Is Chevron Corporation (NYSE:CVX) a Strong Buy at $145?

Chevron's $145 Price Tag: Oversold RSI, 5% Yield, and Growth in Key Markets Like Permian Basin and Guyana | That's TradingNEWS

Chevron Corporation (NYSE:CVX) has become a focal point for investors in the energy sector, standing out due to its strategic focus on upstream and downstream segments, disciplined capital allocation, and a remarkable dividend track record. Trading at approximately $145 per share, Chevron presents a compelling case for long-term investors seeking exposure to the energy sector’s growth potential while enjoying solid dividend returns.

Resilient Performance in a Volatile Energy Market

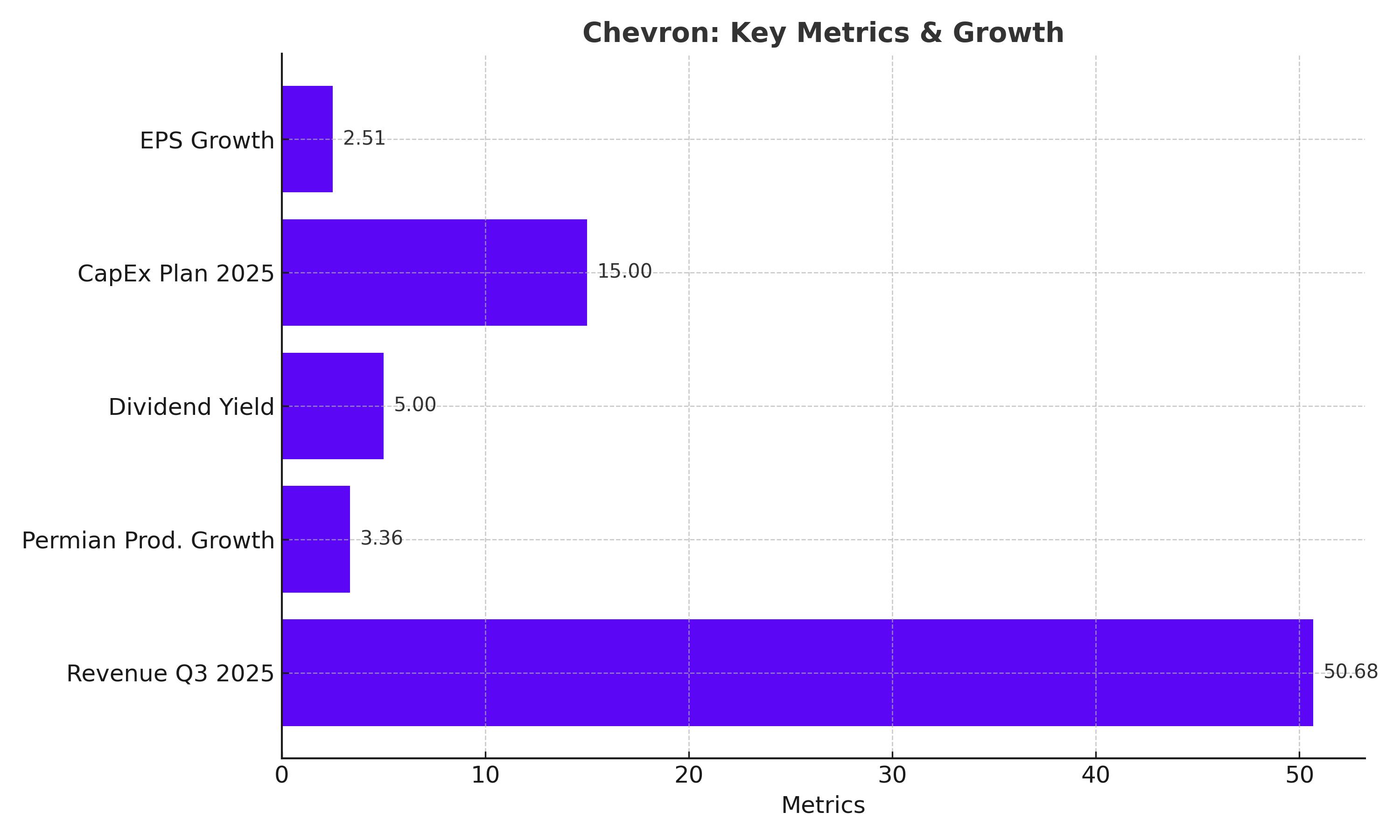

Chevron’s recent earnings reflect its operational resilience despite a challenging macroeconomic backdrop. In Q3 2025, the company reported revenue of $50.678 billion, surpassing expectations by $1.63 billion. GAAP EPS stood at $2.48, while normalized EPS came in at $2.51, beating estimates by $0.09. These results, though slightly down year-over-year due to lower refining margins and weaker crude price realizations, underline Chevron’s ability to generate strong cash flows even in fluctuating market conditions.

Chevron's production in the Permian Basin increased by 2% quarter-over-quarter, reaching 3.36 million barrels of oil equivalent per day (Mboed). This consistent growth aligns with the U.S. Energy Information Administration's projection of record Permian production in 2025, driven by improved drilling efficiency and technological advancements.

Capital Allocation and Dividend Strength

Chevron's disciplined approach to capital allocation remains a cornerstone of its investment thesis. The company recently announced a $15 billion organic capital expenditure plan for 2025, reflecting a $2 billion reduction from 2024. This move underscores management’s commitment to maintaining a strong balance sheet while prioritizing shareholder returns.

Chevron’s dividend yield has surged to 5% amid recent market volatility, offering an attractive entry point for income-focused investors. With a 37-year streak of dividend growth, the company solidifies its status as a Dividend Aristocrat. Its current payout ratio remains sustainable, supported by robust free cash flow and a net cash position of $64 billion.

Strategic Mergers and Portfolio Optimization

Chevron's strategic acquisitions, including Hess Corporation, enhance its portfolio, particularly in high-margin areas like Guyana, the Gulf of Mexico, and the Bakken. The Hess acquisition, pending final arbitration with Exxon Mobil over Guyana assets, could significantly boost Chevron’s production profile and long-term earnings potential.

