XRP-USD Momentum Builds as ETF Speculation and Institutional Demand Fuel Optimism—Can It Break Above $3.00?

XRP-USD Shows Strong Recovery Amid Surging Institutional Interest—Is a Major Rally Coming?

XRP (XRP-USD) has been experiencing a wave of bullish momentum, surging 8% from its recent $2.26 low on February 7 to a current price of $2.50. Investor speculation surrounding a potential XRP ETF approval in the United States has fueled significant market activity, with trading volume rising across major exchanges. The latest Fibonacci projections indicate that XRP could be approaching the final leg of a critical wave structure, potentially setting the stage for a major breakout toward $8.00 in the coming months.

A significant technical indicator supporting XRP’s uptrend is its Fibonacci retracement level, which signals that a parabolic move toward $8.00 is possible if the current rally sustains momentum. However, if XRP fails to hold key support at $2.20, a sharp correction toward $0.82 could materialize, making this a pivotal moment for traders assessing risk-reward opportunities.

Will an XRP ETF Spark a New Institutional Wave?

The ongoing speculation surrounding a spot XRP ETF approval by the U.S. SEC has been a major catalyst behind the recent price surge. Bloomberg ETF analysts Eric Balchunas and James Seyffart have estimated the likelihood of an XRP ETF approval at 65%, placing it in the same category as Litecoin (LTC), Solana (SOL), and Dogecoin (DOGE) for regulatory greenlighting in Q2 2025. If approved, an XRP ETF could bring billions in institutional capital into the market, amplifying demand and reducing volatility over time.

Several major asset management firms, including Grayscale and Cboe BZX, have filed for XRP-linked ETFs, adding further credibility to the potential mainstream adoption of XRP as an investable asset. If the SEC formally acknowledges these filings in the coming weeks, it could act as a significant catalyst for XRP’s next leg higher.

Institutional Demand Could Trigger a Supply Shock—How High Can XRP Go?

Market analysts have explored a scenario where major banks allocate just 0.5% of their assets into XRP, potentially injecting over $148 billion into the cryptocurrency. With XRP’s total circulating supply standing at 100 billion tokens, such an influx of institutional capital could squeeze liquidity, driving prices toward $10, $20, or even $50 under an extreme supply-demand imbalance.

The world’s largest financial institutions, including JPMorgan ($4.21 trillion in assets), Bank of America ($3.32 trillion), and China Construction Bank ($5.83 trillion), are closely monitoring blockchain-based payment solutions. Should they integrate Ripple’s cross-border payment technology, XRP’s real-world utility could expand dramatically, accelerating institutional adoption.

Can XRP Sustain Its Rally Above $2.50 or Is a Pullback Coming?

