Is Google (NASDAQ:GOOGL) Trading at a Steep Discount? Here’s Why $164 Could Be a Golden Entry Point

With Google’s price at just $164, is this the ideal time to buy, or should you wait for further volatility? Let’s break down what’s driving Google’s current valuation and its future prospects | That's TradingNEWS

Analyzing Google (NASDAQ:GOOGL) Stock: Unveiling Its Current Potential Amid Economic Turmoil

Is Google (NASDAQ:GOOGL) Trading at a Discount? Current Price vs. Long-Term Prospects

As the global market continues to experience turbulence, marked by ongoing trade concerns and tariff volatility, Google (NASDAQ:GOOGL) has become one of the most discussed stocks in the tech space. Despite the company’s dominance in search, advertising, and cloud services, GOOGL has seen its stock price falter, trading at $164.16—a significant drop from previous highs. Yet, beneath the surface of this price dip lies a remarkable investment opportunity for those with a long-term outlook. With a forward P/E ratio of just 16.6x for CY2025, this represents the cheapest valuation for GOOGL in over a decade, indicating significant upside potential if the company’s growth trajectory continues.

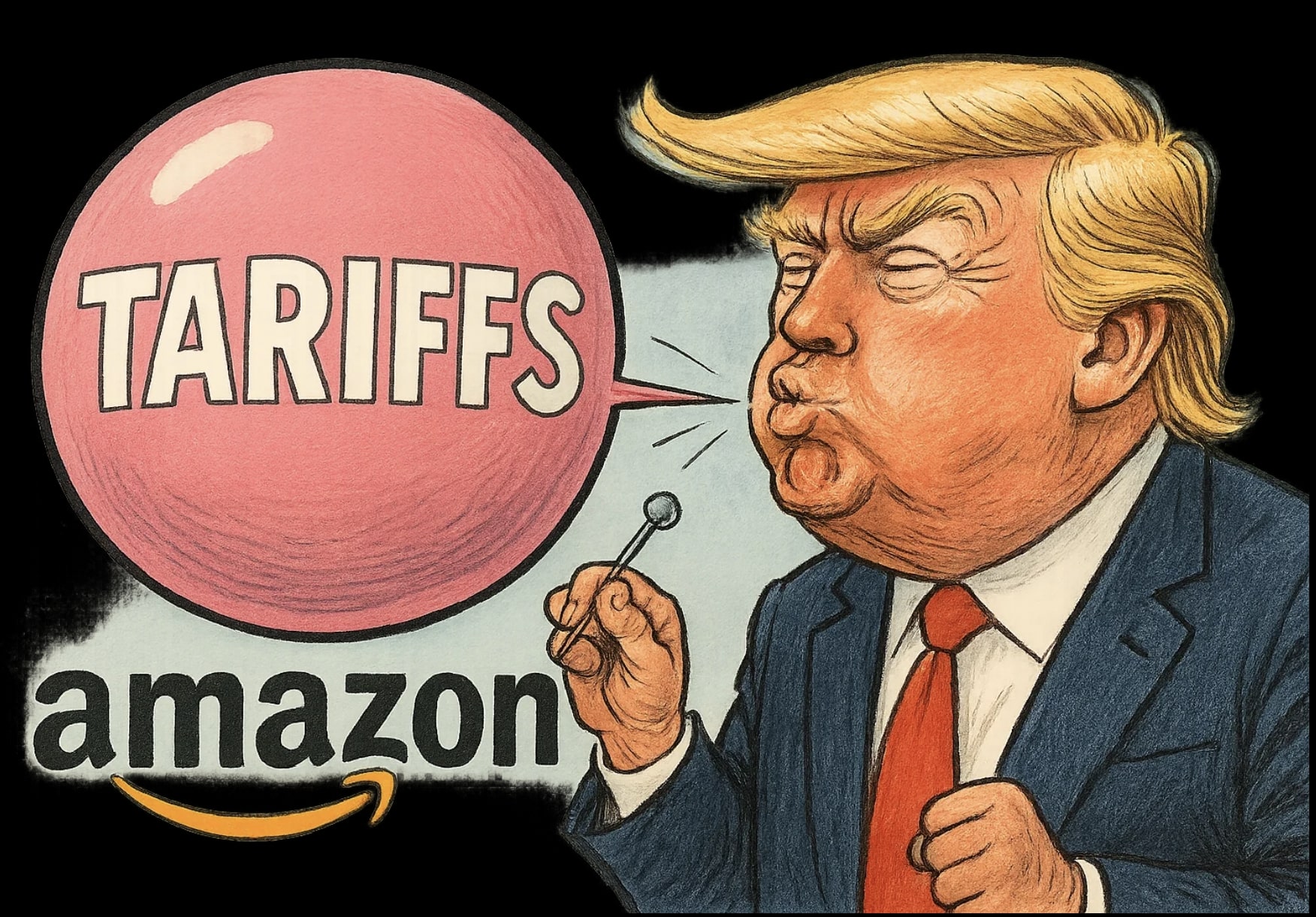

How the Tariff Wars Have Impacted Google’s Stock Valuation

The primary headwind weighing on Google's stock right now is the broader market reaction to global tariffs and trade conflicts, particularly between the U.S. and China. As tensions escalate, many investors have adopted a cautious approach, pulling back from tech stocks that they view as highly vulnerable to economic slowdowns. Google, however, remains resilient. The 75% of Google's revenue that comes from digital advertising is key to understanding why GOOGL is positioned for a strong recovery.

Although tariffs affect global economic activity and can stifle consumer spending, Google’s digital ad revenue model is far more insulated compared to traditional industries. When advertisers scale back on ad spend due to economic uncertainty, Google’s dominance in search and YouTube ads means the company is far more likely to maintain its revenue stream compared to its competitors, such as Meta Platforms (NASDAQ:META), which relies heavily on social media ad revenue. This disparity makes GOOGL a standout in a sea of uncertainty.

