Vanguard Dividend Appreciation ETF (NYSEARCA:VIG): A Strategic Approach to Growth and Stability

Leveraging Dividend Growth and Tech Exposure, VIG Positions Itself as a Strong, Long-Term Investment Choice Amid Economic Shifts | That's TradingNEWS

An In-Depth Look at NYSEARCA:VIG– Resilience Through Dividend Growth

NYSEARCA:VIG, the Vanguard Dividend Appreciation ETF, presents an intriguing option for investors focused on dividend growth, stability, and selective tech exposure. The fund’s strategy is rooted in identifying U.S. large-cap companies that not only pay dividends but also grow them consistently over a decade. With assets under management exceeding $100 billion, VIG combines growth potential with defensive attributes, making it an appealing choice amid fluctuating market conditions.

Dividend Growth Strategy: Balancing Stability with Growth

VIG’s focus is on companies with at least 10 years of consecutive dividend growth. This approach yields a balanced portfolio of 341 stocks, prioritizing firms that display long-term financial health and commitment to shareholder returns. Unlike high-yield ETFs, VIG screens out the top 25% of highest-yielding companies, reducing the risk of exposure to struggling companies. Currently, VIG’s dividend yield stands at 1.7%, slightly higher than the S&P 500’s 1.2%, with the fund consistently outperforming during bullish market trends.

The fund’s core holdings are in sectors that combine growth and defensive qualities. Information Technology (24.1%), Financials (20%), and Healthcare (15.5%) represent the largest allocations, aligning with market dynamics and positioning VIG well for both bullish and bearish phases. Notably, VIG’s 23% tech exposure is higher than many dividend-focused ETFs, offering a growth advantage that has contributed to its 8.57% average annual return over the past three years.

Sector and Stock Composition: Strategic Allocations with Reduced Risk

VIG’s largest holdings are market giants with strong balance sheets, including Apple (AAPL), Microsoft (MSFT), and Broadcom (AVGO), which benefit from tech’s ongoing growth, especially with AI advancements. This sector weighting distinguishes VIG from competitors like SCHD, whose tech exposure remains around 8.8%, limiting its participation in tech-driven growth. As a result, VIG has outperformed SCHD by nearly 2% in the past year, showcasing the strength of its selective tech allocation.

Despite being growth-oriented, VIG provides diversification across cyclical and defensive sectors. For instance, Financials and Healthcare each hold significant weight, providing stability amid economic shifts. VIG’s top 10 holdings, accounting for 30.2% of total assets, include both high-growth and dividend-reliable companies, enhancing its resilience during downturns. In contrast, SCHD’s top 10 makes up 41% of its portfolio, increasing concentration risk.

