Amazon (NASDAQ:AMZN) has demonstrated a remarkable recovery from the tech sector downturn of 2022. After experiencing a 50% drop in its stock price during that challenging year, the company's shares have surged by 123% since January 1, 2023, and now stand 17% higher than at the beginning of 2022. This rebound underscores Amazon's resilience and effective strategic adjustments.

Financial Performance and Key Metrics

Market Cap: $2.01 trillion Current Price: $193.25 52-Week Range: $118.35 - $199.84 Volume: 76,930,192 Gross Margin: 47.59% PE Ratio: 54.13 Forward PEG Ratio: 1.87

Amazon’s financial performance has been bolstered by its robust retail segments, which constitute over 80% of its net sales. In Q1 2024, Amazon reported a 13% year-over-year increase in revenue to $143 billion, surpassing Wall Street’s consensus estimate by $750 million. Notably, the North America segment grew by 12%, and the international segment by 10%, reflecting strong consumer demand and effective business strategies.

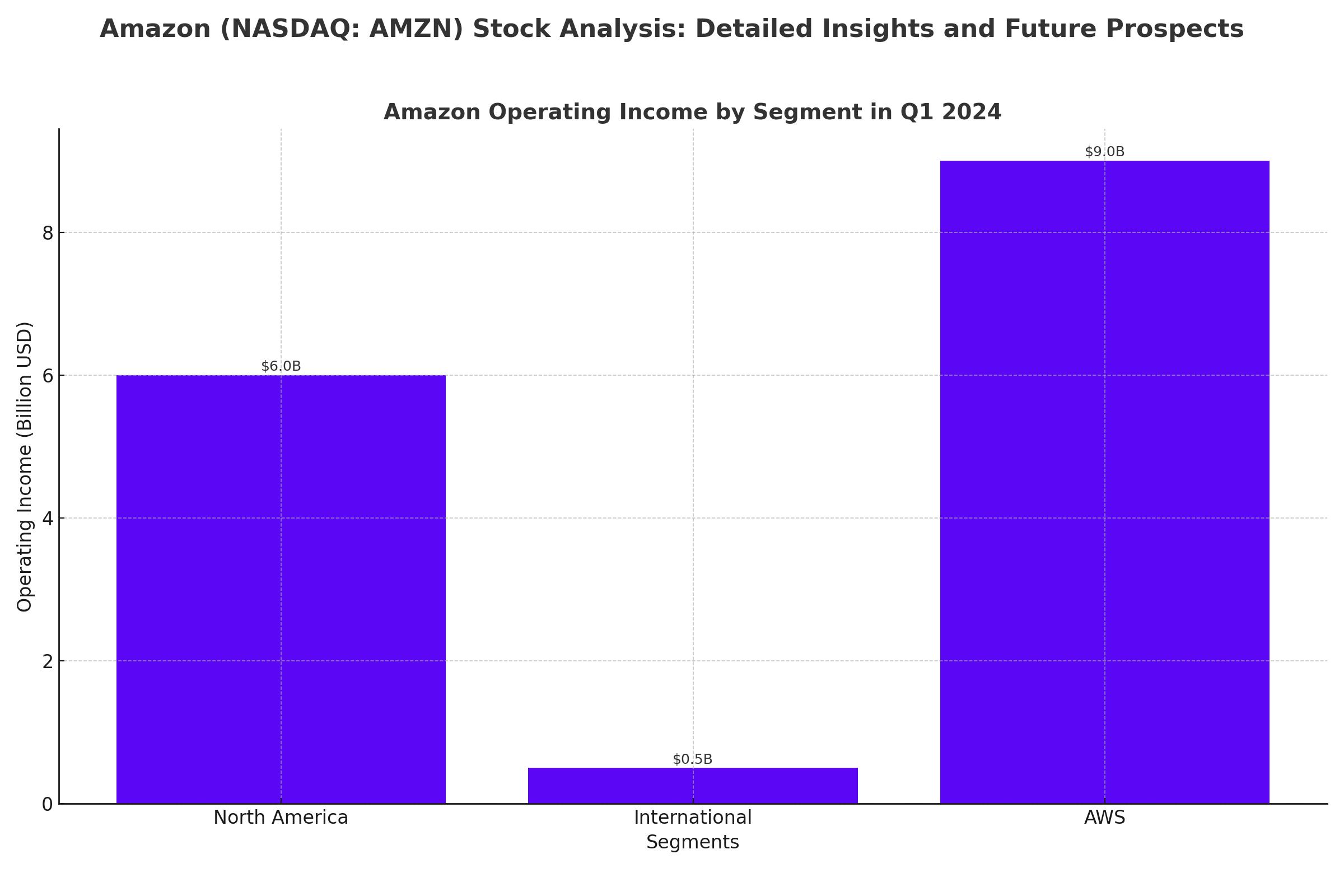

Operating Income Highlights

- North America and International Segments: Combined operating income of $6 billion in Q1 2024, a significant improvement from a $349 million loss in the prior-year period.

Digital Advertising and New Revenue Streams

Amazon's foray into digital advertising, particularly through Prime Video, has significantly boosted its revenue. In Q1 2024, advertising services revenue spiked by 25% year-over-year. This segment is poised for sustained growth, with the digital advertising market projected to reach $740 billion in 2024.

Prime Video's Market Position:

- Market Share: 22%, ahead of Netflix (21%) and Warner Bros. Discovery's Max (14%).

- Ad Pricing: Competitive rates at $30-$35 per 1,000 impressions.

AI and Cloud Computing Leadership

Amazon Web Services (AWS) remains a cornerstone of Amazon's profitability and growth. In Q1 2024, AWS's operating income nearly doubled year-over-year to $9 billion, representing over 60% of the company's total operating income. AWS continues to dominate with a 31% market share in cloud infrastructure.

