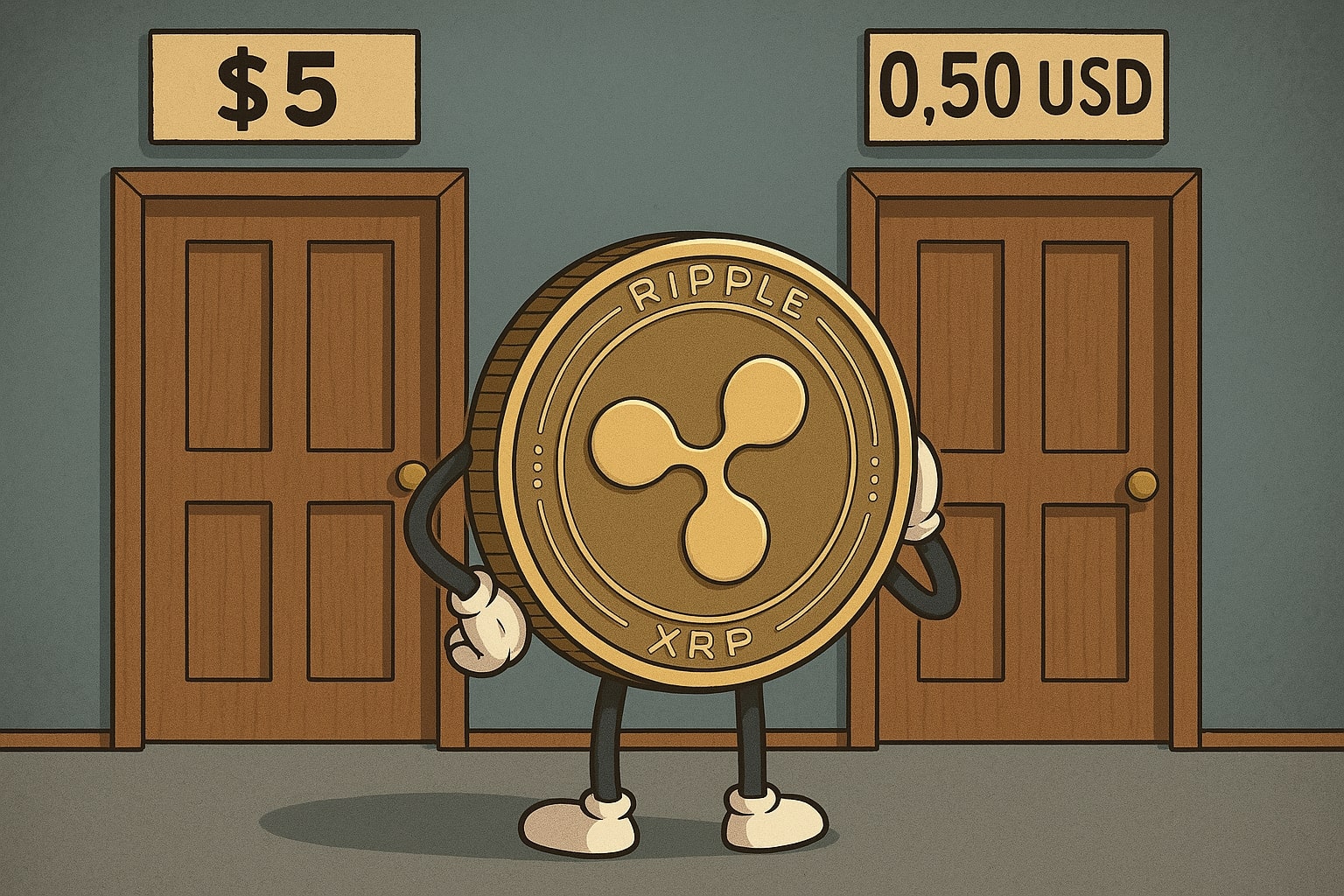

XRP Price Outlook: A Tense Crossroads Between $0.50 and $5

Current Price Trends and Market Sentiment for XRP-USD

Ripple’s XRP-USD has undergone substantial volatility recently, experiencing a dramatic drop of approximately 45% from its January peak above $3.20 to hover around $1.80. The primary catalyst for this significant correction comes from broader macroeconomic uncertainties sparked by geopolitical events, particularly the escalating U.S.-China trade war and tariff announcements by U.S. President Donald Trump.

In early April, XRP’s price saw a minor recovery after hitting lows of $1.84, but it still remains under pressure. Despite this, there is ongoing debate among analysts regarding XRP’s future trajectory, with predictions ranging from a potential resurgence above $5 to further declines that could drive the coin closer to the $0.50 mark. These predictions are grounded in both technical analysis and broader market sentiment, which has been fluctuating due to macroeconomic concerns, regulatory developments, and market psychology.

