XRP Price Prediction – Is a Breakout to $5 Coming or Is the Rally Over?

XRP-USD Faces Key Resistance – Can It Finally Break Past $3? | That's TradingNEWS

XRP Price Volatility – Can XRP-USD Break Above $3 or Is a Correction Coming?

XRP Price Struggles as Market Sentiment Shifts – Is $5 a Realistic Target?

XRP-USD has seen heavy volatility in recent trading sessions, dropping 6.08% to $2.59, extending its month-long 19% decline. The token, closely tied to Ripple’s payments network, has struggled to maintain momentum after a recent failed breakout attempt near $2.82, leaving traders uncertain about its near-term trajectory.

While XRP was expected to benefit from growing institutional interest, the return of Donald Trump to the White House has introduced fresh concerns. Despite Trump’s earlier campaign rhetoric around a Bitcoin (BTC-USD) strategic reserve, his administration has yet to take concrete steps in the crypto space, leaving markets in limbo.

Beyond XRP, the broader crypto market has also suffered. Bitcoin slipped 0.3%, Ethereum fell 2.9%, and Solana dropped 6.9%, reflecting overall investor caution. Meanwhile, speculative attention has turned toward JetBolt (JBOLT), a zero-gas blockchain project powered by Skale, which has surged in presale sales, raising over 320 million tokens. This diversion of investor interest could further limit XRP’s upside potential in the short term.

XRP-USD Faces Major Resistance – Can It Break Past $3?

