Ethereum (ETH-USD) at a Breaking Point: Can Bulls Push Past $3,000?

With ETH Hovering at $2,600, Will Institutional Accumulation Spark a Breakout or Are Lower Lows Coming? | That's TradingNEWS

Ethereum (ETH-USD) at a Crossroads: Will Bulls Take Control or Is a Deeper Correction Coming?

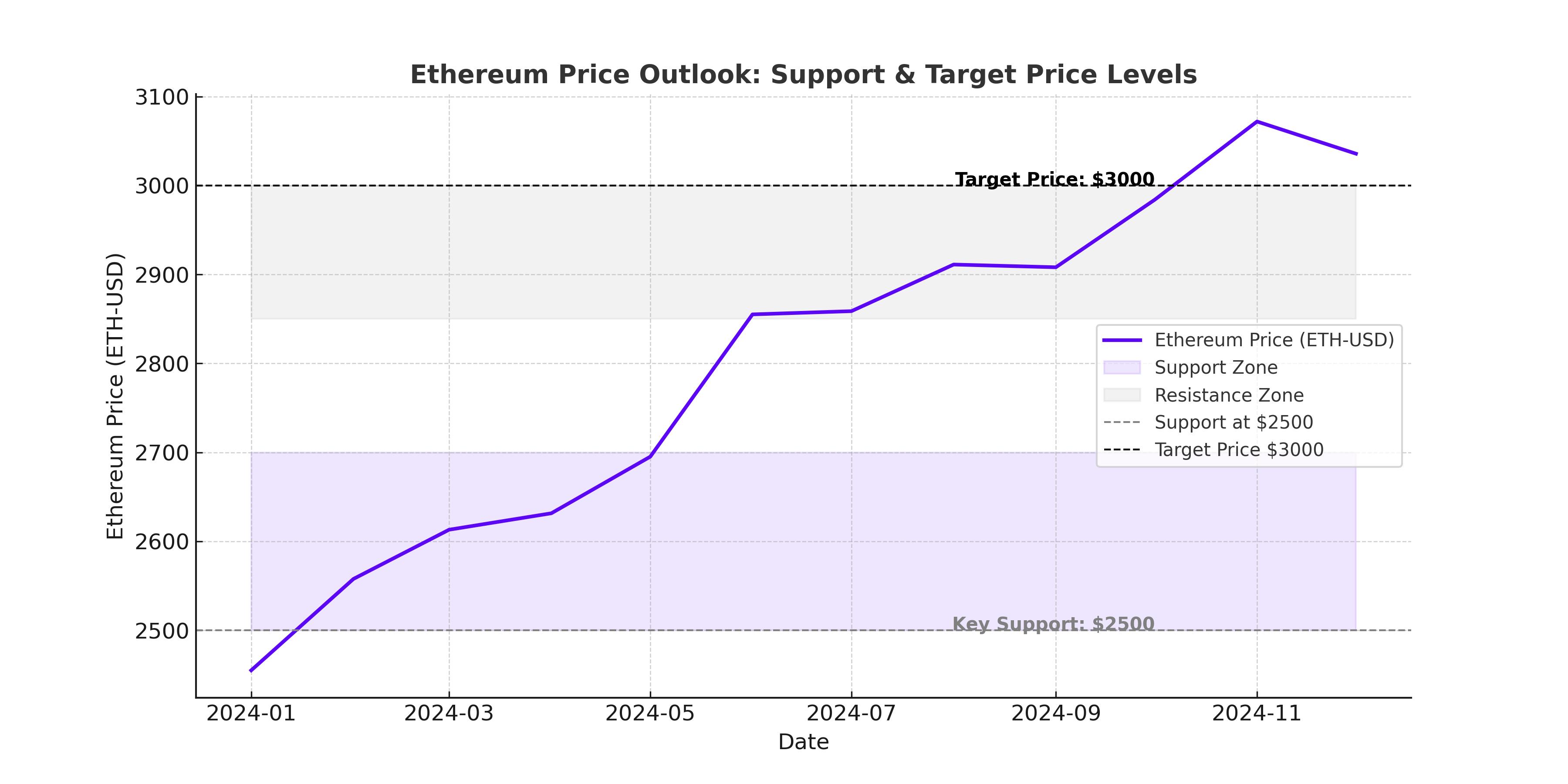

Ethereum (ETH-USD) is at a critical juncture as the price hovers around $2,600, struggling to regain momentum after a recent pullback. Institutional investors, including BlackRock and Goldman Sachs, continue accumulating ETH, signaling confidence in its long-term potential. However, macroeconomic pressures, regulatory uncertainties, and technical indicators suggest a battle between bullish optimism and bearish momentum.

