Advanced Micro Devices (NASDAQ: AMD): A Comprehensive Breakdown of Market Performance and Strategic Growth

Unstoppable Momentum in Data Centers

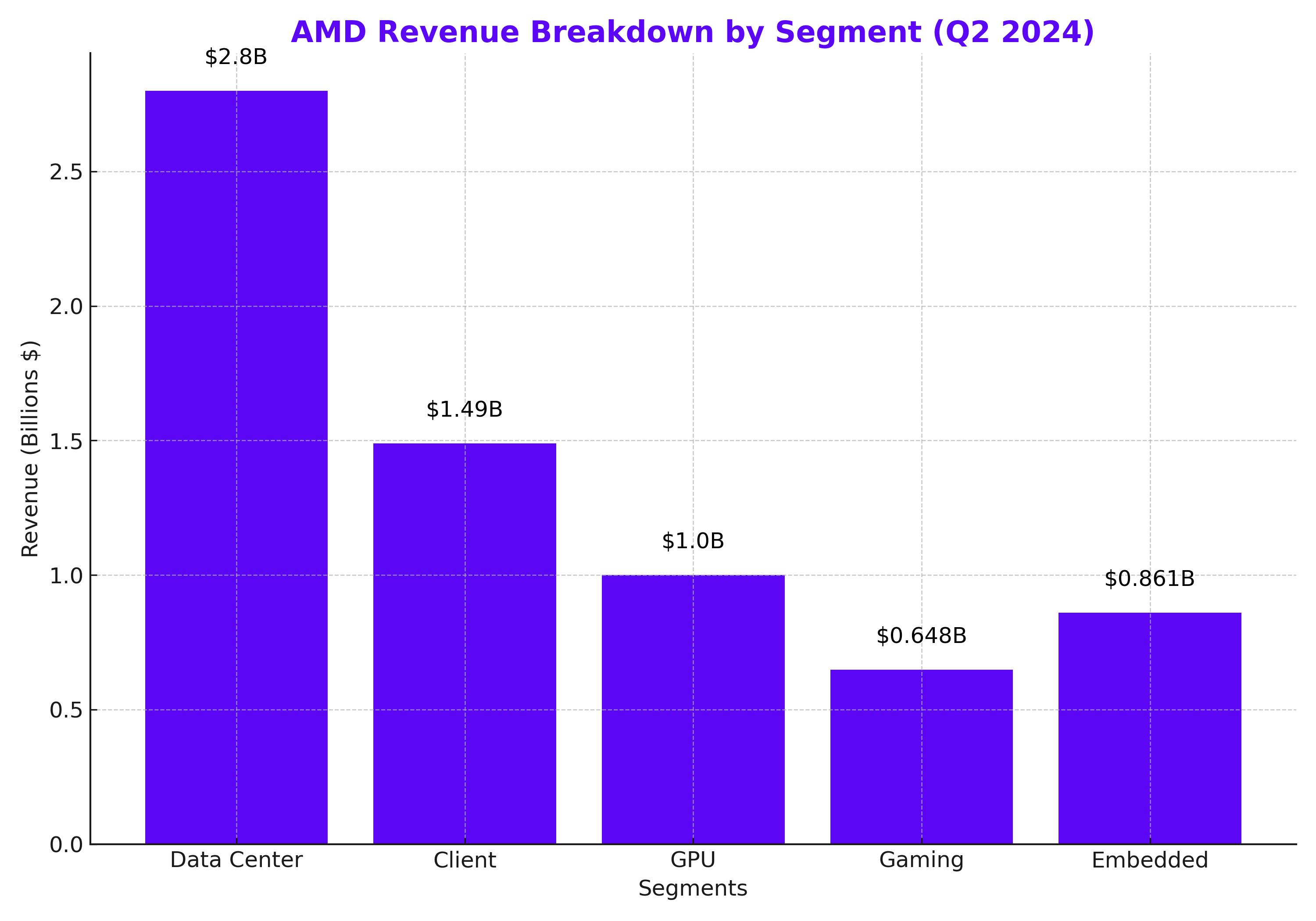

AMD (NASDAQ: AMD) has been shaking up the semiconductor industry, particularly in the data center space, where the company is making a big impact. The real star of the show in Q2 2024 was AMD’s Data Center segment, which posted an impressive 115% year-over-year (YoY) revenue growth, soaring to $2.8 billion. This number is not just a reflection of solid execution but a testament to how much AMD has become a key player in AI and cloud computing. The growth wasn’t just incremental—it was 21% higher compared to the prior quarter, with revenue surpassing all expectations, including our conservative estimate of $2.6 billion.

This surge is largely due to the robust demand for AMD’s Instinct MI300 AI accelerators and the company’s highly regarded EPYC processors. Major contracts were closed with industry titans like Adobe, Netflix, Uber, and Siemens, which are leveraging AMD’s solutions for critical workloads. A telling statistic: Over one-third of AMD’s server processor shipments in the first half of 2024 went to new customers, showing that AMD isn’t just expanding its relationship with current clients—it’s pulling in fresh, big-name accounts.

Looking ahead, the launch of the 5th-generation EPYC processors (Turin) has already begun, and the enthusiasm from the market is clear. With cloud customers, including the likes of Netflix and Adobe, already integrating these chips, AMD is poised to capture more market share as demand for powerful data center solutions grows. For 2024, AMD has raised its revenue guidance for the Data Center segment to $12.8 billion, a significant jump from the previous projection of $11.8 billion.

