Bitcoin (BTC-USD) Price Outlook: Will BTC Surge Past $109K or Collapse Below $90K?

Federal Reserve Rate Decision and Its Impact on Bitcoin (BTC-USD)

Bitcoin is trading around $102,800, recovering slightly after four consecutive days of decline. Market volatility remains elevated as traders brace for the Federal Reserve’s interest rate decision, which could dictate the next major move for BTC-USD. While no rate cut is expected, Fed Chair Jerome Powell’s tone will be critical—if he signals prolonged high rates, Bitcoin could come under pressure. Conversely, if Powell hints at future rate cuts, BTC could gain bullish momentum.

Trump’s push for lower interest rates has created uncertainty. If the Fed resists political pressure and maintains a hawkish stance, Bitcoin could struggle as higher rates reduce liquidity for risk assets. On the other hand, a dovish shift could provide a catalyst for Bitcoin to rally back toward $109,000.

Nvidia’s Crash and Its Unexpected Impact on Bitcoin

The collapse of Nvidia’s stock (NASDAQ: NVDA) this week, triggered by fears of DeepSeek AI’s emergence as a competitor, has rippled into the crypto markets. The Nasdaq dropped 3%, Nvidia fell 17%, and Bitcoin followed with a 2.6% decline.

A growing correlation between BTC and U.S. equities means that Bitcoin is no longer immune to stock market movements. Traders moved to de-risk, with CME Bitcoin Futures open interest dropping by 17,225 BTC—the largest daily decline since August 2023. Bitcoin ETP flows also saw net weekly outflows of 6,900 BTC as risk sentiment turned bearish.

Bitcoin’s Technical Analysis: Will BTC Hold Above $100K or Break Down?