AI Investments:

- AI Tools and Data Centers: Significant investments in AI tools and global data centers.

- AI Processors: Venture into chip design to enhance AI capabilities.

Stock Valuation and Analyst Ratings

Despite its growth, Amazon's stock remains attractively valued. The company's price-to-sales ratio of around 3 indicates a bargain compared to competitors. Analysts are overwhelmingly bullish, with 43 buy ratings and an average price target of $221.68, suggesting a 15% upside potential.

Insider Transactions and Institutional Holdings

Amazon's insider transactions and institutional holdings reflect strong confidence in the company's future. Recent transactions and positions indicate strategic investments and portfolio adjustments by key stakeholders.

Insider Transactions:

- Douglas J. Herrington: Sold 3,500 shares at an average price of $177.29.

- Shelley Reynolds: Sold 2,700 shares at an average price of $181.39.

Richelieu Gestion SA

Richelieu Gestion SA reduced its position in Amazon by 12.9% during the first quarter of 2024. Despite selling 4,191 shares, the firm still holds 28,293 shares of the e-commerce giant. Amazon comprises about 5.2% of Richelieu Gestion SA’s portfolio, making it the second-largest position in their holdings. The total value of Richelieu Gestion SA’s investment in Amazon was $5,103,000 at the end of the most recent reporting period.

Cooksen Wealth LLC

Cooksen Wealth LLC established a new stake in Amazon during the fourth quarter, reflecting a strategic move to gain exposure to the tech giant.

E Fund Management Hong Kong Co. Ltd.

E Fund Management Hong Kong Co. Ltd. significantly increased its position in Amazon by 45% in the fourth quarter. The firm now owns 277 shares of Amazon’s stock, up from 191 shares, highlighting growing confidence in Amazon’s market potential.

Strid Group LLC

Strid Group LLC entered into a new position in Amazon during the fourth quarter, showing an aggressive approach to investing in high-growth technology stocks.

Clarity Asset Management Inc.