Comparing VIG to SCHD and VOO: A Unique Blend of Growth and Defensive Qualities

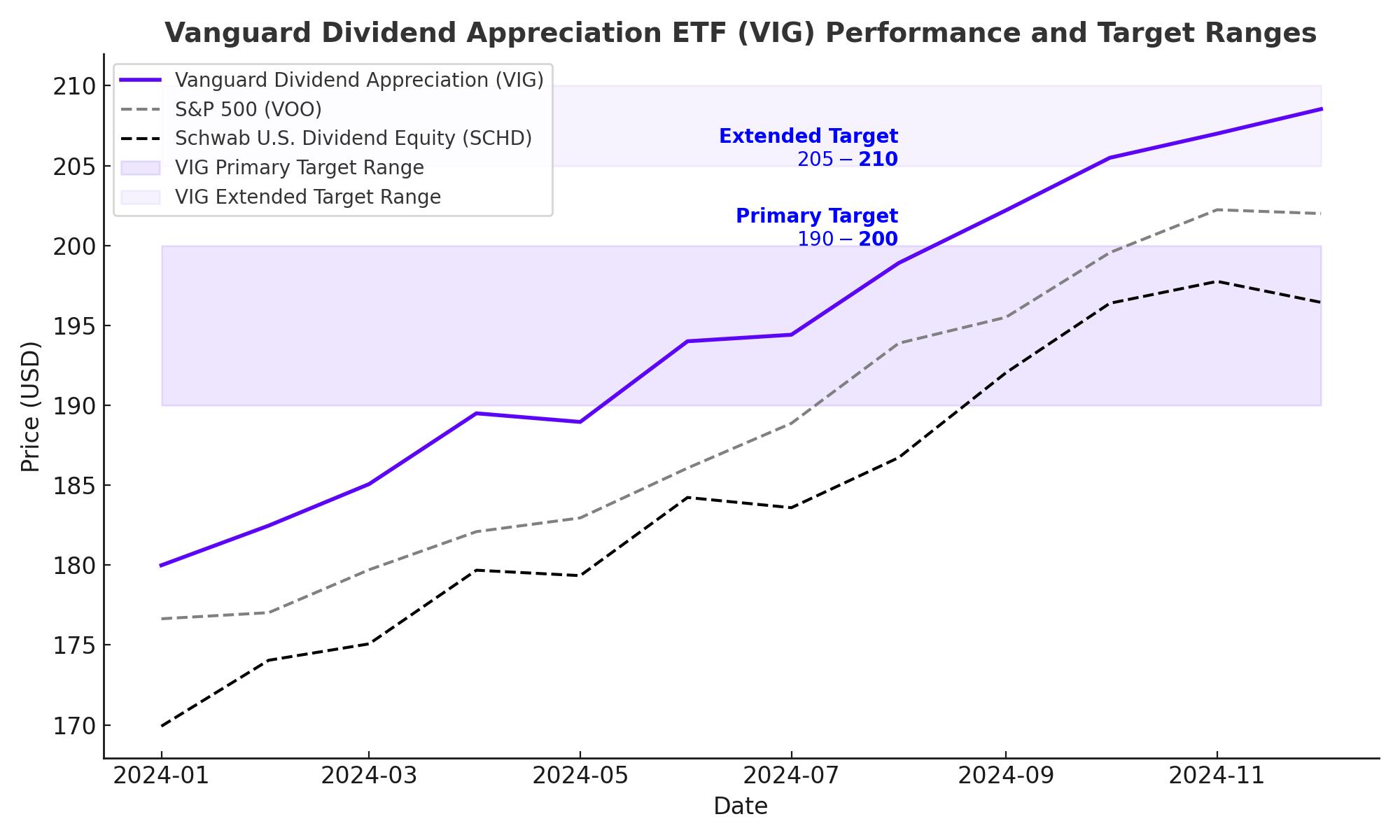

When comparing VIG to SCHD and VOO, a few critical distinctions emerge. VIG’s balanced approach places it in a unique position between growth-focused VOO and income-heavy SCHD. SCHD is appealing for its 3.5% yield and defensive stance, especially in downturns, but its lower tech exposure limits upside potential in bull markets. Meanwhile, VIG’s focus on dividend growth over high yield grants it capital appreciation potential, reflected in its 10-year return of 11.85%, outperforming SCHD’s 11.59% over the same period.

VIG’s tech emphasis, benefiting from trends in AI and software, aligns with a growth outlook, whereas SCHD’s more value-oriented portfolio, including Financials and Industrials, offers stability. VIG’s strategy of excluding the highest yielders helps mitigate the risks of owning potentially distressed companies, as high-yield stocks often indicate financial strain.

NYSEARCA:VIG’s Resilience Against Market Volatility and Economic Pressures

Amid current economic uncertainties, including the U.S. Federal Reserve’s rate decisions, VIG’s portfolio is strategically suited to navigate volatility. As markets adjust to anticipated rate cuts, the potential reduction in Treasury yields could favor VIG, particularly as non-yielding assets like tech stocks may become more attractive. Additionally, VIG’s beta of 0.87, slightly lower than SCHD’s 0.93, suggests a steadier performance during periods of market turbulence.

The Fed’s policy shifts, expected to boost sectors sensitive to interest rates, such as tech, play well into VIG’s strategy. Moreover, global factors like geopolitical tensions in the Middle East and evolving fiscal policies in Europe are expected to increase safe-haven flows into U.S. equities, further supporting dividend growth stocks.

Long-Term Potential: A Strategic Buy for Growth-Driven Investors

With solid momentum indicators, VIG has crossed its $199 target, benefiting from a bullish trend backed by a rising 200-day moving average and robust RSI readings. For long-term investors seeking capital growth through dividend increases, VIG offers a compelling case. Its high liquidity (600,000+ shares traded daily) and low 0.06% expense ratio add to its appeal as a cost-effective, quality ETF choice.

