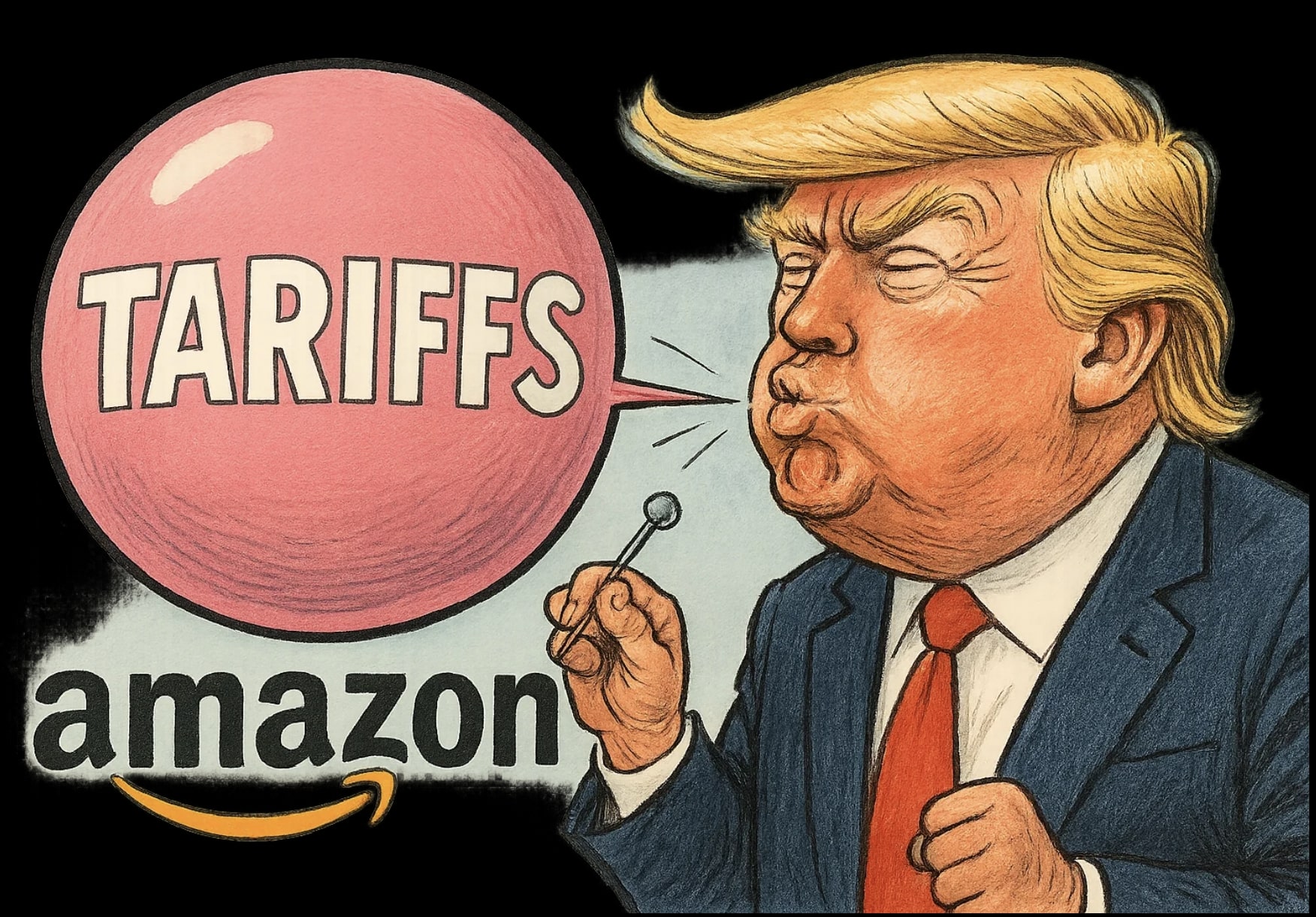

Amazon (NASDAQ:AMZN): Navigating the Trade War Fallout and the Best Time to Buy?

How Will Amazon Tackle the Ongoing Trade War and Its Impact on Profitability?

Amazon (NASDAQ:AMZN), a key player in global e-commerce and cloud computing, has faced significant turbulence recently. The company's stock has been hit hard, with over a 30% decline since its January 2025 highs, as the market reels from the escalating U.S.-China trade war and President Trump's tariffs. Currently, AMZN is trading around $76,200, reflecting growing investor concern over the broader economic effects, including the market's reaction to Trump's tariff policies. The question that investors should ask themselves is whether this price drop presents a buying opportunity for Amazon, a fundamentally strong company with substantial growth prospects, or whether the damage from trade wars will have lasting consequences.

Amazon’s Vulnerability to U.S.-China Trade Tensions and Tariffs

Amazon's exposure to the U.S.-China trade war is a major factor contributing to its stock price decline. According to recent research, a staggering 70% of Amazon's products are sourced from China, which means the 125% tariff imposed on Chinese imports has a substantial impact on the company’s supply chain. The repercussions are already visible, with Amazon adjusting its inventory orders and cutting back on sourcing from Chinese suppliers. Independent vendors on Amazon’s marketplace face a difficult choice: absorb the additional tariff costs, increase prices, or even leave the platform altogether. While Amazon has historically managed supply chain disruptions through its scale and global reach, the tariffs present a new challenge. Will Amazon’s ability to navigate this landscape prove resilient enough to maintain its profitability, or will it face long-term consequences from these trade-related disruptions?

