Nike Stock(NYSE:NKE): Turnaround Play or Overpriced Risk?

Can Nike (NYSE:NKE) Recover Growth and Profitability, or Will It Fall Another 20%? | That's TradingNEWS

Nike (NYSE:NKE): Is the Stock Ready to Rebound or Facing More Pain?

Nike’s Financial Struggles: Is the Turnaround Real or Just Hype?

Nike (NYSE:NKE) has been under heavy pressure, facing declining revenue, weaker margins, and an uncertain retail environment. Once the undisputed king of sports apparel, the stock is now trading at levels not seen in years, leading investors to question: Is now the time to buy, or is Nike still overpriced?

In Q2 FY25, Nike reported $12.4 billion in revenue, down 8% year-over-year, with digital sales plunging 21%. Gross margin fell to 43.6%, a drop of 100 basis points, as the company relied on discounts to move inventory. Even with efforts to reposition itself for long-term profitability, the near-term financials show a company struggling to regain momentum.

Why Is Nike (NYSE:NKE) Struggling?

The decline isn’t just about consumer demand. Nike’s direct-to-consumer (DTC) model, once hailed as a growth engine, has backfired, leading to excess inventory and weaker margins. The company’s pivot back to a wholesale-driven model is a clear admission that its aggressive DTC push failed to deliver the expected returns.

Another major issue is Nike’s weak performance in China, one of its most important markets. In Q2, revenue from Greater China fell 11%, signaling that Nike is losing market share to local competitors. At the same time, the U.S. consumer is turning cautious, further dampening growth.

Even with a well-known brand, Nike is facing fiercer competition than ever. Rivals like Lululemon (NASDAQ:LULU), Adidas (OTCQX:ADDYY), and On Running (NYSE:ONON) are taking market share in high-margin categories like athleisure and performance footwear. Nike’s once-dominant innovation pipeline is now lagging behind competitors, leaving investors questioning whether the brand can still lead the industry.

Nike’s Valuation: Is It Overpriced at $90?