The recent downturn in GOOGL stock is more of an overreaction to the macroeconomic environment rather than a reflection of the company’s fundamental value. At $164.16, GOOGL is now trading well below its historical valuation ranges, presenting a rare buying opportunity for investors who are willing to see past the noise and focus on the company’s consistent growth and profitability.

Google’s Q4 and FY2024 Results: Solid Growth Despite Trade Tensions

GOOGL’s Q4 and FY2024 results paint a picture of continued strength, despite external headwinds. The company reported $96.5 billion in Q4 revenue, which represents a 12% YoY growth. This growth was driven largely by Google Search and YouTube, both of which continue to capture large portions of the global advertising spend. For instance, YouTube ad revenue grew 14% YoY in Q4, proving that, even amid trade concerns, Google’s advertising platform remains robust.

In terms of profitability, Google’s EBIT margin increased from 35% to 39%, an impressive feat for a company of its size. The Google Cloud division also showed remarkable progress, growing 30% YoY, with operating income increasing by over 100% year-over-year. These results highlight the diversification of GOOGL’s business model, with the cloud business gaining significant traction and positioning itself as a long-term growth engine. Google Cloud’s expansion, coupled with a lower-than-peer cost structure, gives the company a distinct advantage as more businesses move towards AI-driven infrastructure.

Valuation: Why Google (GOOGL) Is Undervalued at $164

At its current price of $164.16, GOOGL is trading at 16.6x its expected CY2025 earnings. This low valuation is especially attractive when compared to the broader market: the S&P 500 trades at a forward valuation of 19.4x, and the NASDAQ 100 is at 23.4x. Even if we look at GOOGL’s own historical averages, its current valuation represents a significant discount, especially considering its market-leading position in digital advertising, cloud services, and AI.

If we analyze Google’s valuation relative to its growth potential, the case becomes even more compelling. Analysts expect Google’s earnings to grow 11.5% YoY in CY2025, driving GOOGL’s EPS to around $9 per share. However, due to the significant sell-off caused by macroeconomic factors, GOOGL’s stock is now priced to offer a 25% upside from its current level, compared to other tech stocks with similar growth profiles.

Google’s current P/E ratio of 16.6x is not just cheap in comparison to its peers, but it also reflects historically low valuation multiples for the stock. As seen in the chart below, GOOGL has rarely traded at such low multiples, making now an optimal time to invest. With earnings expectations remaining intact, even if there are slight downward revisions due to macroeconomic concerns, GOOGL’s price should find strong support around the $164 mark, with potential to move upward once the market stabilizes.

What’s Driving Google’s Long-Term Growth? AI, Cloud, and Search Dominate

One of the most critical drivers of Google’s future growth is its continued investment in artificial intelligence (AI) and cloud computing. At the recent Cloud Next event, Google unveiled new advancements in AI, including the launch of its 7th generation TPU processor and the announcement of new AI models such as Gemini. These innovations solidify GOOGL’s leadership in the AI space and position it as a key player in the ongoing AI revolution.

With the world rapidly moving towards AI-powered applications, Google Cloud continues to expand its share in the cloud services market. Google Cloud grew 30% YoY in Q4, with its operating income rising 100%. This growth reflects the increasing adoption of Google’s cloud infrastructure and AI tools by businesses worldwide. Additionally, Google’s AI offerings, such as the Llama 4 model and agents for enterprise data, are gaining traction, further strengthening the company’s position in the AI space.

Moreover, Google’s dominance in paid search remains unparalleled, accounting for a significant portion of global digital ad spending. As businesses continue to invest in digital ads to reach consumers, Google stands to benefit from this ever-growing market. The company’s YouTube ad revenue, which grew 14% YoY in Q4, further showcases its ability to generate strong returns from its digital advertising platforms.

Risks: Navigating Regulatory and Economic Uncertainty

Despite Google’s strong growth prospects, several risks remain on the horizon. Regulatory pressure, particularly from the EU and US, continues to loom large over Google’s business. Antitrust investigations and the possibility of fines may weigh on the company’s bottom line in the coming years. However, GOOGL has shown resilience in navigating these challenges, and its strong cash position allows it to adapt to new regulatory requirements.

Moreover, the ongoing economic uncertainty caused by tariffs and the US-China trade war poses risks to Google’s advertising revenue. However, given Google’s diversified revenue streams, particularly from Google Cloud and AI-powered services, the company is well-positioned to weather these risks and maintain its growth trajectory.

What Role Does Insider Activity Play in Google’s Stock Performance?

Tracking insider transactions is an important aspect of evaluating GOOGL stock. In recent months, insider activity has remained relatively stable, suggesting that executives are confident in the company’s long-term prospects. Insider buying can be an indication of confidence in the company’s future growth, especially at a time when the stock price is undervalued. Investors can track GOOGL’s insider transactions through platforms such as Trading News Insider Transactions.

Conclusion: Google (GOOGL) is a Strong Buy at $164.16

NASDAQ:GOOGL is currently one of the most undervalued stocks in the market. Trading at $164.16, it offers a compelling investment opportunity with significant upside potential. GOOGL is benefiting from its leadership in digital advertising, cloud computing, and artificial intelligence, all of which are poised to drive future growth. Despite short-term concerns about tariffs and regulatory challenges, GOOGL’s fundamentals remain strong. Investors should consider buying into this undervalued stock, with an expected 25% upside as market conditions stabilize and GOOGL continues to innovate.

If you’re looking to capitalize on Google’s strong position in AI, cloud, and digital advertising, now might be the best time to buy GOOGL at a historically low price.