61 per barrel, struggling to hold key support at $72.00. If this level breaks, a further drop toward $70.50 and $69.00 could follow. However, a recovery above $74.00 would indicate a potential bullish reversal, with upside targets at $76.20 and $78.00.

Brent crude faces similar pressure, trading near $77.29 per barrel. The next downside target is $75.50, while resistance is seen at $78.50 and $80.00. If bullish momentum picks up, Brent could push toward $82.00 in the near term.

Outlook: Is Oil a Buy, Sell, or Hold?

Oil remains at a crossroads, caught between geopolitical risks, supply disruptions, and economic uncertainty. The U.S. crude inventory build, weaker refinery demand, and Federal Reserve’s cautious stance lean bearish. However, attacks on Russian refineries, potential OPEC+ supply adjustments, and geopolitical instability in Libya and Ukraine could trigger a rally.

For now, WTI and Brent crude are in a HOLD position, with traders waiting for a clearer direction from OPEC+ policy decisions and Fed rate guidance. A breakout above $74 for WTI and $78.50 for Brent could signal a bullish shift, while a drop below $72 for WTI and $75.50 for Brent would confirm further downside risks.