WTI Oil Price Dips as Trump Declares Energy Emergency

Can WTI Crude Hold $76 Amid Supply Surge and Strong Dollar? | That's TradingNEWS

WTI Oil Price Analysis: Impact of Trump's Energy Policies and Global Market Trends

Trump’s Energy Emergency Declaration and Its Immediate Effects

WTI crude oil prices slipped to $76.33 per barrel, reflecting a 0.9% decline, while Brent crude dropped to $78.95 per barrel. President Donald Trump’s declaration of a "national energy emergency" aimed to ramp up domestic fossil fuel production and reverse offshore drilling restrictions, adding pressure to global oil markets. By lifting prior bans on natural gas exports and incentivizing fossil fuel development in Alaska, the administration signaled a potential increase in U.S. supply, further influencing bearish sentiment in the market.

Despite these moves, Trump’s rhetoric around imposing 25% tariffs on goods from Canada and Mexico added uncertainty. While no immediate action has been taken, the threat of future trade restrictions has heightened concerns about U.S. energy demand and cross-border trade flows. The announcement’s mixed implications—supporting supply while potentially curbing demand—left the market struggling to find equilibrium.

Dollar Strength and Its Ripple Effects on Oil Prices

The U.S. dollar index climbed 0.4% to 108.53, strengthening against a basket of currencies and contributing to the downward pressure on oil prices. A stronger dollar makes crude more expensive for non-dollar buyers, limiting global demand. Historically, oil and the dollar maintain an inverse relationship, with recent moves exacerbating this dynamic. Market reactions to Trump's tariff threats on China and North American trade partners further strengthened the dollar as a safe-haven currency, compounding oil's price struggles.

Global Production and Geopolitical Developments

The Energy Information Administration (EIA) forecasts Brent crude prices to average $74 per barrel in 2025, a significant drop from the $81 average in 2024, due to robust non-OPEC+ production. North and South American producers, including the United States, Brazil, and Guyana, are expected to lead growth, collectively adding 1 million barrels per day (bpd) in 2025. However, challenges like logistical bottlenecks and delayed projects pose risks to sustained output.

Meanwhile, geopolitical developments, including a ceasefire in the Middle East, reduced concerns over supply disruptions. Yemen's Houthi forces pledged to limit Red Sea attacks to Israel-linked vessels, alleviating immediate risks to global shipping routes. This de-escalation, coupled with the Suez Canal expansion expected to streamline navigation, has mitigated upward price pressures.

OPEC+ and Market Balance

OPEC+ production cuts remain a critical factor in stabilizing prices. The alliance’s adherence to output restrictions has softened, with members cautiously unwinding cuts to retain market share. The group’s December 2024 decision to delay relaxing production caps until 2026 underscores their sensitivity to price dynamics. However, non-OPEC growth threatens to erode OPEC+ influence, increasing the potential for internal dissent and production escalations among member states.

Recession Risks in Europe and China's Demand Uncertainty

Economic challenges in Europe, including heightened recession risks, have dampened energy demand projections. Simultaneously, China’s slower-than-expected economic growth, coupled with its pivot toward alternative energy sources like electric vehicles, has capped its oil consumption. China’s GDP is forecasted to grow by 4.4% in 2025, a notable slowdown compared to pre-pandemic averages, raising doubts about its ability to absorb surplus global production.

