AMD Stock Dips 12%, But Can It Rally Past $179 as MI350 Chips Disrupt AI?

Will AMD’s New AI Chips Outperform Nvidia and Send NASDAQ:AMD Surging? | That's TradingNEWS

AMD Stock (NASDAQ:AMD) Poised for Major Breakout – Will MI350 Chips Fuel a Surge?

Can AMD (NASDAQ:AMD) Challenge Nvidia’s Dominance? AI Boom Sparks Huge Potential

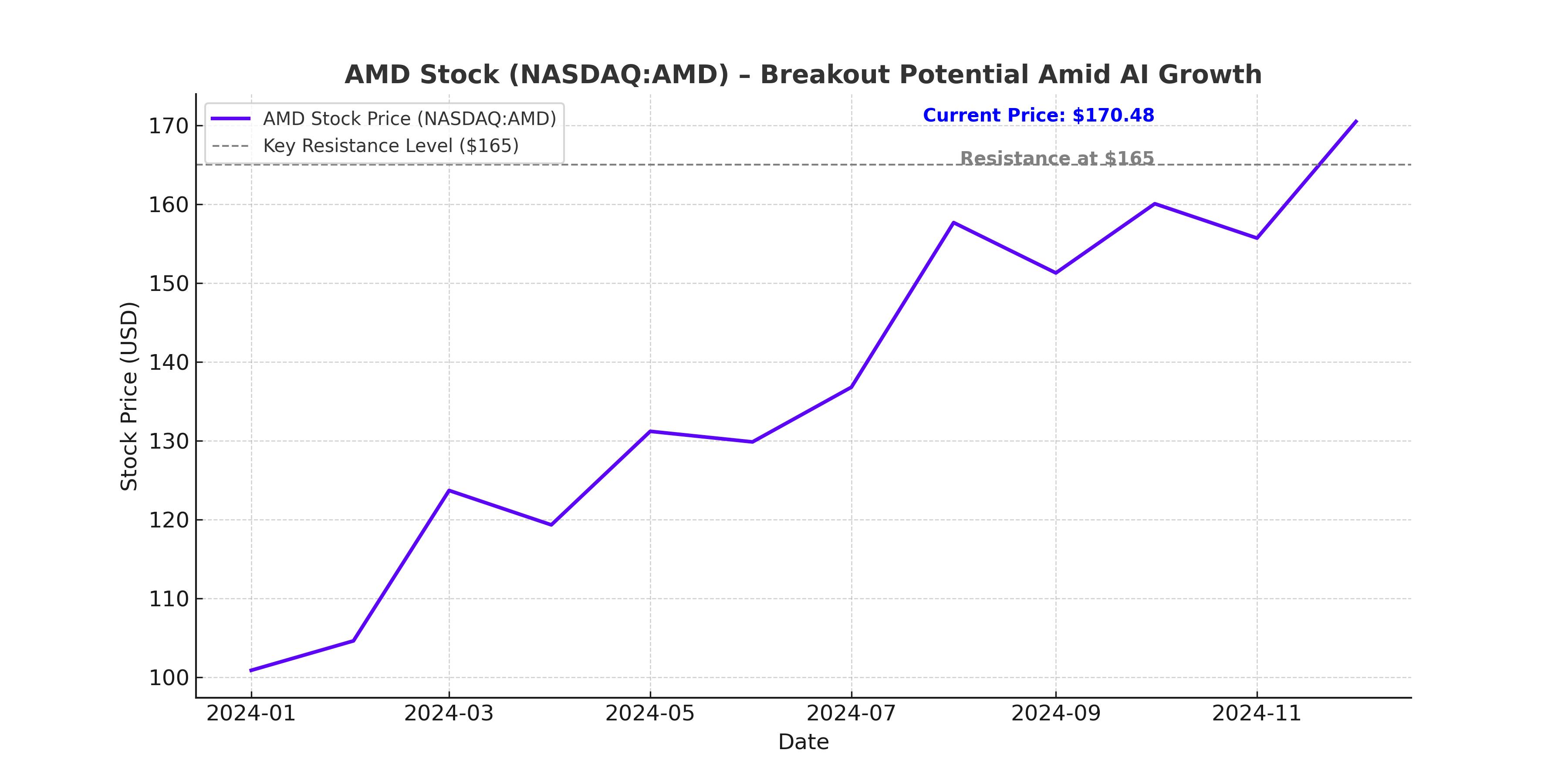

Advanced Micro Devices, Inc. (NASDAQ:AMD) has been on a rollercoaster ride in 2025, with shares retreating 12% from their January highs despite impressive financial performance. Revenue for Q4 2024 hit $7.7 billion, up 24% year-over-year, with an EPS of $1.09—a massive 42% jump from the prior year. While the company’s data center revenue slightly missed expectations, AMD remains in a strong growth position, especially with the upcoming MI350 GPU launch set to disrupt the AI chip market.

Is AMD’s MI350 the Game-Changer That Can Steal Market Share from Nvidia?

AMD’s MI350 GPU, expected to debut in mid-2025, is anticipated to deliver a 35x improvement in AI compute performance over its predecessor. This puts AMD in a direct fight with Nvidia’s Blackwell GPUs, a battle that could reshape the competitive landscape. The MI350, built on CDNA 4 architecture, is designed for inference workloads, an area where AMD has historically been more cost-effective than Nvidia. AI model training has dominated the market, but as enterprises shift focus toward AI inference, AMD’s lower total cost of ownership could be a critical advantage.

Will AMD's AI Growth Double Revenue? CEO Predicts Explosive Expansion

AMD CEO Lisa Su has forecasted that the company’s AI data center revenue could jump from $5 billion in 2024 to tens of billions in the coming years. If AMD can successfully penetrate Nvidia’s dominance, investors could see a massive expansion in valuation. The hyperscaler giants—Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), and Meta (NASDAQ:META)—are all increasing capital expenditures for AI infrastructure, and AMD is well-positioned to benefit.

Stock Valuation – Is AMD Undervalued or Fairly Priced?

With NASDAQ:AMD stock trading at 22.66x forward earnings, it sits below the semiconductor sector median. Its forward PEG ratio of 0.53 is a 71% discount to the industry average, signaling that Wall Street might be undervaluing AMD’s future growth potential. If AMD’s valuation aligns with the sector median, the upside could be 247% from current levels.

Key Risks – Can AMD Overcome the CUDA Software Barrier?

One of AMD’s biggest challenges is its lack of CUDA compatibility, which has made Nvidia the default choice for AI workloads. Developers have historically preferred Nvidia’s ecosystem, but new solutions, like Spectral Compute’s Scale tool, now allow CUDA programs to run natively on AMD GPUs. If AMD can break Nvidia’s CUDA stronghold, the company has a legitimate shot at securing a larger AI market share.

Buy, Sell, or Hold? What’s Next for NASDAQ:AMD?

Despite the short-term sell-off, AMD remains a long-term growth play. Revenue is on track for 19% year-over-year growth, with EPS expected to surge 96.95%, outpacing sector peers. With MI350 rolling out in mid-2025, potential expansion in data centers, and a valuation discount, AMD stock remains a strong buy for investors looking to capitalize on the AI boom.

🔗 Track AMD Stock Performance in Real-Time