Marvell Technology (NASDAQ:MRVL): Redefining AI Infrastructure with Custom Silicon

How Marvell’s AI-Focused Strategy and Strategic AWS Partnership Drive Unprecedented Growth | That's TradingNEWS

Marvell Technology Inc. (NASDAQ:MRVL): Capitalizing on AI Growth and Custom Silicon Innovations

Marvell Technology Inc. (NASDAQ:MRVL) is rapidly establishing itself as a pivotal player in the AI computing and data center markets, riding on a strong foundation of strategic partnerships, robust revenue growth, and an ambitious restructuring plan. At its core, Marvell is not merely participating in the AI revolution; it is building the technological backbone that enables hyperscale operations for major players like Amazon AWS. The company's data center business, now comprising 73% of its total revenue, underscores its transformation into a leading AI infrastructure provider.

Redefining Focus Through Strategic Restructuring

Marvell's Q3 FY25 marked a turning point with a $715.1 million restructuring charge aimed at streamlining its focus on high-growth markets such as custom silicon and AI infrastructure. This pivot entailed divestment from legacy enterprise and carrier product portfolios, allowing the company to reallocate resources to data center technologies. Key investments include advancements in electrical and optical SerDes, die-to-die interconnects, silicon photonics, and packaging technologies. This restructuring not only positions Marvell to scale efficiently but also sets the stage for operational leverage and profitability, with GAAP profitability expected to resume in Q4 FY25.

The company’s aggressive push into AI-specific custom silicon solutions reflects its strategic vision. With demand for AI inferencing accelerators ramping up, Marvell is poised to capture market share in a rapidly expanding segment. The shift toward scalable, high-margin products promises a durable revenue stream for the years ahead.

