Chevron Stock Dips—But Is NYSE:CVX Poised for a Major Rebound with Rising Oil Output?

Can Chevron’s Permian Growth and $27B in Buybacks Drive NYSE:CVX Past $172? | That's TradingNEWS

Chevron (NYSE:CVX) Analysis: Is the Pullback a Buying Opportunity?

Chevron’s Recent Pullback—Overreaction or Opportunity?

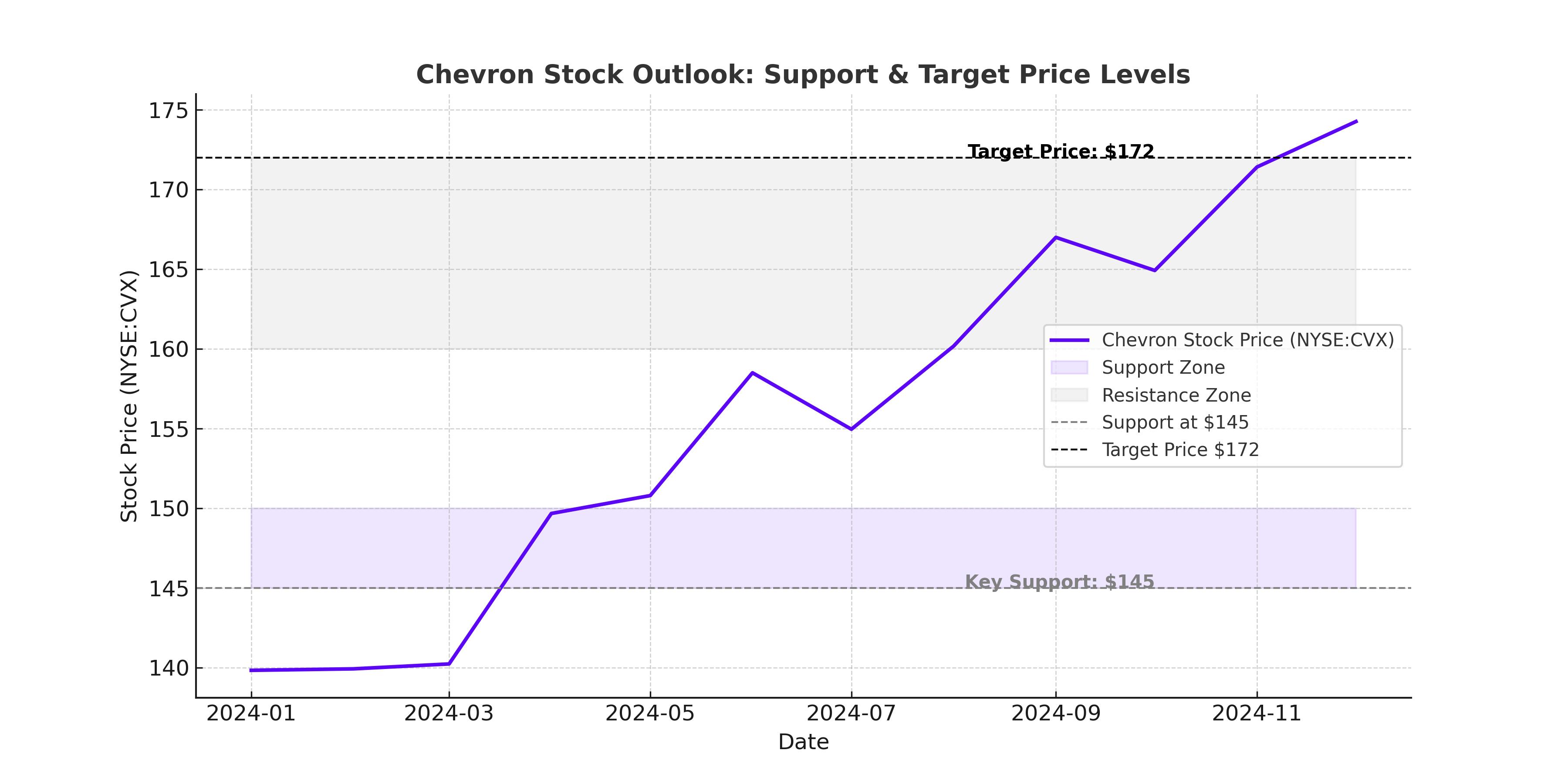

Chevron (NYSE:CVX) stock has seen a pullback despite strong financials, currently hovering around $147.50. The market reacted negatively to a slight Q4 earnings miss, but the bigger picture suggests a buying opportunity rather than a reason for concern. Chevron continues to increase production, generate massive free cash flow (FCF), and return capital to shareholders through dividends and buybacks. With major expansion projects in play, is the recent dip a golden opportunity for long-term investors?