Clarity Asset Management Inc. purchased new shares of Amazon during the fourth quarter, indicating a strategic addition to their portfolio aimed at capitalizing on Amazon's market dominance and growth prospects.

Institutional Ownership

Overall, institutional investors own 72.20% of Amazon's stock. This high level of institutional ownership indicates strong confidence among large investors in Amazon's long-term growth trajectory and financial health. The diverse array of institutional stakeholders, from wealth management firms to asset management companies, underscores the broad-based appeal and robust investment case that Amazon presents.

Financial Projections and Market Expectations

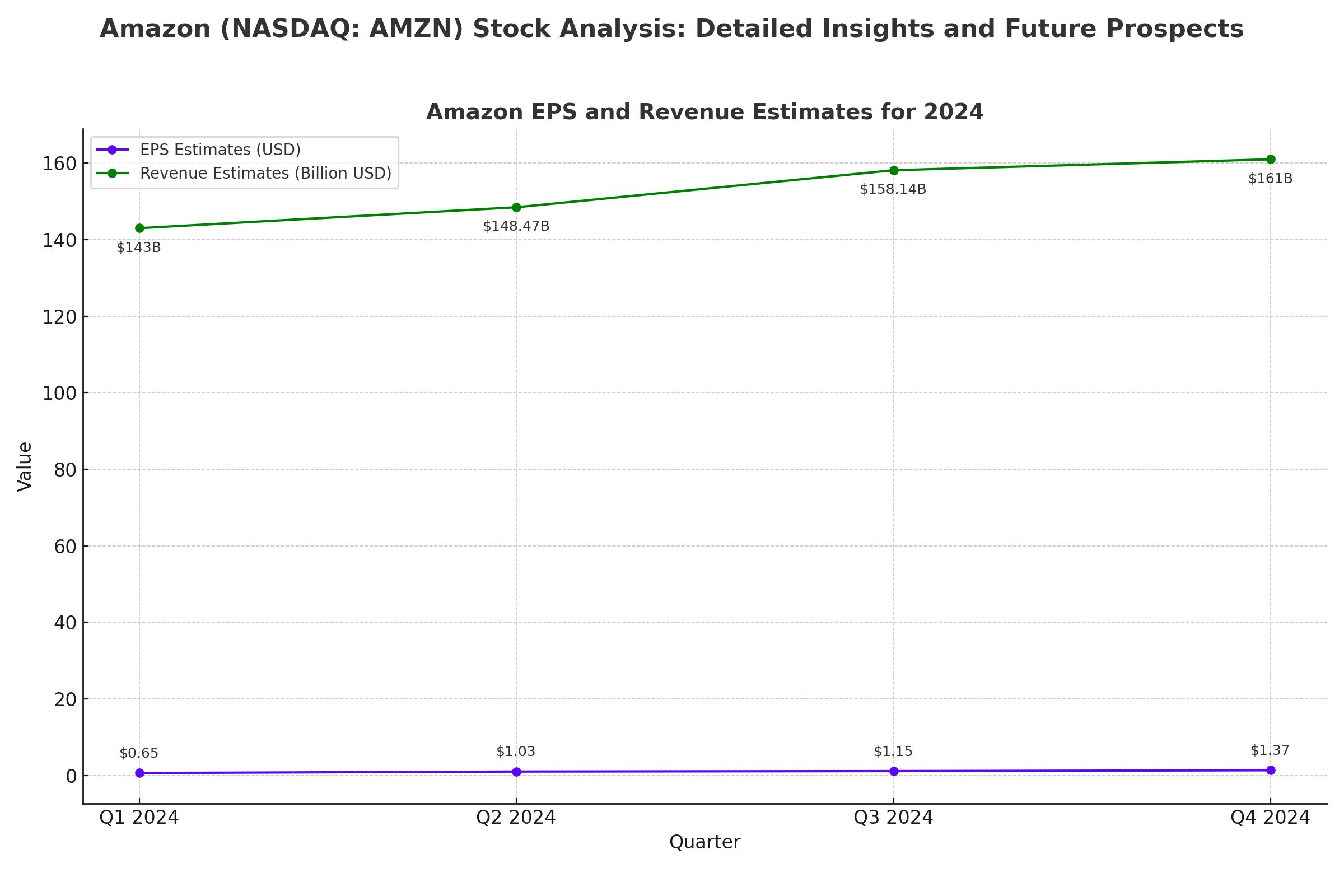

Amazon’s financial projections for the upcoming quarters and years reflect robust growth expectations. Analysts anticipate substantial increases in EPS and revenue, driven by strong performance across all segments and strategic initiatives in AI and digital advertising.

Earnings and Revenue Estimates:

- Q2 2024 EPS: Expected to rise to $1.03 from $0.65 in the prior-year quarter.

- 2024 Revenue: Projected to reach $638.38 billion, growing by 11.1% year-over-year.

Analyst Ratings and Price Targets:

- Goldman Sachs: Increased price target to $225.

- Wells Fargo: Price target raised to $239, reaffirming a buy rating.

- JPMorgan: Price target of $240, highlighting Amazon’s potential to outpace Walmart as the largest U.S. retailer.

Strategic Shifts and Cost Management

Under CEO Andy Jassy, Amazon has shifted focus to higher-margin services and away from first-party retail sales. This strategic shift, combined with significant cost-cutting measures, has enhanced profitability. Amazon's operating margins have improved markedly across all segments.

Operating Margin Improvements:

- North America: Increased from 1.20% to 5.8%.

- International Segment: Improved from -4% to 2.8%.

- AWS: Rose from 24% to 37%, partly due to changes in the estimated useful life of their servers.

AWS’s Open Source Models Opportunity

