XRP-USD Faces Intense Pressure – Can Ripple Regain Momentum?

XRP-USD Tumbles Below $2.00 as Market Sell-Off Intensifies

Ripple’s XRP-USD is facing a brutal sell-off, dropping over 13% in the last 24 hours and currently hovering around $2.15. The downward momentum has accelerated, with XRP now dangerously close to breaking a key psychological level at $2.00. Investors who had been expecting a breakout above $3.40 are now scrambling for answers, as market-wide liquidations and bearish technical formations drive further losses. Despite the slump, some analysts still see potential for a sharp reversal if critical support levels hold.

XRP-USD Battles Support as Market Liquidations Surge

XRP’s market cap has plunged to $120.49 billion, while trading volume has skyrocketed by 184%, reaching $10.72 billion. This signals massive market activity, but most of it has been dominated by panic selling. In the past 24 hours, $57.94 million worth of XRP futures have been liquidated, with an overwhelming $53.58 million in long positions getting wiped out. This mass liquidation event forced traders to exit their bullish bets, dragging XRP even lower.

Adding to the bearish outlook, XRP’s funding rate, which reflects demand for long positions, has dropped sharply from 0.25% per week to just 0.04%, suggesting that traders are turning cautious. This shift in sentiment aligns with the broader market downturn, where Bitcoin (BTC-USD) has lost 7.9%, slipping below $87,780, while Ethereum (ETH-USD) has plummeted 11% to $2,385. With risk sentiment deteriorating, XRP is struggling to attract buyers.

Hidden Bullish Divergence Offers Hope Amid XRP’s Slump

Despite the relentless selling pressure, technical indicators hint at a possible bullish reversal. Crypto analyst Javon Marks pointed to a hidden bullish divergence forming on XRP’s daily candlestick chart. This pattern occurs when the Relative Strength Index (RSI) is making lower lows while XRP’s price forms higher lows, signaling that selling momentum is weakening. Historically, such formations have preceded major price rebounds. Marks suggests that if XRP can hold the $2.00 support level, the next move could be an explosive surge towards $3.80.

However, if XRP fails to defend $2.00, downside risks increase significantly. The next key support zone lies at $1.79, aligning with the 61.8% Fibonacci retracement level. A breakdown below this point could send XRP plummeting towards $1.61, further unraveling its bullish outlook.

Regulatory Uncertainty Still Weighs on XRP-USD

Ripple’s long-standing battle with the SEC continues to cast a shadow over XRP-USD’s price action. While Ripple won a key legal victory in May 2024, confirming that XRP is not a security, the case remains unresolved. Many institutional investors are hesitant to enter the market until regulatory clarity is fully established. Despite growing adoption of Ripple’s On-Demand Liquidity (ODL) solution for cross-border transactions, this legal overhang keeps XRP from realizing its full upside potential.

Meanwhile, the SEC has acknowledged multiple XRP ETF filings, including applications from Grayscale, WisdomTree, and CoinShares. If the SEC greenlights a spot XRP ETF, it could inject fresh institutional capital into the market, propelling XRP to new highs. Current Polymarket odds suggest an 80% probability of ETF approval in 2025 under a pro-crypto Trump administration, but for now, investors remain cautious.