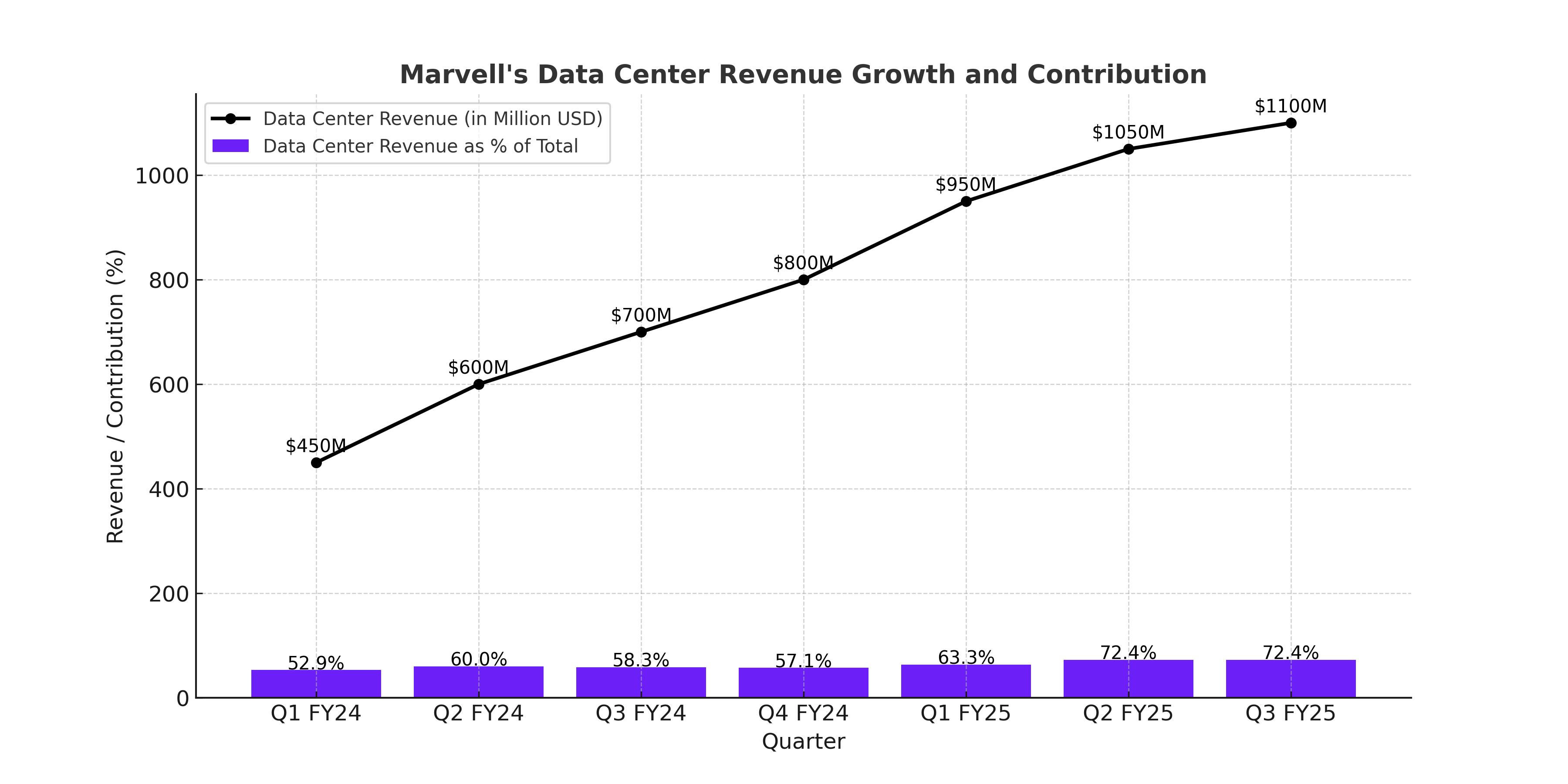

Data Center Dominance Drives Revenue Surge

Marvell's Q3 FY25 results highlighted a 98% year-over-year increase in data center revenue, accounting for $1.1 billion of its $1.52 billion in total revenue. This remarkable growth was driven by robust demand for custom silicon and optical DSP products tailored for AI workloads. The company’s partnership with Amazon AWS has been instrumental in this success, encompassing a broad range of products including AI accelerators, Ethernet switching silicon, and optical interconnects. The five-year agreement with AWS underscores Marvell’s critical role in enabling hyperscale AI operations, particularly with products like Trainium2 and Inferentia chips.

The accelerating adoption of Marvell’s 800G PAM DSPs and the introduction of its 1.6T PAM DSP with 5nm process technology further bolster its position. These innovations address the growing demand for high-performance, energy-efficient data center solutions. The planned rollout of a 3nm 1.6T DSP featuring 200G/lane electrical and optical interfaces in 2025 underscores Marvell’s commitment to staying ahead in a fiercely competitive market.

Commercial Partnerships and Product Innovation

Marvell's partnerships extend beyond AWS, reflecting its broader strategy to serve a diverse customer base in the AI and networking sectors. The company has capitalized on its engineering expertise and extensive intellectual property portfolio to deliver solutions that cater to the unique demands of hyperscale data centers. This approach has resonated with customers seeking alternatives to Nvidia's dominance in AI GPUs, positioning Marvell as a key enabler of differentiated AI infrastructures.

The ramp-up of advanced active electrical cable DSPs, PCIe retimers, and interconnect optical modules further diversifies Marvell’s product offerings. These technologies are critical for optimizing the performance and scalability of AI and machine learning workloads. The company’s ability to innovate at the cutting edge of data center technology ensures its relevance in an industry undergoing rapid transformation.

Financial Highlights and Market Performance

Marvell reported adjusted EPS of $0.43 in Q3 FY25, exceeding market expectations, and issued strong guidance for Q4, with projected revenue growth of 26% year-over-year. The company expects Q4 revenue to range between $1.71 billion and $1.89 billion, supported by a ramp-up in custom silicon production and increased adoption of Ethernet switches and interconnects. Gross margins are expected to remain stable at around 60%, reflecting the profitability of its data center-focused product mix.

The company's balance sheet is robust, with $868 million in cash and a manageable net debt-to-adjusted EBITDA ratio of 1.76x. Inventory levels rose to $859 million in Q3, driven by growing demand for custom silicon products, but days of inventory outstanding decreased to 96.6 days, indicating efficient supply chain management.