Technical Outlook for WTI and Brent Crude

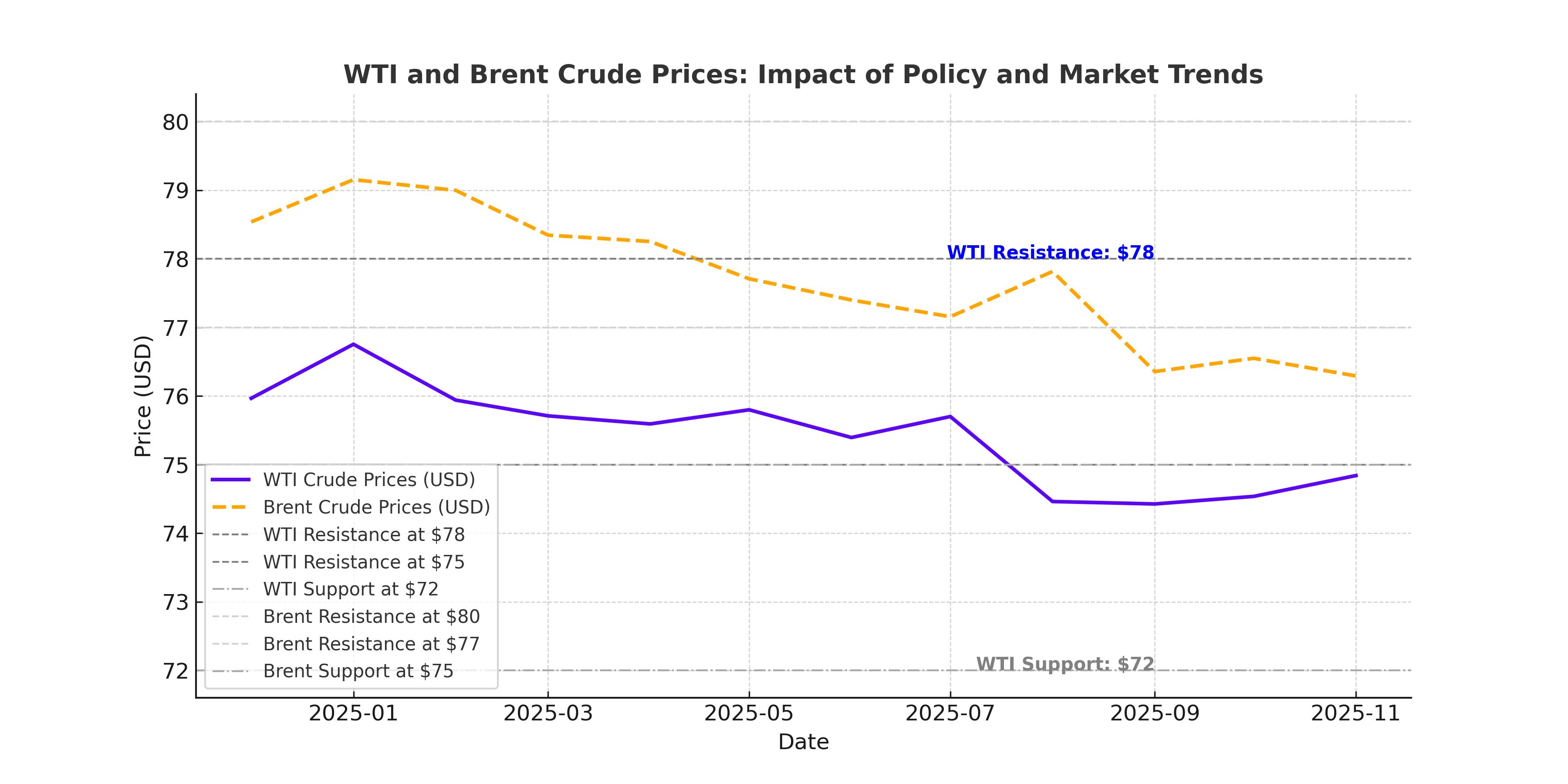

WTI crude faces strong support at $75 per barrel, with immediate resistance at $78. A sustained break below $75 could accelerate selling pressure, targeting the next key level of $72. Conversely, Brent crude’s support stands at $77, with resistance at $80. The failure to break above these resistance levels would signal continued bearish momentum.

Verdict: Bearish Bias with Limited Upside Potential

Trump’s aggressive energy policies, combined with a strengthening dollar, are tipping the scales toward oversupply and subdued demand. While geopolitical risks have eased, the broader macroeconomic environment, including recession fears and slowing Chinese growth, adds to oil's bearish outlook. WTI and Brent crude prices are expected to remain under pressure unless OPEC+ interventions or unexpected supply disruptions provide a catalyst for recovery.

Current trends suggest that WTI crude is a "hold" for now, as short-term gains seem limited amidst bearish sentiment. However, traders should closely monitor tariff announcements and geopolitical developments, which could sharply alter market dynamics. For investors, patience will be key as the oil market adjusts to these multifaceted pressures.