Technical Outlook – XRP-USD Must Hold Above $2.00 for a Rebound

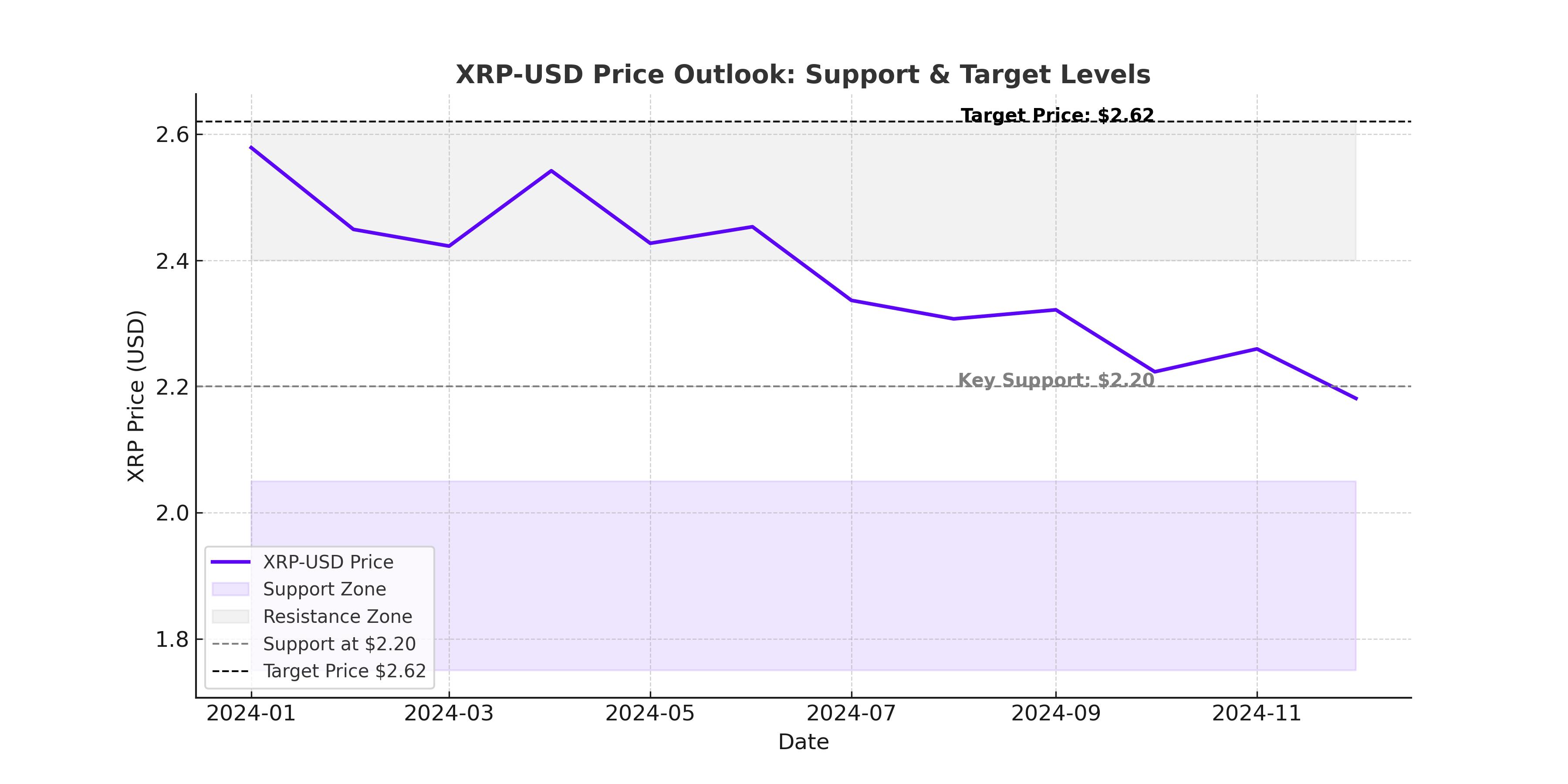

From a technical standpoint, XRP-USD remains under heavy pressure, but a break below $2.00 would be critical. The 50-day Simple Moving Average (SMA) sits at $2.73, serving as the first key resistance level for any attempted recovery. If bulls regain momentum and push XRP above $2.60, a rally towards $3.40 could come into play.

However, failure to reclaim these resistance levels could lead to further losses. The Head and Shoulders pattern currently forming on XRP’s chart signals the risk of deeper declines. A confirmed breakdown below $1.79 would likely accelerate selling towards $1.61, bringing further pain for XRP investors.

Can XRP-USD Reach $5 in the Next Bull Run?

The big question for traders remains whether XRP can break above $5 in the next bull cycle. For this scenario to play out, Ripple’s institutional adoption must accelerate, and regulatory clarity must improve. The growing adoption of XRP for remittances and cross-border payments presents a strong use case, but it needs to translate into sustained price appreciation.

Another critical factor will be the crypto market cycle. XRP has historically outperformed in altcoin bull runs, and a decisive move above $3.40 could confirm a long-term bullish trend. However, with current market conditions still fragile, XRP must first stabilize above $2.00 before any discussions of $5 price targets become realistic.

XRP-USD Faces Make-or-Break Moment

With XRP trading near $2.15, the next few days will be pivotal. If buyers defend the $2.00 level, a sharp rebound could follow, targeting $2.60 and $3.40 as key upside levels. However, continued weakness could see XRP plunge to $1.79 or lower, erasing months of gains. The market remains on edge, waiting to see whether bulls can regain control or if another wave of selling will send XRP into deeper losses.