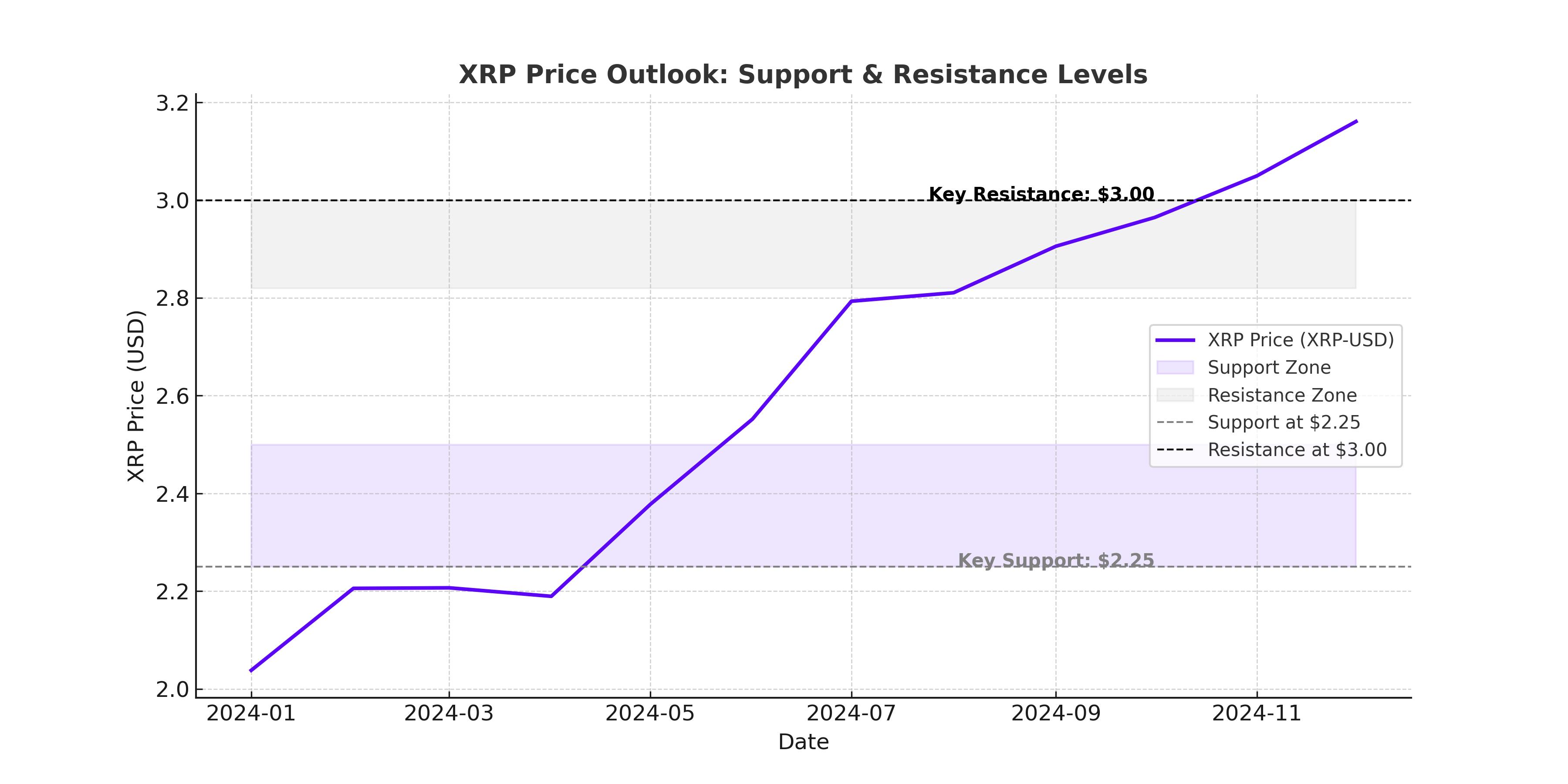

Technically, XRP’s bullish Cup and Handle pattern remains intact, but momentum has stalled near the $2.82 resistance level. A confirmed breakout above this mark could drive the token toward $3.30, but failure to do so risks a return to $2.25 support, a historically significant price zone.

Recent on-chain data suggests traders are actively accumulating, with $28.6 million worth of XRP leaving exchanges in the past 24 hours. This signals confidence in a potential upward move, yet volume indicators reflect weaker buyer engagement, hinting at possible downside risks.

If XRP fails to hold above the 50-day EMA at $2.65, it could trigger a bearish shift, leading to further corrections. The key question is whether investor enthusiasm can sustain enough buying pressure to push past $3.00 psychological resistance.

SEC Lawsuit and ETF Hopes – How Much Does Regulation Matter?

One of the biggest overhangs on XRP-USD remains regulatory uncertainty. The ongoing SEC lawsuit against Ripple continues to impact investor sentiment, despite the partial legal victory Ripple secured in August 2023. With SEC Chair Gary Gensler stepping down, speculation has increased that a more favorable regulatory stance could emerge, potentially benefiting XRP’s long-term outlook.

Adding to the optimism is the recent acknowledgment of multiple XRP ETF filings, including those from Grayscale, WisdomTree, and Bitwise. The SEC’s review process is now underway, with Bloomberg analysts assigning a 65% probability of approval by year-end.

If an XRP ETF is approved, it could drive significant institutional inflows, providing the demand necessary to push the token beyond its current resistance levels. However, given the SEC’s cautious approach, investors should temper expectations in the near term.

Market Sentiment and the Trump Effect – Will XRP Thrive or Struggle?

XRP’s long-term performance could be heavily influenced by macroeconomic and political factors. Trump’s stance on crypto regulation remains ambiguous, and while a more industry-friendly environment could materialize, uncertainty persists.

Meanwhile, central banks and financial institutions continue integrating blockchain-based settlement systems, with Ripple’s cross-border payments network gaining adoption. If major banks expand their use of XRP for liquidity solutions, it could fuel sustained demand, supporting higher price targets.

However, for XRP to break decisively above $3.50 and target $5, it would likely require a combination of:

- ETF approval, unlocking institutional investment

- Legal clarity, removing SEC-related uncertainty

- Stronger technical breakout, confirming bullish momentum

Until these catalysts materialize, XRP remains in a make-or-break trading zone, where failure to sustain gains could lead to further declines toward $2.25 or lower.

Final Verdict – Buy, Sell, or Hold XRP?

With XRP facing strong resistance near $2.82–$3.00, a cautious approach is warranted. While long-term fundamentals remain solid, short-term risks persist due to regulatory uncertainty, weak market sentiment, and broader crypto sell-offs.

If XRP can break and hold above $3.00, upside targets of $3.30 and $3.89 come into play. However, if sellers regain control and push XRP below $2.50, a retest of $2.25 and even $1.75 could be next.

Given the potential upside from ETF approvals and Ripple’s growing adoption, long-term investors may consider accumulating on dips. But for short-term traders, waiting for a decisive breakout above $2.82 may be the smarter move before going bullish.

For now, XRP remains a hold, with the $3.00 resistance level acting as a critical inflection point.