Bitcoin Price Analysis: Is BTC-USD Positioned for a Bullish Breakout?

Bitcoin (BTC-USD), the world’s largest cryptocurrency, has recently reclaimed the psychologically critical $100,000 level, rallying on the back of improved macroeconomic sentiment and softer U.S. inflation data. With Bitcoin currently trading around $99,200 as of Thursday, traders are closely monitoring the upcoming U.S. Retail Sales report and the policy implications of the Trump administration’s inauguration, both of which are poised to influence BTC’s short-term trajectory. This analysis explores Bitcoin’s recent performance, technical indicators, and broader market context to assess its potential for further gains.

Bitcoin Reclaims $100K: CPI and Interest Rate Expectations

Bitcoin surged 4% this week, briefly reclaiming the $100,000 mark after the release of December's U.S. Consumer Price Index (CPI) report. The CPI data indicated core inflation had decelerated more than anticipated, reinforcing investor expectations of Federal Reserve rate cuts in mid-2025. Lower rates tend to boost Bitcoin’s appeal as a risk asset, with its price movements often reflecting macroeconomic sentiment. As of Thursday, Bitcoin slightly corrected to $99,200, reflecting caution ahead of critical economic data releases.

Crypto investors remain optimistic about Bitcoin’s trajectory under the incoming Trump administration, which has signaled pro-crypto policies. These include discussions about establishing a national Bitcoin reserve and appointing crypto-friendly regulators, such as Paul Atkins, to key positions within the SEC.

Trump Inauguration and Market Dynamics

The market anticipates heightened volatility surrounding Trump’s inauguration on January 20. Historical data suggests that significant political events, like presidential inaugurations, often create short-term volatility followed by medium-term upward trends in Bitcoin prices. The Trump administration’s crypto-friendly rhetoric, coupled with expected regulatory clarity, has bolstered market confidence. BTC-USD, however, faces immediate resistance near its all-time high of $108,353, set on December 17, 2024.

The K33 Report highlights how current conditions differ from past inaugurations. Unlike 2016, where market conservatism prevailed post-election, 2024 saw Bitcoin reach multi-month lows before rebounding strongly in anticipation of favorable policy announcements.

