Record Highs for MicroStrategy as Bitcoin Hits New Milestones

MicroStrategy (NASDAQ:MSTR) has achieved an all-time high in its stock price, closing above $351—a level not seen since the heights of the dot-com bubble in 2000. This historic surge aligns with Bitcoin’s unprecedented price rally, which recently breached $88,000, fueled by renewed optimism following Donald Trump’s re-election and his pro-crypto stance. Year-to-date, MSTR stock has risen nearly 396%, driven by Bitcoin’s growth trajectory, reflecting MicroStrategy’s unique position as the largest corporate holder of Bitcoin worldwide. This explosive correlation between MicroStrategy's stock and Bitcoin’s rise signals an extraordinary opportunity for further growth.

Bitcoin as the Core of MicroStrategy’s “42 Strategy” and Institutional Dominance

Michael Saylor’s bold leadership has driven MicroStrategy to pivot from traditional enterprise software to a powerful Bitcoin-centric strategy. The recently unveiled “42 Strategy” outlines an ambitious plan to purchase $42 billion worth of Bitcoin by 2027, reinforcing MicroStrategy’s transformation into a “Bitcoin finance company.” This plan, alongside a new Bitcoin purchase of 27,200 BTC valued at $2.03 billion, brings MicroStrategy’s total holdings to 279,420 BTC—worth an astounding $24 billion at current prices. By consistently increasing its Bitcoin reserves, MicroStrategy has not only cemented itself as a corporate leader in Bitcoin holdings but also gained the market's attention as a proxy for institutional Bitcoin investment. This strategy is rooted in Saylor’s vision to utilize Bitcoin as a hedge against inflation, effectively transforming MicroStrategy into a leveraged bet on Bitcoin’s price trajectory.