Cash Flow and Shareholder Returns—The Backbone of CVX's Strength

Despite a weaker quarter, Chevron remains one of the strongest cash flow machines in the energy sector. In FY 2024, the company generated $15 billion in free cash flow, with $27 billion returned to shareholders—a mix of $11.8 billion in dividends and $15.2 billion in stock buybacks. This means Chevron bought back nearly 6% of its outstanding shares while maintaining a 4.5% dividend yield, which remains well-covered by operating cash flow.

Chevron’s forward free cash flow yield sits at 10%, based on its projected $10 billion in additional FCF by 2026. Even at $70 Brent crude, the company still expects to generate $9 billion per year in excess cash, underscoring its resilience in various oil price environments.

Production Growth and Expansion—Can It Fuel Future Gains?

Chevron’s production has continued to rise, particularly in the Permian Basin, where output surged 9% year-over-year in FY 2024. The Permian is expected to exceed 1 million barrels per day by 2026, up from 900,000 today, making it a major growth driver. With 20% lower reinvestment rates, these barrels are becoming even more profitable, supporting long-term cash flow expansion.

Beyond the Permian, Chevron's Tengizchevroil (TCO) project in Kazakhstan is now ramping up, marking the completion of a nearly $50 billion megaproject. This development will add 250,000 barrels per day to Chevron’s production, delivering $6 billion in annual free cash flow by 2026, with $2 billion allocated for loan repayments and the remaining $4 billion available for dividends and buybacks.

With these expansions, Chevron forecasts 7% production growth in 2025 and another 4.5% in 2026, reinforcing its ability to sustain high dividend payouts while aggressively buying back shares.

Earnings Miss and Refinery Weakness—A Short-Term Concern?

Chevron’s Q4 earnings came in at $2.06 per share, missing consensus estimates by $0.05 per share, but the top-line revenue of $52.2 billion beat expectations by $3.8 billion. While profits from U.S. crude production were strong, earnings were dragged down by weak refinery margins and slightly lower petroleum price realizations, which dropped 3% quarter-over-quarter.

However, refining is a volatile, cyclical business, and weakness here is unlikely to impact Chevron’s long-term trajectory. With global oil demand expected to remain robust in 2025 and geopolitical tensions supporting energy prices, the refinery segment should recover in the coming quarters.

Is NYSE:CVX Stock Undervalued?

Chevron trades at a forward P/E ratio of 11.6x, which is cheaper than Exxon Mobil (NYSE:XOM) at 12.2x. This means Chevron offers a higher earnings yield of 9%, making it one of the most attractively valued large-cap energy stocks.

With its dividend yield at 4.5% and aggressive buyback program reducing share count, Chevron offers a compelling total return package for investors. Analysts estimate fair value at $172 per share, suggesting a potential 17% upside from current levels, not including dividends.

What Are the Risks for Chevron?

The biggest risk to Chevron is a sustained decline in oil prices. If Brent crude were to fall significantly below $60 per barrel, free cash flow would come under pressure, potentially impacting buybacks. Additionally, the trade war between the U.S. and China could escalate, leading to tariffs on energy products, though this remains speculative.

However, Chevron has one of the strongest balance sheets in the sector, with only $3.6 billion in net debt, allowing it to weather downturns better than most competitors.

🔗 Check Chevron’s Real-Time Stock Performance

🔗 Track Insider Transactions for CVX

Final Verdict—Buy, Sell, or Hold?

Chevron’s strong cash flow, aggressive buybacks, and expanding production make it one of the most attractive energy plays. The current pullback looks like a buying opportunity, with shares trading at a discount to fair value. With a secure dividend, a 10% free cash flow yield, and Permian/TCO expansions fueling future earnings, Chevron remains a top pick in the energy sector. Investors with a long-term horizon should view the dip as an opportunity to accumulate shares before the next leg higher.