While valuations are elevated with a P/E ratio near 21, VIG’s portfolio remains robust, and its defensive yet growth-oriented nature provides a hedge against inflationary pressures and economic slowdowns. For investors prioritizing dividends with growth potential, VIG’s diversified, large-cap-focused portfolio remains an ideal option.

Technical Analysis: VIG’s Bullish Momentum and Support Levels

On a technical level, NYSEARCA:VIG is positioned well above key moving averages, indicating strong bullish momentum. With its 200-day moving average rising, the ETF reflects a long-term uptrend, while recent price action above the 50-day moving average underscores a positive outlook. The Relative Strength Index (RSI) is also currently in a bullish zone, suggesting that buying interest remains solid, although the ETF might see minor pullbacks, creating potential entry points for long-term investors.

Current support sits around $190, marked by previous highs, which now act as a strong floor. Should VIG experience a minor correction, this level could provide an attractive entry for those looking to capitalize on its dividend growth strategy and robust sector allocation. Resistance around the $200 mark may serve as a near-term target, though the ETF’s underlying strength suggests potential to break through this level in the upcoming months.

Portfolio Outlook and Growth Forecasts

Looking ahead, NYSEARCA:VIG stands to benefit from various macroeconomic factors, particularly as it emphasizes dividend-growing companies across essential industries like tech, healthcare, and financials. The anticipated Federal Reserve interest rate adjustments could further support capital inflows to dividend-focused ETFs like VIG, which tend to attract investors seeking a balance between income and growth in low-yield environments.

Additionally, VIG’s strategic allocation to growth-centric tech companies offers exposure to advancements in sectors such as AI, cybersecurity, and cloud computing, where substantial demand is anticipated over the coming years. This focus on growth, combined with dividend stability, positions VIG well to benefit from increased capital inflows as investors prioritize high-quality stocks.

Dividend Stability and Yield Growth Potential

With its current dividend yield of 1.7% and a five-year growth rate near 40%, VIG has established itself as a reliable income provider. While its yield remains below high-dividend counterparts, the ETF’s emphasis on dividend appreciation supports gradual income increases over time. VIG’s ability to maintain steady dividend growth, particularly through companies with strong cash flows and robust balance sheets, gives it a resilience that can appeal to both growth and income investors.

The ETF’s holdings in reliable dividend growers, such as Procter & Gamble (PG) and Johnson & Johnson (JNJ), provide additional stability, particularly during economic downturns. These stocks bring defensive qualities, balancing the more volatile growth stocks within the tech sector, creating a diversified income stream that benefits investors looking for a combination of growth and safety.

VIG vs. Peers: Why VIG Remains a Top Choice

Comparatively, VIG’s blend of growth and stability sets it apart from other ETFs, particularly those with higher yields but less emphasis on capital appreciation. Competitors like SCHD offer higher yields (around 3.5%) and a more defensive allocation, but VIG’s focused approach on dividend growth makes it more suitable for investors seeking capital gains potential alongside income. This distinction is especially notable in bull markets, where VIG’s tech exposure can lead to stronger performance.

As an alternative to the broader market ETF VOO, which focuses on overall market performance, VIG’s emphasis on dividend growers provides a strategic advantage for investors prioritizing quality and consistency. For those already holding growth-heavy funds, VIG serves as an effective complement by reducing overall portfolio volatility while offering growth potential through dividend compounding.

Final Take: Buy, Hold, or Sell?

Considering the technical indicators, insider sentiment, and VIG’s sector-focused approach, NYSEARCA:VIG presents a strong case as a Buy for long-term investors. Its diversified, high-quality portfolio is well-suited to withstand economic fluctuations, offering both stability and growth. Investors focused on dividend appreciation and moderate income should find VIG’s blend of growth and defensive holdings appealing, while those looking for direct growth exposure, particularly in tech, will appreciate VIG’s forward-looking allocations.

For a deeper dive into VIG’s current price and performance updates, check the real-time chart. This ETF remains one of the best choices for those seeking to capture both dividend growth and robust sector diversification, making it a valuable addition to any long-term, growth-oriented portfolio.