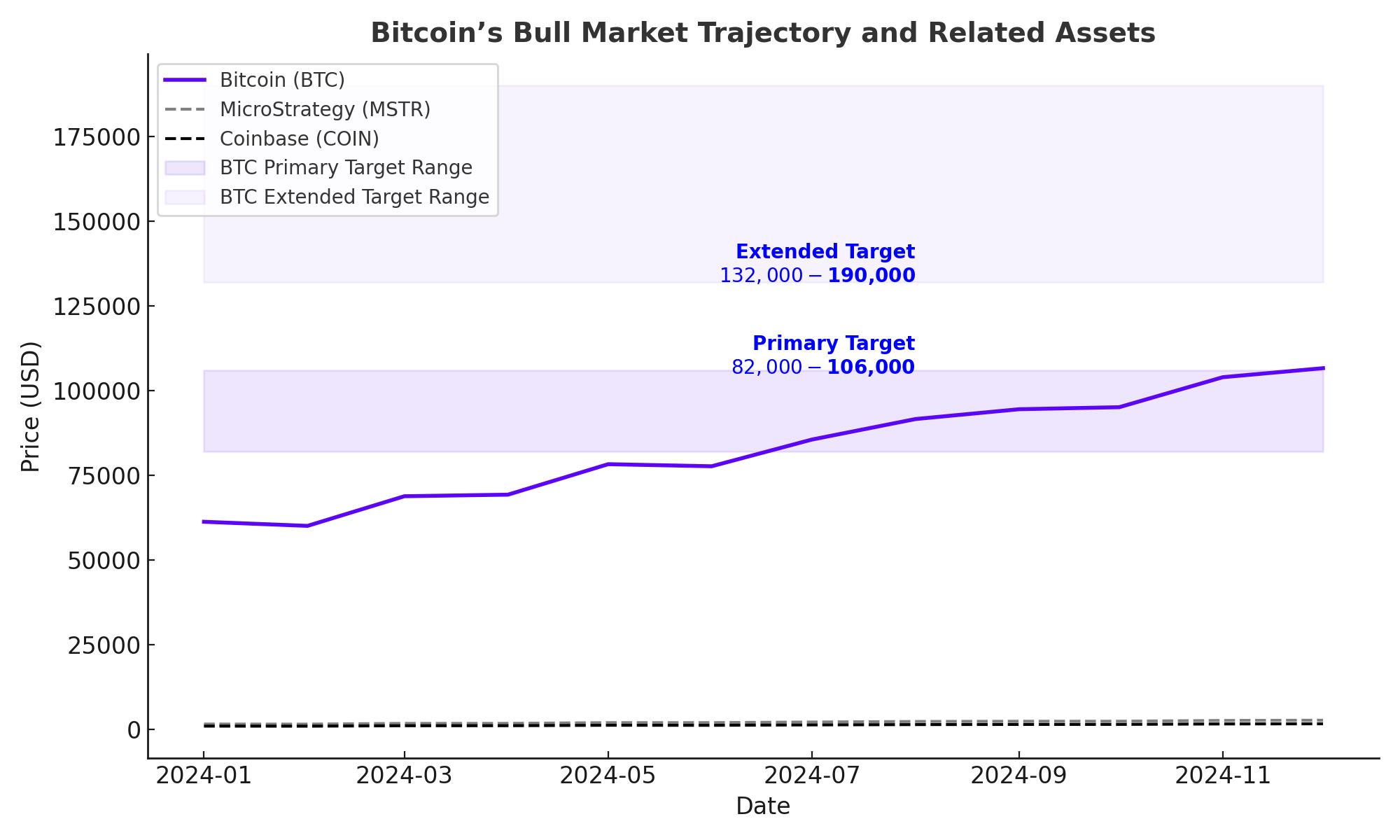

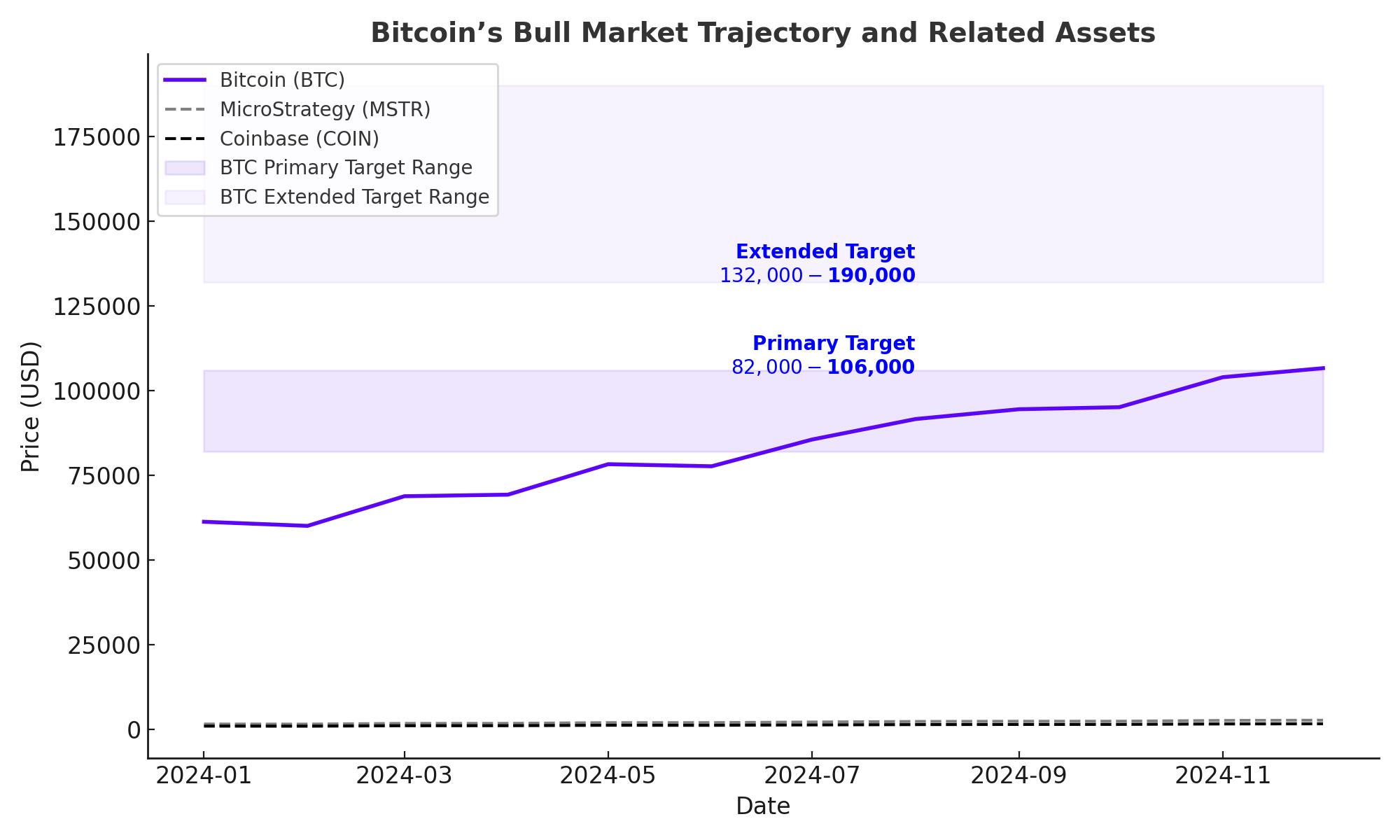

Correlation with Bitcoin Amplifies MSTR’s Potential for Future Gains

MicroStrategy’s recent stock performance is strongly correlated with Bitcoin’s trajectory, positioning the company as a strategic proxy for investors seeking exposure to the digital currency. This correlation has only strengthened with Bitcoin’s rapid appreciation, as MicroStrategy’s value continues to grow alongside its substantial Bitcoin reserves. With Bitcoin expected to see continued bullish momentum under a crypto-supportive U.S. administration, MicroStrategy’s stock is primed for further gains. Each Bitcoin purchase by MicroStrategy adds to this appreciation potential, effectively tying the company’s stock performance directly to Bitcoin’s upward trajectory.

Game Theory and Institutional Adoption: Driving FOMO Across Markets

MicroStrategy’s unprecedented success and Bitcoin-centric strategy have created a ripple effect across corporate America, with other institutions increasingly exploring Bitcoin as a treasury asset. The concept of “game theory” becomes highly relevant here, as companies witness MicroStrategy’s stock outperforming traditional investments and feel the pressure to adopt similar Bitcoin strategies. The recent proposal for Microsoft (NASDAQ:MSFT) to consider Bitcoin investments illustrates this shift, even as MSFT’s board advises against it. Should major companies like Microsoft follow MicroStrategy’s lead, it would drive Bitcoin’s adoption exponentially, with each addition by high-profile firms adding to Bitcoin’s legitimacy as a treasury reserve asset.

U.S. Policy Shifts: A Catalyst for Bitcoin and MicroStrategy Growth