Ethereum’s Price Struggles Below $2,700 as Market Sentiment Shifts

Ethereum’s price has remained stuck in a range between $2,500 and $2,700, failing to break through key resistance levels. The broader cryptocurrency market has been under pressure after hotter-than-expected U.S. inflation data dampened expectations for Federal Reserve rate cuts.

On Wednesday, Ethereum rebounded 3% after President Donald Trump announced a diplomatic breakthrough with Russian President Vladimir Putin, temporarily boosting market sentiment. However, ETH remains below the critical $3,000 resistance level, which it needs to reclaim to confirm a short-term bullish reversal.

Institutional Interest in Ethereum Continues to Grow

Despite short-term price struggles, institutional demand for Ethereum remains strong. Goldman Sachs recently increased its Ethereum ETF holdings to $480 million in Q4 2024, marking a nearly 2,000% increase from its initial investment of $22 million. The bank’s Ethereum exposure is split between BlackRock’s iShares Ethereum Trust (ETHA), Fidelity Ethereum Fund (FETH), and a small position in Grayscale Ethereum Trust (ETHE).

BlackRock also continues to aggressively accumulate ETH, with its Ethereum ETF now holding $4.44 billion in assets. Meanwhile, World Liberty Financial (WLF), an investment firm with ties to Trump’s financial network, recently purchased 1,917 ETH, increasing its total Ethereum holdings to 18,520 ETH worth $48.25 million.

The surge in institutional buying aligns with a broader trend of decreasing ETH supply on exchanges. Over the past week, more than 1 million ETH, valued at $2.9 billion, has been withdrawn from centralized exchanges, reducing available liquidity and potentially setting the stage for a supply squeeze.

Ethereum’s Technical Outlook: Bullish Breakout or More Downside?

Descending Triangle Formation Signals Uncertainty

Ethereum’s price action on the 4-hour chart reveals a descending triangle pattern, a formation that typically precedes a breakout in either direction. The upper resistance near $2,894 (23.6% Fibonacci retracement level) is a crucial level to watch. A breakout above this level could trigger a move toward $3,000, while failure to break higher could see ETH retesting support at $2,509 or even dropping to $2,400.

Key Resistance and Support Levels

Resistance Levels:

- $2,894 – 23.6% Fibonacci retracement level and triangle resistance

- $3,000 – Psychological resistance and key pivot point

- $3,500 – 61.8% Fibonacci level and major breakout target

Support Levels:

- $2,509 – Key horizontal support and previous demand zone

- $2,400 – Major support level from early 2024

- $2,200 – Critical level, breaking below could invalidate bullish momentum

Indicators Suggest Mixed Signals

- Relative Strength Index (RSI): Currently neutral, around 45, indicating a lack of clear trend direction.

- MACD: Recently turned bearish, signaling weakening momentum.

- Bollinger Bands: Squeezing, indicating a potential breakout is imminent.

Ethereum vs. Bitcoin: ETH/BTC Ratio Hits Historic Oversold Levels

Ethereum has underperformed Bitcoin in recent months, with the ETH/BTC ratio dropping to 0.02, its lowest level in years. The ratio’s Relative Strength Index (RSI) has entered oversold territory, a condition that historically precedes a period of Ethereum outperformance. If this pattern repeats, Ethereum could be on the verge of a significant rally against Bitcoin, further supporting the case for a bullish reversal.

Regulatory and Macro Risks: Will They Hold Ethereum Back?

The biggest risks facing Ethereum right now include regulatory uncertainty and macroeconomic headwinds. The U.S. Securities and Exchange Commission (SEC) has yet to approve a spot Ethereum ETF, and ongoing discussions around crypto regulations could impact investor sentiment. Additionally, rising inflation has led the Federal Reserve to delay potential interest rate cuts, which could reduce risk appetite in the crypto market.

Will Ethereum Reclaim $3,000 or Face Another Sell-Off?

Ethereum’s price trajectory depends on a combination of technical breakouts, institutional buying, and macroeconomic conditions. The $2,894 resistance level is the key barrier preventing a move higher. If ETH breaks above this level and reclaims $3,000, it could trigger a rally toward $3,500. However, failure to do so could see Ethereum retesting $2,509 or lower.

The growing institutional accumulation, declining exchange supply, and historical ETH/BTC trends suggest Ethereum has strong long-term upside potential. However, short-term volatility remains high, and traders should closely watch resistance and support levels for confirmation of the next major move.

The question remains: Will Ethereum break above $3,000 and ignite a new rally, or will bearish forces push ETH-USD toward new lows?