Additionally, Chevron's divestiture of non-core assets, such as its stake in the Athabasca Oil Sands Project, aligns with its focus on optimizing its global energy portfolio. This move is expected to generate $10-$15 billion in proceeds by 2028, which can be reinvested in higher-return projects or returned to shareholders.

Valuation: A Discounted Opportunity

Chevron's valuation metrics indicate a favorable entry point. Its forward P/E ratio of 14.12x for FY2024, decreasing to 13.35x in 2025, underscores its attractive pricing relative to peers and the broader market. On an EV/EBITDA basis, Chevron trades at 6.35x, slightly below Exxon Mobil’s 6.68x, reinforcing its position as a high-quality energy investment.

Despite short-term headwinds, including inflationary pressures and regulatory uncertainties, Chevron’s robust financial health and operational efficiency provide a solid foundation for growth. The anticipated EPS recovery in 2025 and beyond, driven by cost-control measures and production growth, positions the company for a strong rebound.

Technical Outlook: Signs of a Rebound

Chevron's (NYSE:CVX) Relative Strength Index (RSI) has fallen to 22.5, firmly in oversold territory, indicating a significant potential for a price rebound. Trading at approximately $145 per share, the stock has breached critical support levels, including the 20-day, 50-day, and 200-day moving averages, under heavy trading volume. This confluence of technical factors suggests that Chevron is positioned for a recovery, particularly as market sentiment improves. Investors looking to capitalize on this setup could see an attractive entry point as the stock regains its footing.

Conclusion: Chevron’s Value Proposition

At $145 per share, Chevron Corporation (NYSE:CVX) offers a compelling investment opportunity underpinned by its robust financial position and disciplined growth strategy. The company’s 5% dividend yield, coupled with its proven track record of 37 consecutive years of dividend growth, enhances its appeal for income-focused investors. With substantial growth potential in the Permian Basin and anticipated production gains in Guyana following the Hess acquisition, Chevron is poised to deliver both capital appreciation and reliable income. Despite market volatility, Chevron’s commitment to optimizing its portfolio and driving shareholder value cements its status as a strategic buy.

That's TradingNEWS

Is Google (NASDAQ:GOOGL) Trading at a Steep Discount? Here’s Why $164 Could Be a Golden Entry Point