As tariffs on Chinese goods soar, it’s worth considering how Amazon's competitive edge might change. Amazon operates with razor-thin margins in e-commerce, relying on scale and efficiency to drive profits. With increased tariffs, the cost of goods will likely rise, impacting Amazon’s bottom line. However, the question remains: can Amazon’s diversified business model, including its rapidly growing cloud computing arm, AWS, offset these challenges and drive the company’s growth moving forward?

The Role of AWS in Amazon’s Resilience Amid Trade War Pressures

While Amazon’s e-commerce business is feeling the sting of trade tariffs, the company’s cloud computing division, AWS, remains a major growth driver and a bulwark against the ongoing uncertainties. AWS is Amazon's most profitable segment, and it continues to outperform its competitors in terms of market share. The cloud business is a critical part of Amazon's strategy to maintain profitability during tough economic times. In the face of the current market downturn, AWS’s operating performance has been steady, and its growing customer base continues to generate strong revenue.

For example, AWS has seen substantial demand for its cloud services, driven in part by the increasing need for data storage and computing power in industries such as AI, data analytics, and machine learning. As more businesses move to the cloud, AWS remains a critical player in the cloud infrastructure space. The question is: as the economic uncertainty from tariffs and trade wars continues to affect the broader market, can AWS continue to scale and maintain its dominant position, or will it too face challenges from global trade pressures?

Additionally, AWS’s ability to adapt and expand into new markets—such as offering cost-effective computing for companies looking to adopt in-house AI chips—positions it well to capture market share from competitors, particularly as businesses look to cut costs. With AWS’s scale and profitability, Amazon may continue to benefit from a strong competitive advantage even as its e-commerce business faces headwinds.

Is Amazon’s Growth in New Markets at Risk Due to Tariff Concerns?

Amazon has been aggressively expanding into new markets, including the fast fashion sector, where it aims to challenge companies like Temu and Shein. However, the ongoing trade war has raised questions about Amazon's ability to capitalize on these new growth opportunities. With the 125% tariffs on Chinese goods, Amazon’s plans to gain a foothold in the fast fashion space could be stymied, as the costs of sourcing products from China rise sharply. This could lead to higher prices for consumers and reduced profitability for Amazon’s third-party sellers.

Furthermore, Amazon’s plan to expand its reach into lower-margin, higher-cost industries—such as fashion—could be further delayed by the trade war. While the impact of tariffs on companies like Shein and Temu may be more significant, Amazon still faces challenges as it tries to compete in an increasingly crowded and competitive space. Will Amazon be able to sustain its growth trajectory in new sectors, or will the trade war and the associated economic uncertainty force it to reconsider some of these initiatives?

The Impact of Tariffs on Consumer Spending and Amazon’s Profitability

As tariffs continue to disrupt global trade, the broader economic environment also faces challenges. Consumer spending, which is a critical driver of Amazon’s revenue, is expected to slow down due to higher costs resulting from tariffs. For Amazon, this could mean lower demand in discretionary spending areas, particularly in segments like electronics and apparel, which are heavily impacted by tariffs. A sustained period of reduced consumer spending would put pressure on Amazon’s margins, especially in its low-margin e-commerce business.

However, Amazon’s diversified revenue streams, including its advertising and cloud services, could mitigate the effects of a slowdown in consumer spending. Amazon’s advertising business, for example, has proven to be a high-margin segment, similar to the revenue models of companies like Meta (META) and Alphabet (GOOGL). As demand for digital advertising continues to grow, Amazon stands to benefit significantly. Can Amazon continue to drive strong revenue growth in its high-margin segments, such as advertising and AWS, while its e-commerce business faces pressure from a slowing economy and trade tensions?

Amazon’s Valuation: Is Now the Time to Buy?

Despite the ongoing trade war and the challenges it presents, Amazon’s stock is looking increasingly attractive from a valuation perspective. Currently trading at around $76,200, Amazon’s stock has significantly deflated from its previous highs, which makes it a potentially great entry point for long-term investors. With a forward EBITDA multiple of 11x, Amazon is currently trading at a 25% premium over its sector peers. However, its forward PEG ratio of 1.3 aligns with the sector median, suggesting that the stock may be undervalued given its growth potential.

Additionally, Amazon’s historical valuation metrics indicate that the company is currently trading at its lowest price relative to earnings in recent years. This makes it an attractive option for investors looking for a high-quality company at a more reasonable price. Despite the volatility in the market, Amazon’s long-term growth prospects, driven by its dominant position in cloud computing, advertising, and logistics, make it one of the most promising stocks for investors with a long-term horizon.

Is AMZN Stock a Buy, Hold, or Sell?

At its current price point of around $76,200, Amazon presents an attractive opportunity for investors looking to capitalize on a fundamentally strong business at a discounted price. Despite the challenges posed by the ongoing trade war and economic uncertainties, Amazon remains one of the most dominant companies in the world, with its diversified revenue streams offering a solid foundation for continued growth. The key question for investors is whether the short-term volatility creates an opportunity to buy AMZN at a low price before the stock rebounds.

In the near term, the stock faces risks, especially if trade tensions worsen or if consumer spending continues to slow. However, with Amazon's resilience and dominant position in key industries like cloud computing and digital advertising, the company is well-positioned to recover once the broader market stabilizes. As the stock is now trading well below its January highs, this may be the perfect time for long-term investors to buy Amazon on the dip. If the stock can hold above the $150 level, it may signal a strong buying opportunity, with the potential for significant upside once the trade war issues subside.

To view the live real-time chart for Amazon (NASDAQ:AMZN), follow this link. For insider transactions and detailed stock profile information, visit Amazon's insider transactions page.