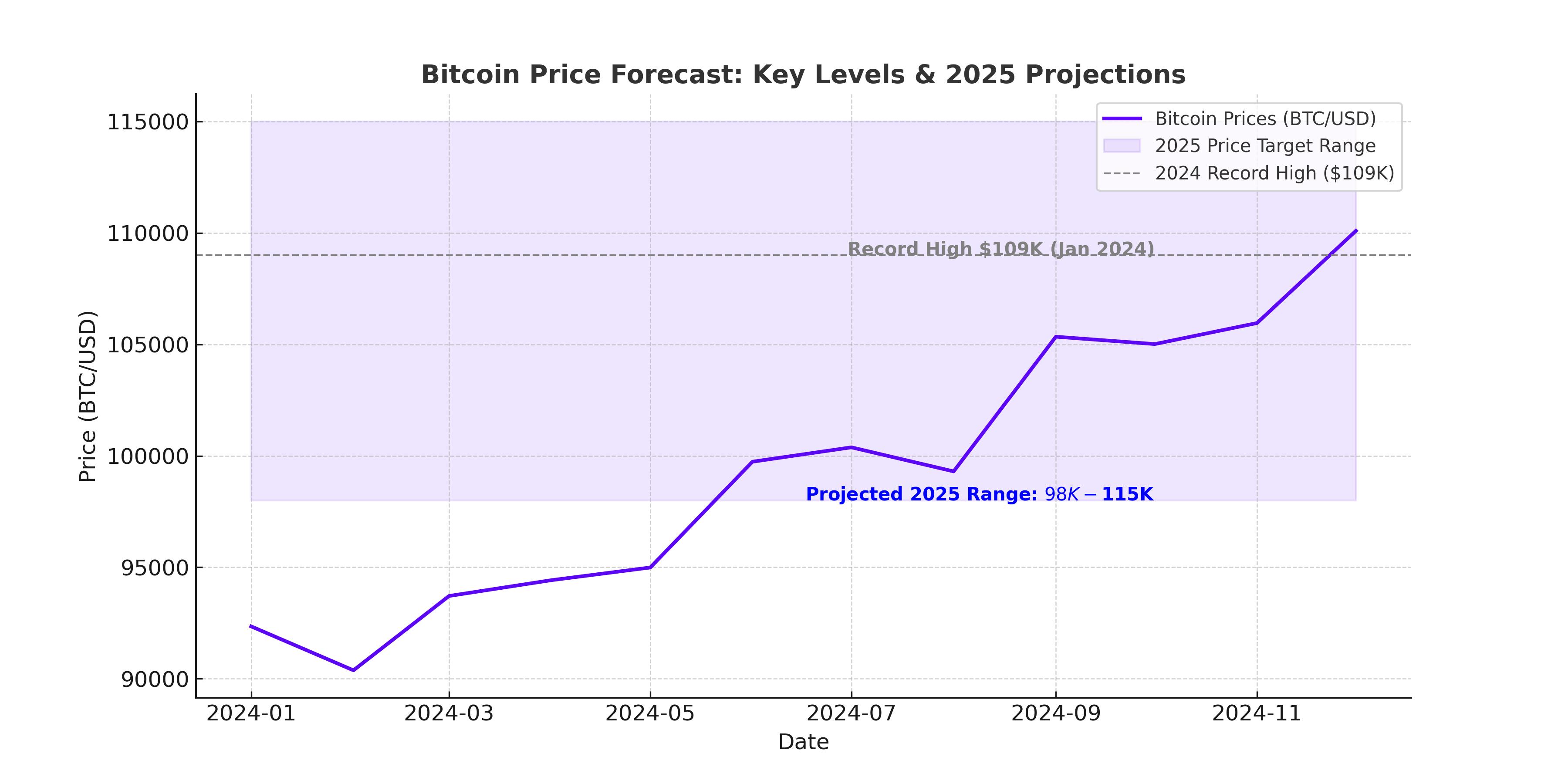

Bitcoin dipped to $98,223, testing its 50-day Exponential Moving Average (EMA), before rebounding above $102,000. The Relative Strength Index (RSI) stands at 55, showing mild bullish momentum, but the MACD indicator has flipped to a bearish crossover, signaling downside risks.

If BTC breaks below $100,000 and closes below its 50-day EMA, a decline toward $90,000 is likely. The key support zone sits at $88,913, where BTC has bounced before. A break below this level could trigger panic selling, pushing prices toward $85,000.

On the upside, if Bitcoin holds above $102,800 and regains momentum, it could retest its all-time high of $109,588. A decisive break above $109K would clear the path for $115,000, with long-term targets stretching toward $150,000 as some analysts predict.

Bitcoin ETF Flows: A Green Trading Day Amid Market Turbulence

Despite broader market weakness, Bitcoin ETFs showed modest inflows of $18.44 million. BlackRock’s IBIT led with $30.14 million in inflows, while ARK and 21Shares’ ARKB saw $11.7 million in outflows.

Bitcoin ETF net assets now total $118.62 billion, with an ETF market share of 5.91% of Bitcoin’s total market cap. Institutional demand remains strong, but investors remain cautious as the market navigates economic uncertainty.

Bitcoin's Long-Term Outlook: Will BTC-USD Reach $150K?

Crypto analysts are split on Bitcoin’s trajectory. Some expect a major rally, with Standard Chartered’s Geoffrey Kendrick predicting BTC could hit $150K—particularly if Trump’s pro-Bitcoin policies gain traction. The recent executive order establishing a national crypto stockpile has fueled speculation that the U.S. government may accumulate BTC as a strategic reserve asset.

Meanwhile, Czech National Bank Governor Aleš Michl is proposing to allocate 5% of the nation’s reserves to Bitcoin, marking a potential breakthrough in central bank crypto adoption. If approved, this move could trigger further institutional demand, bolstering Bitcoin’s long-term price outlook.

Final Verdict: Is Bitcoin a Buy, Sell, or Hold?

Bitcoin remains in a high-risk, high-reward zone. If BTC-USD holds above $100,000, it has a strong chance to rally toward $109K and beyond. However, a break below $98K would signal weakness, with downside targets at $90K and $88K.

For long-term investors, Bitcoin remains a BUY, especially if institutional accumulation continues. Short-term traders, however, should exercise caution as the market digests Fed policy signals and broader macroeconomic developments.