Trump’s re-election has solidified a pro-crypto stance in U.S. policy, which could accelerate Bitcoin adoption at both corporate and national levels. His administration has proposed supportive policies for Bitcoin, including a potential national Bitcoin reserve and a more favorable regulatory framework for the crypto industry. The potential impact of such policies is enormous: should the U.S. adopt a strategic reserve of Bitcoin, as proposed by pro-Bitcoin Senator Cynthia Lummis, this move would validate Bitcoin as a reserve asset on a global scale and set off a “game theory” effect among nations, particularly in the U.S.-China economic rivalry.

Long-Term Vision: MicroStrategy as the Premier Bitcoin Investment Vehicle

Under Saylor’s leadership, MicroStrategy’s path is clear—to accumulate as much Bitcoin as possible, leveraging capital raises and issuing equity and debt as tools to achieve this. The strategy positions MicroStrategy as a unique hybrid of a software company and a Bitcoin investment bank, with every dollar raised directly funneled into expanding its Bitcoin reserves. This vision has not only propelled MicroStrategy to outperform every major S&P 500 stock since 2020, but it has also underscored the company’s potential to become one of the most influential Bitcoin investment vehicles on the market.

Conclusion: A Unique Investment Opportunity with Explosive Potential

MicroStrategy’s remarkable alignment with Bitcoin’s growth and the proactive “42 Strategy” underscore its value as an investment that both mirrors and amplifies Bitcoin’s price action. The unprecedented pro-crypto environment in the U.S., coupled with the game theory dynamic sparking institutional and potentially national adoption of Bitcoin, places MicroStrategy in a powerful position. With each Bitcoin rally, MicroStrategy’s valuation benefits, giving investors a unique opportunity to gain exposure to Bitcoin through a high-growth corporate lens. Michael Saylor’s ambitious vision and MicroStrategy’s unrelenting commitment to Bitcoin suggest a trajectory that could redefine both the company’s and the digital asset’s place in the global financial landscape.

That's TradingNEWS