AWS's support for open-source models positions it favorably against competitors like Microsoft’s Azure and Alphabet’s Google Cloud. Enterprises are increasingly leaning towards open-source models, which could benefit AWS due to its flexibility and scalability.

Amazon’s Valuation Amid Growth Trends

Amazon trades at a forward P/E ratio of 43x, higher than its cloud rivals Microsoft and Alphabet. However, considering Amazon’s forward EPS long-term growth rate of 23.4%, the forward PEG ratio of 1.87 looks notably attractive.

Institutional Investor Confidence

Institutional investors continue to show confidence in Amazon. Richelieu Gestion SA, despite reducing its position, still holds significant shares. Other institutional investors have also increased their stakes, reflecting strategic interest in Amazon’s long-term potential.

Market Dynamics and Analyst Consensus

The broader market dynamics indicate a strong performance for Amazon. The company’s ability to navigate economic headwinds, combined with strategic investments in high-growth areas, supports a positive outlook.

Current Quarter (Jun 2024):

- Avg. Estimate: $1.02 EPS on $148.47 billion revenue.

- High Estimate: $1.19 EPS on $150.49 billion revenue.

- Low Estimate: $0.78 EPS on $146.5 billion revenue.

Next Quarter (Sep 2024):

- Avg. Estimate: $1.15 EPS on $158.14 billion revenue.

- High Estimate: $1.37 EPS on $161 billion revenue.

- Low Estimate: $0.8 EPS on $153.46 billion revenue.

Broader Market Trends and AI Integration

Amazon's integration of AI technologies across its platforms, particularly in AWS, positions it for continued leadership in the tech industry. The company’s AI-driven growth strategies are expected to enhance its competitive edge and drive long-term profitability.

Conclusion

Amazon (NASDAQ:AMZN) continues to exhibit robust growth and resilience, driven by its diversified business model and strategic investments in high-growth areas like AI and digital advertising. With strong financial performance, attractive valuation, and bullish analyst ratings, Amazon remains a compelling investment for long-term growth. Investors should monitor the company’s progress in AI integration and market expansion to capitalize on its future potential.

Thta's TradingNEWS