Macro Factors Impacting XRP-USD: Global Trade Tensions and Tariffs

The recent slump in XRP’s price is directly correlated with the broader crypto market downturn driven by U.S. President Trump’s announcement of tariffs on imports, particularly from China. This triggered an overall sell-off across all risk assets, including cryptocurrencies, with XRP seeing a sharp drop from $3.20 to $1.80. The market’s risk-off sentiment reflects concerns over global economic slowdowns, trade wars, and the potential for a deep recession, all of which have spooked investors away from riskier assets like XRP.

Despite the legal clarity Ripple received in its battle with the SEC over XRP’s classification, the broader macroeconomic environment remains a significant challenge for Ripple and its digital token. The sentiment shift from greed to anxiety, as indicated by the NUPL (Net Unrealized Profit/Loss) data, further exacerbates the bearish outlook, signaling that investors are increasingly cautious about further downside risks.

XRP Technical Analysis: A Struggle Between Bulls and Bears

From a technical standpoint, XRP-USD is at a critical juncture. After testing key support levels, including the 50% Fibonacci retracement at $1.6145, XRP has since rebounded. However, the market faces significant challenges that suggest the possibility of a continuation of the downtrend. XRP's formation of a "doji" candlestick, which often signals a trend reversal, is a cause for cautious optimism, but the market’s failure to decisively break through key resistance levels raises questions about whether the recent bounce is genuine or just a “dead cat bounce.”

The $2 level has emerged as a key resistance point. Following a brief rally, XRP has struggled to hold above this level, suggesting that selling pressure remains strong. If XRP fails to maintain the support at $2 and breaks below the critical $1.55 level, it could lead to further declines toward $1.15, as indicated by the inverse cup-and-handle pattern visible on XRP’s chart.

Despite the recent rebound, there’s growing concern that XRP may face a classic "bull trap." If XRP fails to break above the $2 level and instead falls back toward $1.55, this could set the stage for a deeper retracement. In the short-term, XRP is exhibiting a 20% upside potential within its current descending channel, but the inverse cup-and-handle pattern suggests a possible 38% drop to the $1.15 range if bearish sentiment prevails.

XRP's Future: From $0.50 to $5—Where is XRP Headed?

The ongoing debate about XRP’s price trajectory hinges on several factors. On the bearish side, analysts have suggested that XRP could fall as low as $0.50 if broader market trends continue to deteriorate, with the possibility of a prolonged correction fueled by weak market sentiment and regulatory uncertainties. On the other hand, some analysts believe that Ripple's growing adoption in the cross-border payments sector, combined with its legal victory over the SEC, could drive XRP’s price back toward the $5 mark.

Ripple’s increasing role in cross-border payments is a key driver for long-term growth, and analysts at Standard Chartered predict that XRP could surge to $12 in the next four years. This growth is primarily driven by Ripple’s cost-effective and fast transaction model, which stands in stark contrast to the expensive and slow SWIFT system. Ripple’s technology has the potential to revolutionize international money transfers, significantly lowering the cost of cross-border payments, which could drive adoption and push XRP’s price upwards.

Moreover, Ripple’s success in integrating its XRP Ledger into various financial institutions could accelerate XRP's market adoption, providing further bullish pressure on its price. While the broader macroeconomic conditions have caused XRP to struggle recently, these positive developments in Ripple’s business operations could provide significant tailwinds if XRP manages to break key resistance levels.

XRP-USD On-Chain Data: Shift in Market Sentiment

On-chain data from Glassnode and other analytics platforms provides further insight into XRP’s current market environment. The shift in the Net Unrealized Profit/Loss (NUPL) data from a state of euphoria to anxiety further supports the bearish outlook for XRP. Historically, such shifts signal the end of bullish phases and the onset of prolonged bearish corrections.

The current sentiment in the XRP market is reflective of broader cryptocurrency trends. With XRP struggling to regain momentum and failing to break above key resistance levels, the shift in sentiment suggests that further downside could be on the horizon unless a significant catalyst emerges to reverse the market’s current direction.

The XRP-USD Outlook: The Road to $5 or $0.50?

The future of XRP remains highly uncertain, with the possibility of a sharp decline toward $0.50 still on the table. The current macroeconomic landscape, coupled with XRP’s failure to break through critical resistance points, makes the bearish case more compelling. However, if Ripple can continue expanding its role in global payments and secure more institutional partnerships, there is still a possibility for XRP to reach new highs. The price levels to watch are $1.55 on the downside and $2.50 on the upside. If XRP can break above $2.50, the path to $5 could become much more likely. Conversely, a failure to maintain support at $1.55 could trigger a deeper correction toward $1.15 or lower.

The broader market will continue to play a significant role in XRP’s price action, with Bitcoin and the overall cryptocurrency market providing the underlying momentum. The next few months will likely determine whether XRP can hold its ground or if it will succumb to the broader bearish trends sweeping through the cryptocurrency space.