Alphabet Inc. (NASDAQ:GOOGL): AI Leadership, Revenue Growth, and Stock Valuation Amid Market Dynamics

Alphabet Inc. (NASDAQ:GOOGL), trading at $192.50 as of the latest market close, is a cornerstone of the tech industry, leading advancements in artificial intelligence, cloud computing, and digital advertising. With a market cap exceeding $1.3 trillion, Alphabet’s robust financial performance and strategic investments in AI and cloud solutions reinforce its position as an industry leader. However, the stock faces significant pressures from antitrust challenges and competitive threats, making its trajectory a critical focus for investors.

AI Advancements Fuel Alphabet’s Competitive Edge

Alphabet’s commitment to artificial intelligence is reflected in its massive $29 billion AI CapEx, positioning it second only to Microsoft in AI spending. Its latest offering, Gemini 2.0, has redefined the AI landscape by integrating text, image, and video processing capabilities. The AI platform’s efficiency is highlighted by a 90% reduction in query processing costs over 18 months, achieved through advanced hardware and engineering upgrades.

Gemini 2.0’s success has solidified Alphabet’s dominance in AI-enabled search, a critical revenue driver for the company. Google Search, which contributes over $162 billion annually, benefits from AI-driven overviews that improve query precision and ad relevance. The company handles a staggering 20 billion visual searches per month, unlocking new revenue streams and content formats.

Google Cloud: A Growth Engine with Expanding Margins

Google Cloud continues to outperform, achieving 35% year-over-year revenue growth in Q3 2024 and contributing $30 billion in annualized revenue. The segment’s 17% operating margin reflects enhanced profitability, driven by enterprise adoption of generative AI tools. Alphabet’s AI-enabled cloud solutions are helping clients cut processing costs while accelerating innovation, making Google Cloud a formidable competitor to AWS and Microsoft Azure.

Search Advertising and YouTube’s Growing Revenue

Search remains Alphabet’s most significant revenue contributor, but YouTube’s burgeoning advertising potential is a vital growth area. Over the past four quarters, YouTube’s subscription and ad revenue surpassed $50 billion, with monetization of Shorts contributing significantly. Alphabet’s AI-driven content creation tools, like the VO advanced video generation model, further empower creators, expanding its advertising ecosystem.

Stock Valuation and Financial Strength

Trading at 18x forward P/E, Alphabet is undervalued compared to peers like Microsoft (30x P/E) and Amazon (35x P/E). With projected 2025 adjusted EPS of $11, the stock offers an attractive entry point given its robust financials and growth potential. The company maintains $93 billion in cash and equivalents, bolstered by a current ratio of 1.8, allowing for continued investment in innovation while weathering potential regulatory costs.

Alphabet’s trailing twelve-month revenue stands at $324 billion, up 15% year-over-year, with a net profit margin of 24.7%, underlining its operational efficiency. These metrics, combined with its strong balance sheet and low debt levels, position the company to sustain growth amid competitive pressures.

Challenges: Antitrust Trials and Competitive Risks

The Department of Justice’s antitrust trial is a looming threat, with potential outcomes including the loss of the $20 billion annual default search deal with Apple. If mandated to divest Chrome or Android assets, Alphabet may face higher customer acquisition costs and reduced profitability. Additionally, competition from Microsoft’s Bing and OpenAI’s ChatGPT challenges Alphabet’s AI supremacy, though its recent market share gains mitigate immediate concerns.