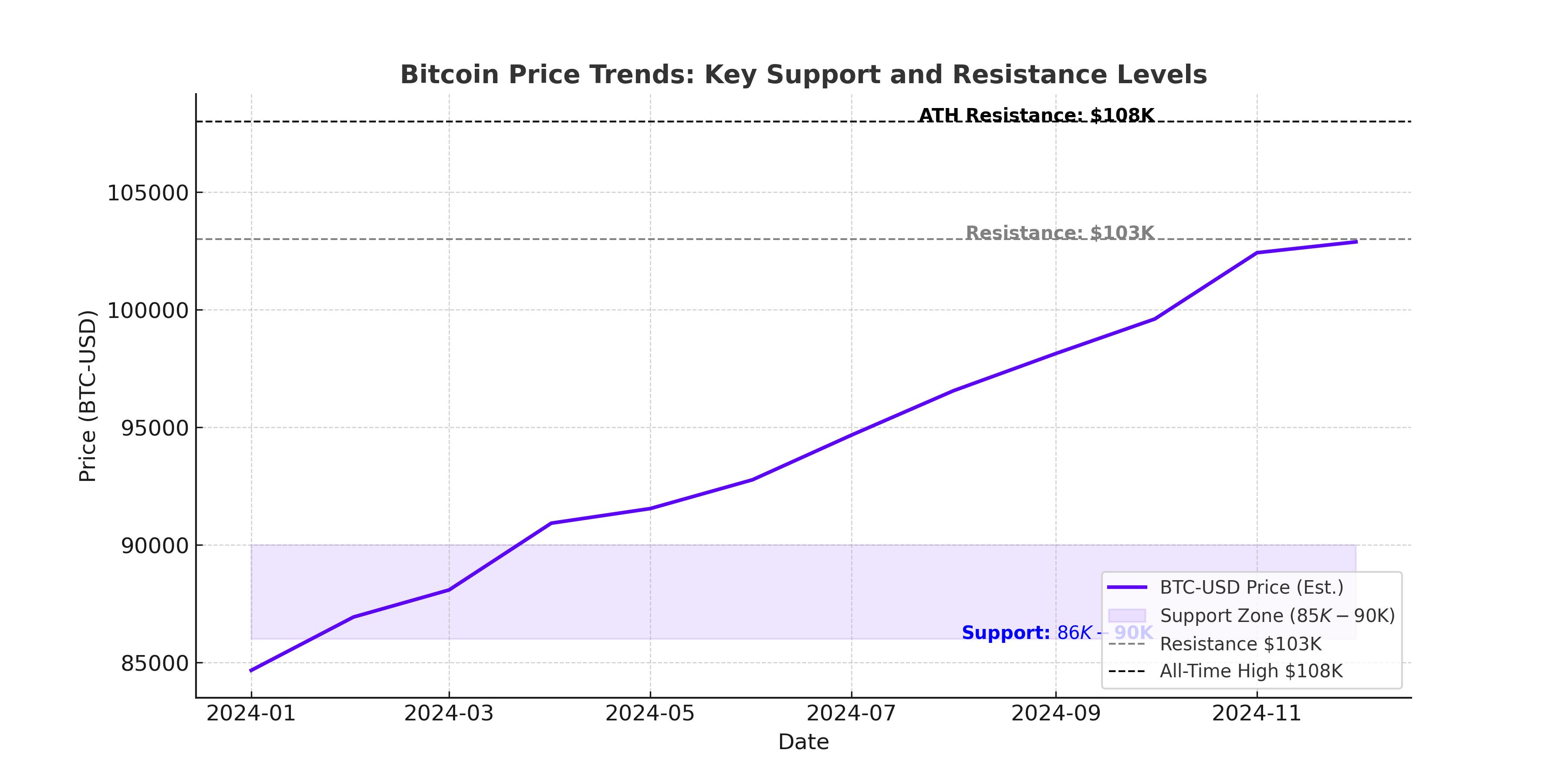

Bitcoin Technical Analysis: Support and Resistance Levels

Bitcoin’s technical indicators provide further insight into its price dynamics. The Relative Strength Index (RSI) on the daily chart is at 55, signaling moderate bullish momentum. The Moving Average Convergence Divergence (MACD) flipped to a bullish crossover on Wednesday, reinforcing upward momentum. Immediate support is seen at $90,000, a level Bitcoin must defend to sustain its bullish outlook.

If Bitcoin consolidates above $100,000, the next critical resistance lies at $105,000. Breaking this level could trigger a parabolic rally toward its previous all-time high of $108,353, with potential upside extending to the widely-discussed $170,000 cycle target highlighted by analysts like Tony Severino. Severino points to historical price action and stochastic momentum as key indicators of Bitcoin’s ability to achieve a 90% surge from current levels.

Institutional Interest and Spot Bitcoin ETFs

Bitcoin’s rally has been further supported by staggering institutional inflows into spot Bitcoin ETFs. According to QCP, these inflows totaled $755 million on January 15 alone, reflecting robust demand for regulated investment products. Institutional participation has long been considered a cornerstone of Bitcoin’s price appreciation, and the approval of additional ETFs could accelerate its adoption.

Altcoin Market Steals the Spotlight

While Bitcoin has reclaimed $100,000, the broader cryptocurrency market has seen even stronger performances from altcoins. XRP surged 14% to hit $3.26, while Solana rose 6.4%, reflecting renewed risk appetite among investors. Litecoin gained 11% amid optimism over its ETF approval prospects, and Ethereum remains above the critical $3,200 level, contributing to an overall bullish environment for digital assets.

Bitcoin dominance has declined from 58.6% to 57.4%, a trend often associated with the onset of altcoin season. For this trend to solidify, Bitcoin dominance must break below the 57.3% threshold, a level closely watched by market participants.

Macro Risks and Challenges Ahead

Despite Bitcoin’s bullish outlook, certain macroeconomic risks persist. Market expectations of Federal Reserve rate cuts remain subdued following stronger-than-expected U.S. labor data. The CME FedWatch Tool indicates only a 2.7% probability of a rate cut at the Fed’s next meeting, which could weigh on Bitcoin and other risk assets.

Additionally, geopolitical uncertainties, including tensions in the Middle East, may impact market sentiment. Crypto assets remain closely correlated with U.S. equities, and any significant downturn in the S&P 500 could ripple into Bitcoin’s price performance.

Bitcoin Price Forecast: Buy, Sell, or Hold?

Given the macroeconomic tailwinds, Bitcoin’s robust technical indicators, and anticipated pro-crypto policies under the Trump administration, BTC-USD presents a compelling buy opportunity for long-term investors. While near-term volatility is likely, the confluence of institutional interest, ETF inflows, and AI-driven adoption signals strong upside potential. Holding the $100,000 level as support is crucial, and a sustained breakout above $105,000 could pave the way for Bitcoin to reach its all-time high of $108,353 and potentially target $170,000 within the current cycle.

Bitcoin remains a dynamic asset class, offering both risks and opportunities. Investors should stay vigilant, monitoring macroeconomic developments and market sentiment closely as Bitcoin navigates this pivotal phase in its bull cycle.