GPUs Lead the AI Charge

On the GPU front, AMD’s Instinct MI300 has been a game changer. For the first time, the company surpassed $1 billion in revenue from its GPU business in Q2 2024 alone. What’s remarkable here is the context: Competitor NVIDIA has delayed shipments of its Blackwell chips, leaving AMD with an open runway to capitalize on the current demand for AI accelerators.

This momentum has prompted AMD to raise its 2024 guidance for GPU revenue from $4 billion to $4.5 billion, driven by a robust pipeline and consistent demand. The roadmap for future releases, extending through 2026, has been solidified, offering clarity and confidence to investors. With MI300 already seeing strong traction, the anticipation for MI325X and other upcoming chips is high. AMD’s ability to maintain a competitive edge, while its closest rival struggles with delays, underscores the company’s execution prowess.

Ryzen Processors Keep Client Segment Buoyant

The Client segment, driven by AMD’s Ryzen processors, continues to perform beyond expectations. Q2 2024 revenue hit $1.49 billion, marking a 49% YoY growth and outperforming the projected $1.37 billion. Demand for the Zen 5 architecture, known for its energy efficiency and high performance, is pushing AMD to the forefront of the PC market.

This is a segment that continues to show signs of strength. Independent benchmarks from Phoronix revealed that Ryzen 5 9600X and Ryzen 7 9700X, built on the new Zen 5 architecture, outperform competing Intel chips while maintaining lower prices. With the PC market showing signs of recovery, and global shipments on the rise, AMD’s leadership in the space is likely to continue. For Q3 2024, AMD is projecting Client segment revenue to increase further to $1.65 billion.

Gaming Segment Under Pressure, But With Potential Catalysts

While AMD’s Data Center and Client segments are seeing rapid growth, the Gaming segment remains a concern. Revenue in Q2 2024 slumped to $648 million, down a sharp 59% YoY. The weakness here is largely driven by a slowdown in console sales, particularly from Sony’s PlayStation 5 and Microsoft’s Xbox Series X/S, both of which are nearing the end of their product life cycles.

Sony revised its fiscal 2025 sales forecast for the PS5 down to 18 million units from 21 million, signaling weaker demand. Additionally, Xbox sales are faltering as Microsoft contends with stiff competition in key markets. Despite the ongoing decline, there’s a potential upside on the horizon: anticipated releases like GTA 6 in 2025 could drive a late-cycle surge in demand for gaming consoles.

However, the larger issue stems from the growing shift toward cross-platform gaming, which is reducing the emphasis on dedicated gaming hardware. Given this reality, AMD’s Gaming segment is expected to remain under pressure, with Q3 2024 revenue forecasted to dip further to $602 million.

Embedded Segment Shows Glimmers of Recovery

The Embedded segment delivered $861 million in revenue in Q2 2024, a 41% decline YoY but a slight improvement from the previous quarter’s $842 million. AMD is cautiously optimistic about this segment, citing early signs of recovery in order volumes. For Q3 2024, the company expects revenue to hit $887 million as demand in this segment stabilizes.

Financial Outlook: Raised Targets Amid Growing Confidence

AMD’s overall financial performance is reflecting the company’s strategic dominance in high-growth markets like AI and data centers. The company has increased its full-year 2024 revenue guidance to $25.5 billion, up from the previous estimate of $25.3 billion, representing 12% YoY growth. For 2025, AMD has raised its forecast to $36.3 billion, driven by expected continued growth in its core Data Center and Client segments.

The EBITDA forecast has also been bumped up to $4.9 billion for 2024, an impressive 27% YoY increase, with expectations for 2025 at $9.78 billion. These numbers highlight AMD’s operational efficiency, particularly in managing supply chains and ramping up production of high-demand products like MI300.

The company's operating margin has improved from 5.5% to 6.7% in 2024, with no expected changes for 2025 despite rising component costs, such as TSMC’s anticipated price hikes. Additionally, AMD’s free cash flow is projected to hit $1.6 billion in 2024, a 43% increase YoY, and balloon to $6.75 billion in 2025 as its core segments continue to drive growth.

Mergers & Acquisitions: Expanding into AI and Data Center Infrastructure

AMD is making bold moves in the M&A space to secure its future in AI. The acquisition of Silo AI, a Finnish AI startup, for $665 million is the largest European deal in a decade. This acquisition positions AMD to leverage Silo AI’s expertise in enterprise AI applications, targeting clients like Allianz, Ericsson, and Nokia.

AMD is also pushing deeper into data center infrastructure with its $4.9 billion acquisition of ZT Systems, a leader in computing infrastructure. This acquisition, expected to close by mid-2025, further solidifies AMD’s position in the AI and data center markets, putting it head-to-head with NVIDIA and Intel in a competitive race for dominance in the server market.

Valuation and Final Thoughts

AMD’s stock currently trades at around 43x forward earnings, which aligns with the broader semiconductor industry. The company’s price-to-earnings growth ratio (PEG) of 1.01x suggests that the stock is fairly valued relative to its growth potential. This valuation looks particularly attractive considering AMD’s strong momentum in AI, data centers, and client markets.

AMD’s performance in the AI race, particularly with its MI300 AI accelerators and EPYC processors, positions the company for sustained growth. While there are challenges in the Gaming and Embedded segments, AMD’s leadership in AI and data centers, along with its strategic acquisitions, make the stock a compelling BUY at this point. The raised price target of $192 reflects the confidence in AMD’s ability to continue executing at a high level.