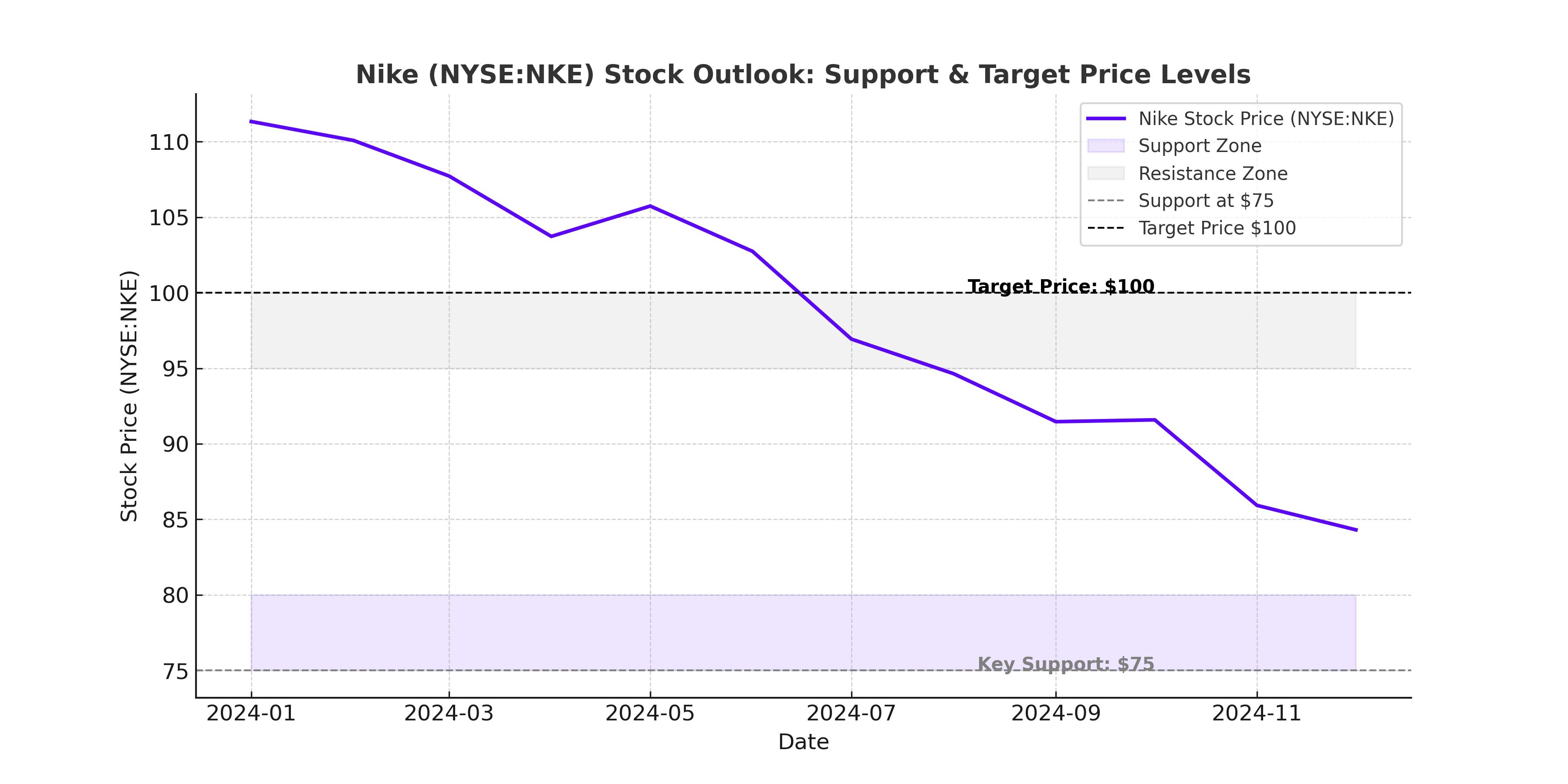

At its current price of $90 per share, Nike trades at a P/E ratio of 33x FY26 earnings, which is well above industry averages. Even if the company’s EPS grows at 10% per year, the valuation still looks stretched unless profitability improves dramatically.

On a price-to-sales (P/S) basis, Nike is trading at 2.35x revenue, historically low for the stock. But compared to competitors, this isn’t exactly a bargain. Adidas, for example, trades at 1.4x sales, reflecting its own challenges but also a more reasonable valuation.

If Nike continues struggling with weak growth and profitability pressures, a 20% downside to $72 per share is entirely possible. However, if the company successfully executes its turnaround, the stock could rebound toward $100+ in the next 12 months.

Nike’s Turnaround Plan: Can It Work?

Nike’s management has outlined a strategy to regain profitability, but execution remains a risk. Here’s what they are focusing on:

- Returning to Full-Price Selling: Nike is shifting away from constant promotions to rebuild brand strength, but this could hurt sales in the short term.

- Strengthening Wholesale Partnerships: Retailers like Dick’s Sporting Goods (NYSE:DKS) and Foot Locker (NYSE:FL) are critical to Nike’s strategy after the failed DTC push.

- Investing in Performance Sports: Nike wants to regain dominance in core categories like running and basketball, but execution has been weak so far.

- Reducing Inventory Overhang: The company is still working through excess inventory, which could weigh on margins for another few quarters.

Should You Buy, Hold, or Sell Nike (NYSE:NKE)?

Nike is still one of the strongest brands in the world, but its financials don’t justify a premium valuation right now. The stock is priced as if the turnaround will be successful, yet evidence suggests that challenges will persist through FY25.

If you’re a long-term investor, waiting for a better entry point below $80 may be a smart move. If the company shows stronger-than-expected growth in China and North America, the stock could move higher—but without a clear catalyst, a retest of $75 is likely before a real recovery begins.

For now, Nike (NYSE:NKE) is a Hold, with a near-term downside to $75 and upside to $100 if the turnaround gains traction.

That's TradingNEWS

Is Google (NASDAQ:GOOGL) Trading at a Steep Discount? Here’s Why $164 Could Be a Golden Entry Point