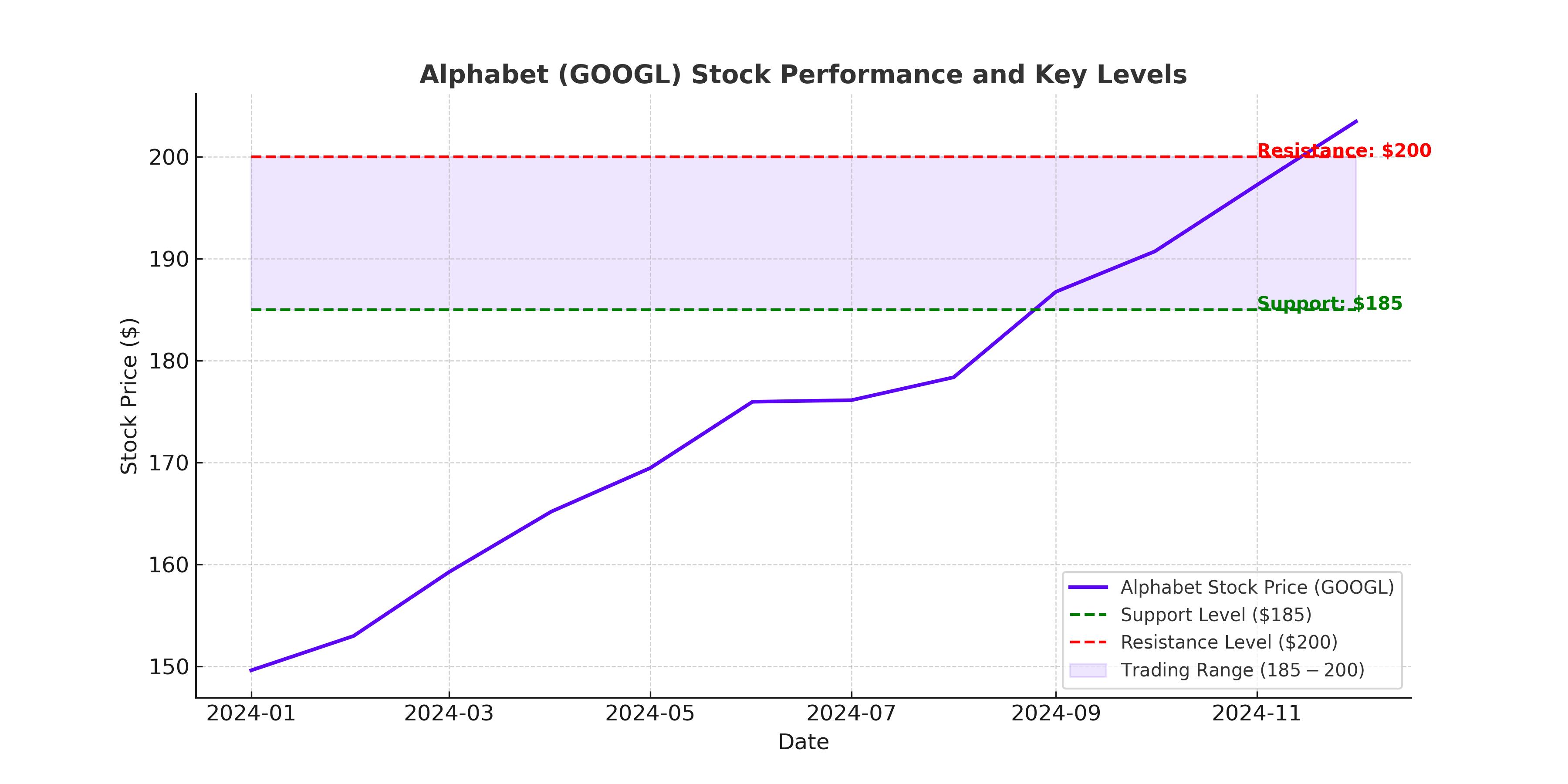

Technical Analysis: Resilient Stock Performance

Alphabet’s stock has demonstrated resilience, recovering from a 2022 low of $85 to trade above $192. Key technical levels include support at $185 and resistance at $200, with a breakout above the latter likely signaling further bullish momentum. Since reclaiming the $150 level in early 2024, the stock has posted higher lows, reflecting growing investor confidence.

The Path Forward: Buy, Hold, or Sell?

With its stock trading near $192, Alphabet presents a compelling buy case for investors focused on long-term growth. Its AI advancements, growing cloud market share, and YouTube monetization strategies are offset by potential antitrust costs and competitive risks. However, the company’s strong financial foundation and diversified revenue streams suggest it is well-equipped to navigate these challenges.

For real-time stock updates and analysis, visit GOOGL Real-Time Chart. Alphabet remains a pivotal player in the tech sector, offering robust growth potential at an attractive valuation.