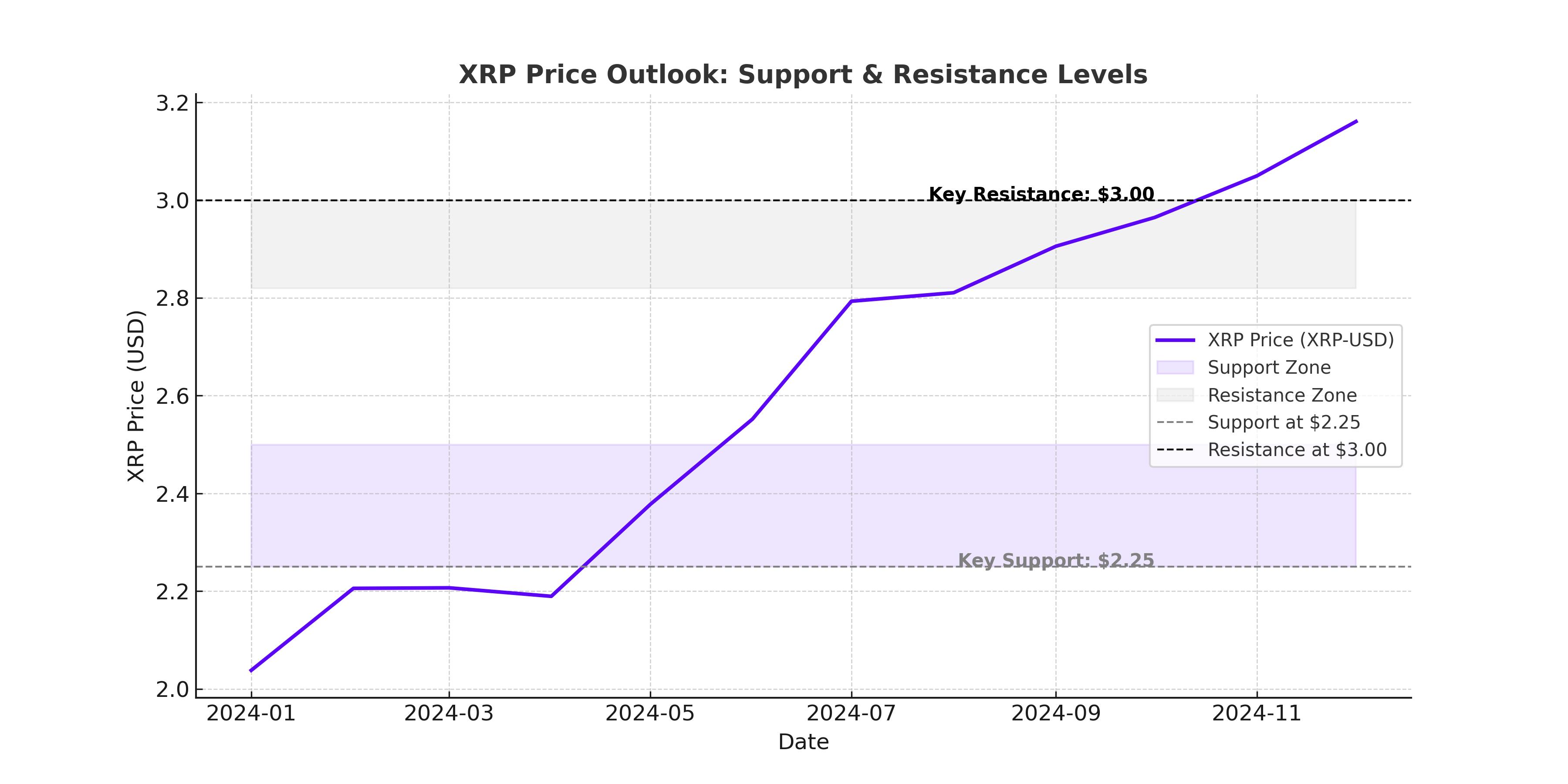

Despite its bullish trajectory, XRP is now entering a critical resistance zone. The key resistance levels to watch are $2.50, $2.52, and $2.60, with a potential breakout toward $2.80 and $3.00 if buyers maintain momentum. However, if XRP struggles to clear the $2.50 level, a short-term pullback toward $2.32 or even $2.20 could emerge, testing the strength of recent gains.

From a technical perspective, the RSI (Relative Strength Index) stands at 62, signaling bullish momentum but approaching overbought territory. Additionally, the MACD indicator has flashed a bullish crossover, reinforcing the potential for further upside price action. Meanwhile, XRP’s Bollinger Bands are narrowing, typically an indicator of imminent volatility, suggesting a large move is ahead.

XRP’s Correlation with Bitcoin and Broader Market Sentiment

XRP’s rally has coincided with Bitcoin (BTC-USD) surpassing $50,000, further reinforcing the broader crypto market’s risk-on sentiment. Historically, XRP has maintained a moderate correlation of 0.6 with Bitcoin, meaning BTC’s trajectory could influence XRP’s short-term movements. If Bitcoin maintains its bullish structure above $50K, it could provide additional tailwinds for XRP’s next rally.

Meanwhile, Ethereum (ETH-USD) has climbed to $3,500, signaling strong institutional demand for layer-one blockchain assets. With increased capital flowing into the crypto sector, the likelihood of sustained bullish sentiment for XRP remains high, particularly if ETF speculation continues to gain traction.

On-Chain Data Signals Increased Network Activity for XRP

The latest on-chain metrics support XRP’s positive market outlook, with active addresses increasing by 15% and on-chain transaction volume rising 10% following the recent surge in real estate market volume to $327 trillion. This reinforces the perception of XRP as a bridge currency for international transactions, benefiting from global economic shifts.

The XRP/USD pair on Coinbase recorded a 4% price increase to $0.78, with trading volume hitting 600 million XRP. Meanwhile, the XRP/BTC trading pair on Kraken saw a volume surge to 300 million XRP, indicating heightened institutional engagement in cross-pair arbitrage opportunities.

Final Outlook—Is XRP a Buy, Sell, or Hold?

XRP’s current price action suggests a high-stakes breakout scenario, with technical indicators favoring further upside toward $3.00 and beyond. The growing ETF speculation, institutional interest, and on-chain activity all point to a potential long-term uptrend.

However, traders should remain cautious of key resistance levels between $2.50 and $2.60, as failure to break above these thresholds could lead to a retracement toward $2.32 or lower. If XRP successfully clears these resistance zones, $3.00 and $3.50 become the next critical targets.

From an investment perspective, XRP remains a strong hold with a bullish bias, particularly as regulatory developments and institutional demand continue to shape its trajectory. If ETF approvals materialize and global financial institutions integrate Ripple’s cross-border payment solutions, XRP could enter an entirely new phase of adoption, pushing prices toward double-digit levels in the coming years.