Marvell has demonstrated its commitment to shareholder value through $500 million in stock buybacks year-to-date, with $200 million executed in Q3 alone. The company also maintains a modest dividend policy, reinforcing its appeal to both growth-oriented and income-focused investors.

Valuation: Balancing Premium Multiples with High Growth

Marvell’s current valuation reflects its status as a high-growth AI infrastructure provider. The stock trades at a forward price-to-sales ratio of 15x and an EV/EBITDA multiple of 83.2x, comparable to industry leader Nvidia. While these multiples are elevated, they are justified by Marvell’s 98% year-over-year growth in its data center business and its aggressive expansion into high-margin AI markets.

Analysts project significant revenue growth for Marvell, with overall revenue expected to increase by 38% from FY26 to FY27. The company’s focus on operational efficiency, including a planned reduction in stock-based compensation as a percentage of revenue, is expected to drive margin expansion. A discounted cash flow analysis suggests a one-year target price of $159 per share, reflecting a compelling upside from current levels.

Institutional Backing and Insider Transactions

Institutional investors hold an 86% stake in Marvell, underscoring the company’s credibility in the investment community. Major shareholders include FMR LLC (15%), The Vanguard Group (8.6%), and BlackRock (7.1%). While insider transactions have been limited, they are worth monitoring for potential signals of confidence or concern. For real-time insights into insider activity, visit Marvell Insider Transactions.

Risks and Considerations

Marvell Technology Inc. (NASDAQ:MRVL) faces several key challenges that could influence its growth trajectory. Delays in custom silicon production, a cornerstone of its AI and data center strategy, pose a risk to meeting growing demand and could impact revenue projections. Additionally, custom silicon, while driving sales, comes with higher production costs, potentially compressing gross margins, which stood at 60.5% on a non-GAAP basis in Q3 FY25 but are sensitive to product mix and production efficiencies.

Competition in the semiconductor industry remains fierce, particularly from Broadcom (NASDAQ:AVGO), which has significant contracts with industry leaders such as Google and Meta, directly challenging Marvell’s market share in AI infrastructure. Furthermore, Marvell's reliance on major clients, including AWS, which accounts for a significant portion of its custom silicon sales, introduces revenue concentration risks. If AWS were to shift focus or reallocate its semiconductor needs, Marvell could face a material impact on its financials.

Macroeconomic pressures, such as tightening enterprise technology budgets and potential reductions in hyperscaler spending, could also dampen Marvell’s growth momentum. These factors may slow adoption rates for its advanced interconnect solutions and AI-focused products, further complicating its near-term outlook. Investors should remain vigilant about these risks as Marvell navigates an intensely competitive and rapidly evolving industry landscape.

Conclusion: A Leader in AI Infrastructure

Marvell Technology Inc. (NASDAQ:MRVL) has cemented its position as a frontrunner in AI and data center innovation, leveraging a sophisticated portfolio of custom silicon solutions and strategic partnerships. At a current price of $89 per share, the stock reflects a robust 98% year-over-year growth in its data center segment, now representing 73% of total revenue. The recent five-year agreement with Amazon AWS for custom AI accelerators, optical interconnects, and Ethernet switching silicon highlights Marvell’s critical role in enabling hyperscale AI computing.

While valuation concerns linger, with Marvell trading at a forward price-to-sales multiple of 15x, its growth narrative justifies the premium. The company’s revenue guidance for Q4 FY25 projects a 26% year-over-year increase, driven by continued demand for AI-focused products. Furthermore, Marvell’s operational efficiency, highlighted by its record 60% adjusted gross margin and robust free cash flow generation, strengthens its long-term investment appeal.

Marvell's ability to innovate, coupled with its financial resilience, makes it a compelling opportunity for investors seeking exposure to the expanding AI and data center markets. Although risks such as competition and revenue concentration exist, the company’s leadership in custom silicon and its expanding addressable market position it for sustained growth. For real-time updates, explore Marvell’s Stock Chart.